Efficient Multifamily Portfolio Underwriting

Modeling multiple properties in a portfolio offering can be tedious. My record is evaluating a 30+ property portfolio! I had to underwrite every piece of real estate individually (ouch). When it came time to tweak assumptions (rent growth, residual cap rates, occupancy, NOI, etc.), these simple changes took days to phase in.

Perhaps you share the same predicament and are looking for a more efficient way to analyze multiple multifamily investment opportunities simultaneously. This article covers the spectrum of portfolio underwriting, when it’s appropriate, and with what proforma workbooks.

Multifamily Investment Portfolio “How-To”

Multifamily Portfolio Underwriting

I occasionally get asked, "Can I underwrite multiple apartment buildings as one when using a Tactica underwriting model?"

Modeling a portfolio opportunity as one apartment community can unlock time savings and offer you much convenience. I plan to walk you through when it's okay to model multiple apartment complexes as one vs. when you should avoid it.

Our Value-Add and Redevelopment Models are featured in this article as they are the ideal tools for modeling a portfolio sale when appropriate.

When to Avoid Multifamily Portfolio Underwriting

There are instances when you should never consolidate different properties in one proforma spreadsheet.

Different Asset Classes

Varying asset classes is a non-starter. If you have a portfolio that includes any combination of multifamily real estate, student housing, mixed-use, and senior housing, modeling these investment opportunities as one would be nearly impossible, and I don't recommend it.

Different Vintages

The ages of properties will also determine if modeling as one is wise. Older properties will have different CAPEX requirements than newly constructed buildings. Community amenities, floorplans, and ancillary income opportunities differ significantly between newer and older buildings. Ideally, if properties weren't built in the same decade, you'd want to avoid modeling them as one complex.

Different Locations

Different zip codes make portfolio modeling challenging for a variety of reasons. The biggest hindrance is property taxes. Different applicable tax rates and reassessment potential post-sale make modeling property taxes a nightmare.

Not to mention, rent growth and occupancy assumptions could differ significantly from zip code to zip code. Ideally, you'd want all real estate investments located in the same county and, ideally, within the same zip code.

Example: Three properties on the east side of Dallas would be ideal. You should probably model the three properties separately if they’re scattered between Dallas and Fort Worth.

Underwriting Portfolio Investment Opportunities

If properties possess:

The same asset classes

Similar vintages

Proximity

It may be sensible to model them as one. Think of a portfolio of brownstones in the same neighborhood or newly constructed market-rate lofts on the same thoroughfare.

New Listing Scenario: You're interested in three brownstone properties within a two-block radius. All properties were built in the 1960s.

Let's discuss how we'd underwrite these projects using Tactica's Value-Add and Redevelopment Model.

Refresher: Value-Add is the model to use if properties need cosmetic upgrades to units and common areas and are generally not distressed. Redevelopment is the model to use if the properties are in disrepair and require a total repositioning effort. Your business plan will determine the best fit between Value-Add and Redevelopment Models.

Value-Add and Redevelopment overlap on specific tabs, so we will discuss those tabs first and best practices when inputting portfolio financials into the proforma model.

Investment Summary

While the "Investment Summary" dashboard will look different and display contrasting inputs, the thought process for both the Value-Add and Redevelopment models is the same when modeling a portfolio opportunity.

You must alter portfolio pricing, financing, and closing costs for three properties vs. one. Your lender and title company should give you appropriate cost estimates to plug into the proforma.

Real Estate Taxes

Typically, off to the right of the inputs section, I will create a separate grid that notes all up-to-date tax information for each property in the portfolio.

The bottom row is a simple "sum" formula that flows into the inputs section (brown text cells).

Then, I will make tax assumptions just as I would for an individual complex.

Note: You can see how this could get convoluted if you have properties in different counties with different applicable tax rates. Underwriting multiple properties as one works well when all parcels in the portfolio are taxed the same.

Financials

