Planning a Multifamily Repositioning Investment Strategy

Tactica's latest underwriting tool is the Multifamily Redevelopment Model. The idea is to provide multifamily investors with an underwriting tool for total property repositioning efforts.

What is Redevelopment

Unlike the value-add strategy, which is a more "linear" endeavor from an underwriting standpoint, this tool will allow investors to get much more detailed with their rehab assumptions. Users can control the rehab down to the individual unit if desired (although this level of detail isn't necessary).

This blog post will show you how to accurately organize your renovation assumptions to depict your business plan. Tactica defines “redevelopment” opportunities as properties that are:

Distressed physically or from an occupancy standpoint

Not eligible for agency or bank financing due to the condition of the apartment complex

Displays dismal financial trend lines

Needing significant capital investment for unit interiors, common areas, and exteriors

When you want to take over the property, renovate, and stabilize it as quickly as possible, intending to sell or refinance at stabilization, the following steps will be perfect for your real estate analysis.

You can check out how Tactica defines and differentiates Redevelopment and Value-Add business plans.

Repositioning a 36-unit Multifamily Building

Let's look at a property. For simplicity, we will concentrate on just the interior unit renovations, specifically underwriting the logistics. In a different article, I’ll touch on budgeting for common areas, landscaping, fitness centers, parking lots, or perhaps a clubhouse facelift.

The case study looks at a 36-unit garden-style multifamily asset that is distressed. Property management has dropped the ball, and only 24 units are currently occupied (a 33% vacancy rate). Not only is vacancy out of control, but the units could command higher rents if you repositioned the property effectively. It's prime for redevelopment. Due to the issues at the property, you plan to use construction financing with the intent to fix and stabilize as expeditiously as possible.

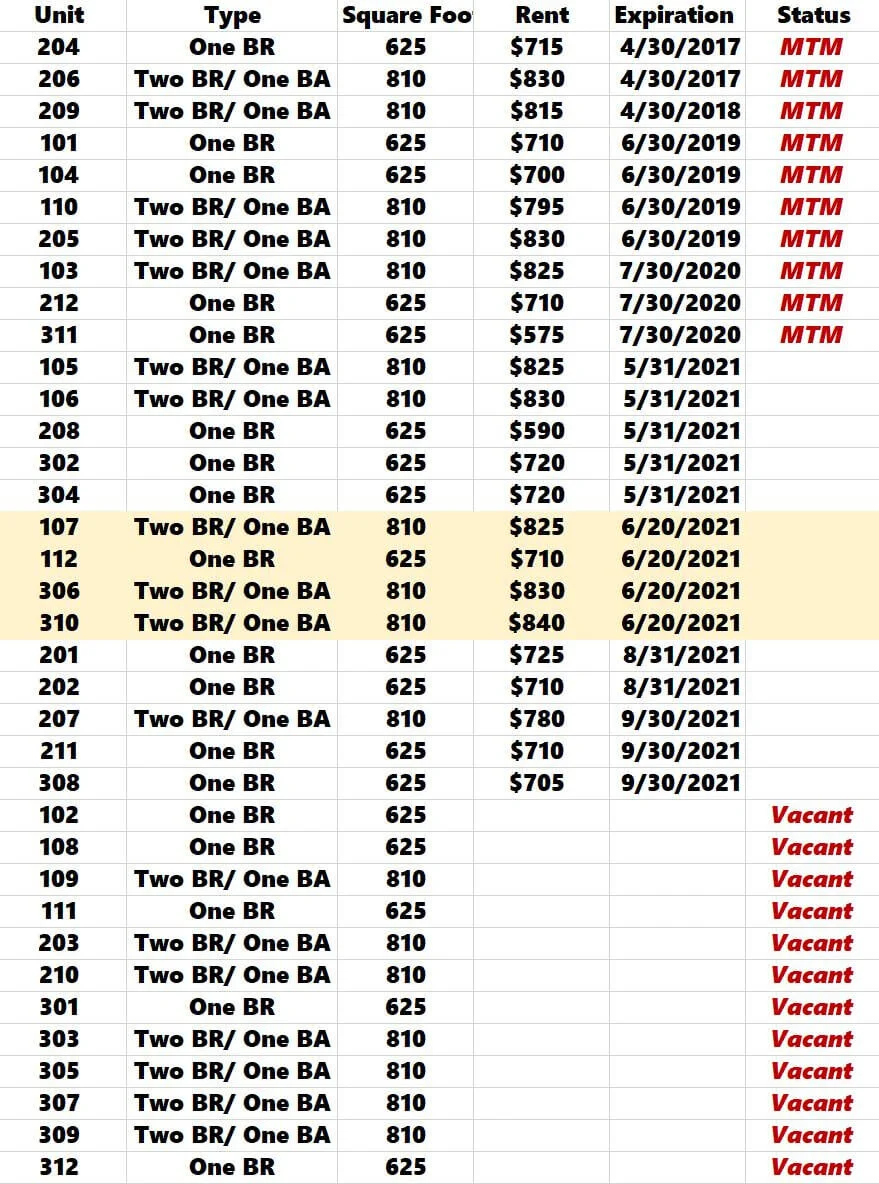

Rent Roll

Here is a look at the property rent roll. There’s no need to digest anything as of yet.

It is all one-bedroom and two-bedroom units of 625 and 810 square feet, respectively.

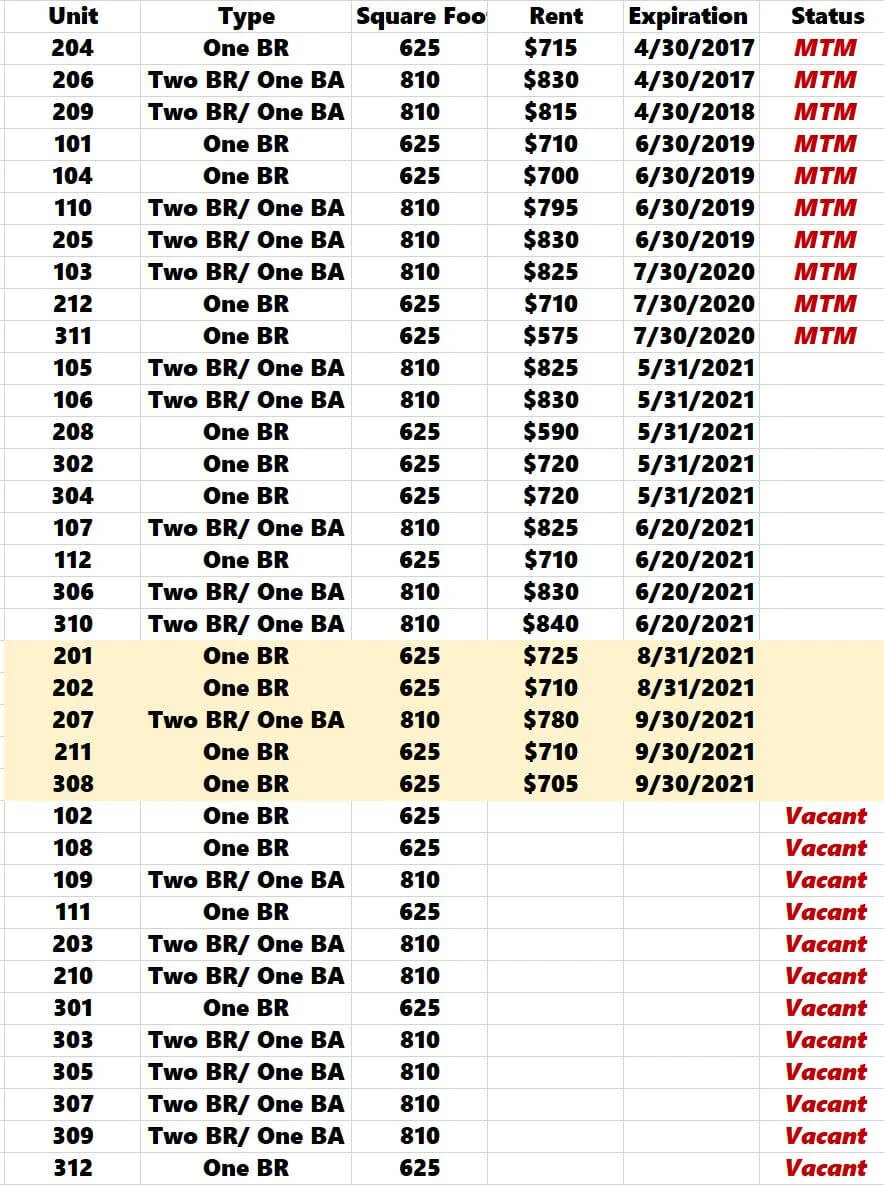

First, we would want to sort the rent roll by lease expirations (oldest to newest).

You can see that a lot of these leases expired a while ago. Many owners will let leases go "month-to-month" (or "MTM") after their initial lease term. I have labeled all "MTM" and "Vacant" units.

This is good information. All vacant units can be renovated immediately, and upon closing on the property, you can give the "MTM" tenants a heads-up that you will not be renewing their lease. For simplicity, I will assume that both MTM leases and vacant units will be renovated simultaneously. Realistically, you would likely get a later jump on the "MTM" units as you must give proper notice.

Renovation Sections

The Tactica Redevelopment Model allows up to eight different renovation sections. Think of areas as "groupings." They could be:

Floors

Blocks

Buildings

Lease Expirations

I want to give the user control over how the rehab is being implemented. Eight different options are a good number that will offer flexibility. In this particular scenario, we will be using 4/8 sections, and I will be labeling each section as the following:

Section 1: MTM & Vacant Units

Section 2: May Lease Expirations

Section 3: June Lease Expirations

Section 4: July Lease Expirations

For the sections I'm not using, I will leave them blank.

Multifamily Repositioning: Step 1

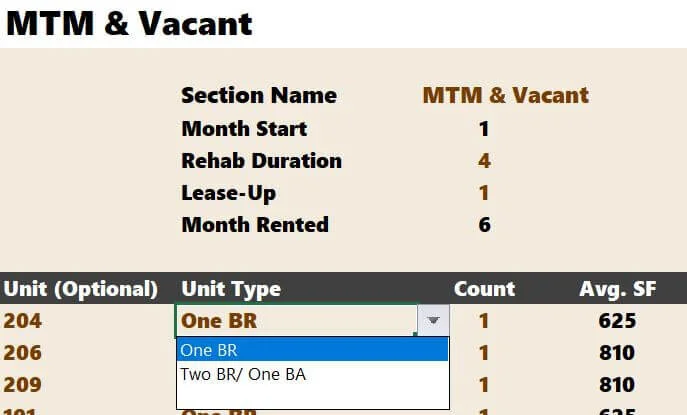

You'll first need to enter all the unique unit types and square footage of units. The sample property is simple. There are only two different unit types.

You could be as detailed as you want here. You could enter all those if there were five different One BR floorplans (A1, A2, A3, A4, and A5). If you are more comfortable grouping all One BR units as one, that is fine, too. It's totally up to you and how detailed you want to get in the analysis.

Entering the unit types will create a drop-down list to select the units as you begin populating the renovation schedule.

Necessary: You will want to enable the error check at this juncture. To learn more about setting up your analysis to avoid potential mistakes, read this brief article on the error check mechanism in the “Reno Inputs” tab.

Square footage will populate automatically, depending on your selection. This will save you time when populating the model and help prevent data entry errors.

MTM & Vacant Units

Return to the rent roll and input all the highlighted units into the model.

As with any Tactica tool, brown text cells are your responsibility. We can then make assumptions for this chunk of units:

Section Name

You choose the appropriate label for the section.

Month Start

The model assumes the first section of renovations will commence in month one. For other selections, you will choose.

Rehab Duration

How long will the rehab take (in months)?

Lease-Up

How many months will it take to lease the units upon completion?

Note: The “rehab duration” and “lease-up” assumptions must be an integer for the model to work correctly.

Month Rented

Month Start + Rehab Duration + Lease-Up

Cash For Keys

Some owners will pay tenants cash to get them to vacate the unit ASAP. I'll talk about this assumption in more depth later on. It won't be prevalent for vacant and "MTM" leases.

Occupancy Post-Rehab

What do you project the occupancy for this chunk of units post-renovation? 95% will be standard. More conservative estimates will be closer to 90%.

Annual Rent Increase Post-Reno

How do you project rent growth in the future? The model assumes new leases are one-year leases and will phase in your rent growth assumption 12 months after the "Month Rented" assumption. This growth rate will be applied annually.

Lease-Up Concession

Will you need to give away rent concessions to attract renters to the renovated unit? The assumption is made in terms of months. If the average post-renovated rent is $1,000 and you plug in 1.5 months of concessions, the model will deduct $1,500 for each unit in the section.

With all of our assumptions made and the unit data inputted, we can look at the final product of this section:

May Expirations

The next section of the rent roll we can focus on is May expirations.

Again, we will put all the rent roll data into the model (Section 2). For the remaining sections, there is one extra assumption:

General Occupancy Pre-Rehab

What is the occupancy of the units before renovating? This assumption will be more prevalent for more extended renovation plans where specific units won’t be renovated for one or two years (the model allows up to a 36-month renovation plan).

Our May section is now complete.

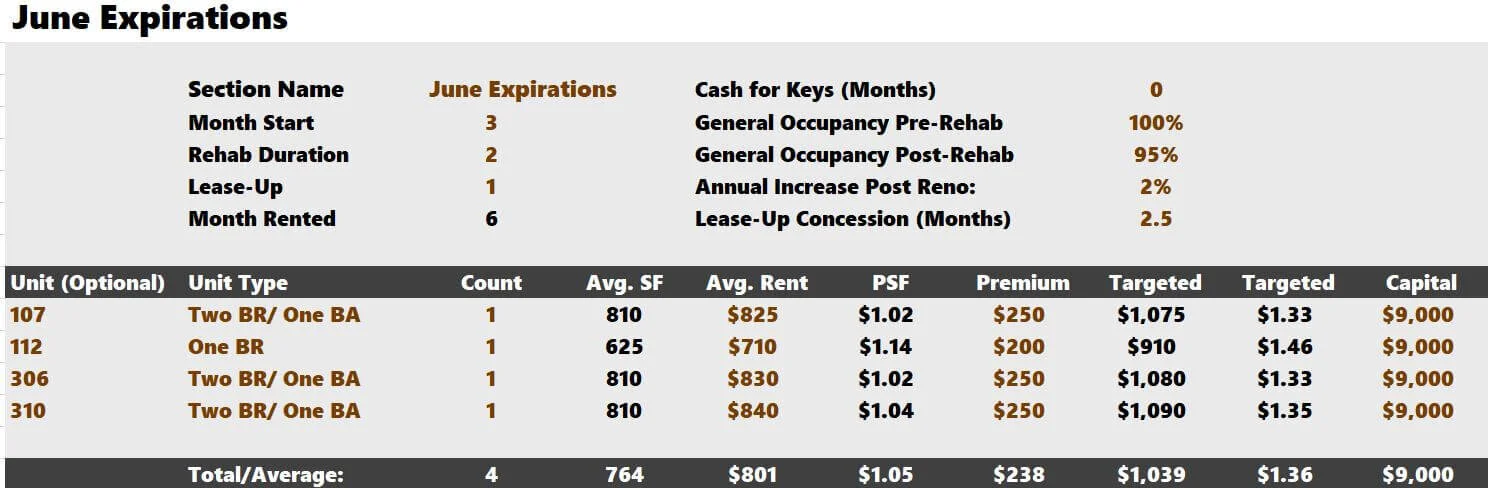

June Expirations

We will follow identical steps with June expirations as we did for May. First, grab all the data from the rent roll.

Get the units into the financial model (Section 3) and make your assumptions for the section.

July Expirations

You may have noticed that no July expirations appear in the rent roll. Only August and September.

However, as an owner, you want to entice these residents to vacate early. If you wait until later summer or fall to commence the renovations, it may be challenging to get the units leased before the winter months (which is a considerable problem in colder climates).

This is when the “cash for keys” assumptions may be helpful. Like the concession assumption, you make cash for keys assumptions based on months. If the average rent of a section was $800 and you offered the residents one month of money for keys, you would be paying them $800 each to vacate.

In this section, the average rent of the remaining five units is $726. In the proforma, $3,630 in loss would flow out in Month 4.

$726 x 5 units = $3,630

Final Asset Reposition Analysis

Our renovation inputs are now complete (all four sections):

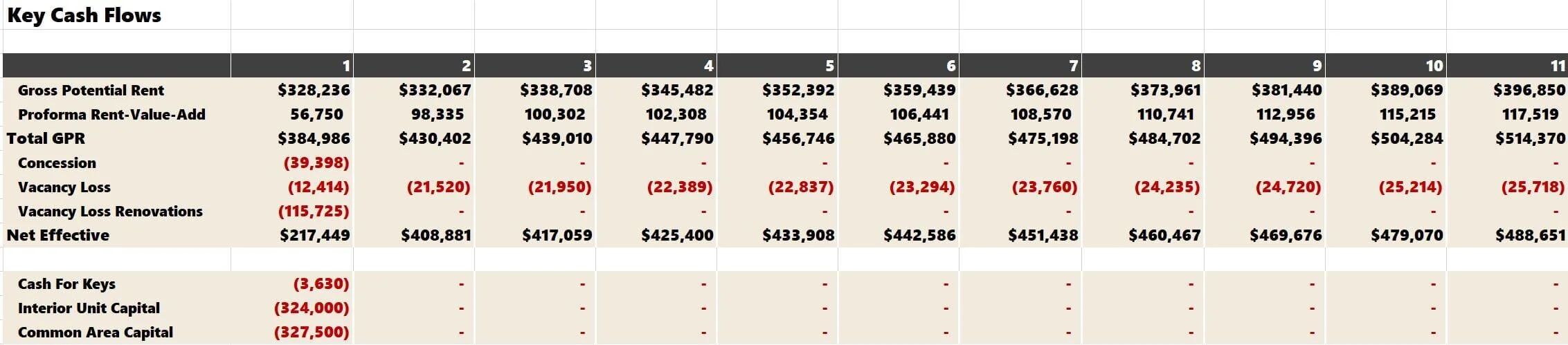

With all units successfully entered into the workbook, the financial model will aggregate all the data into neat annual cash flows.

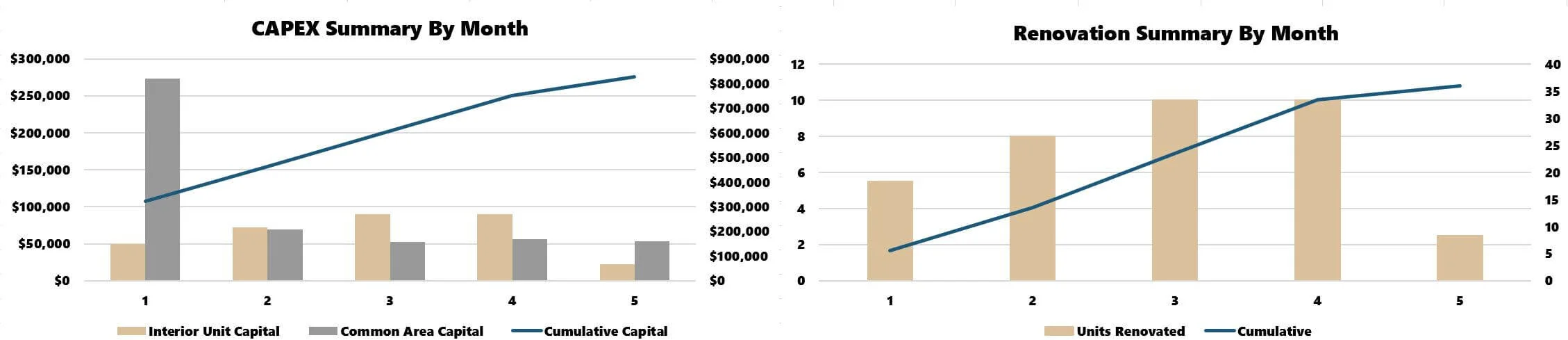

There are also detailed charts summarizing the CAPEX spend and renovation summary by month.

While the blog post doesn't get into common area capital, another tab in the workbook is dedicated to budgeting and allocating capital expenditures for common areas, exteriors, and even a construction interest reserve.

Asset Reposition Strategy for a Larger Apartment Complex

This was a small property, and plugging in the individual units wasn't a huge burden. You may be wondering how this would work on a larger property.

Thankfully, getting as granular as the unit is not necessary. It's optional. I would likely assemble the analysis much differently if I worked on a larger property. Let's use this same property and assume you don't want to take the time to get as detailed as I did before. You could do the following:

Group the renovation into two sections (1st block and 2nd block)

Plan for the renovation to take 11 months (10 months of construction and one additional month of leasing)

Renovate 50% of the units in months 1 - 5

Renovate 50% of the units in months 6 - 10

Assume there will be cash for keys and lease-up concessions in both blocks.

You don't need to plug in every unit as we did in the previous example. You could group the One BR and Two BR units to move much faster. The "Reno Inputs" tab would look like this:

The other six sections will remain blank.

The summary of cash flows will still be very similar to our more detailed example from earlier:

I would argue that the difference between the two scenarios isn't material. The simplified version is more conservative as the rehab isn't nearly as front-loaded as in the detailed scenario.

Year 2 Net Effective Cash Flow for each scenario is:

Detailed Reposition Scenario: $409K

Expedited Reposition Scenario: $405K

You likely wouldn't change your mind on this project over a $4K delta in Net Effective cash flow annually (less than 1% of total revenue). Rest assured, this tool allows you both accuracy and speed. Perhaps on initial underwriting runs, you will elect to do a more “general” grouping and get more dialed in later in the sales process.

Summarizing Multifamily Repositioning

Hopefully, this case study sheds some light on how to underwrite a multifamily redevelopment investment strategy. Your analysis will require a much different due diligence process to reposition a multifamily asset than a traditional value-add property. Using a tool like Tactica's Redevelopment Model will ensure that your proforma underwriting is accurate and obtainable.

Related: If you want to review another case study to help you master the “Renovation Inputs” tab, check out another renovation methodology we use on 100+ unit properties.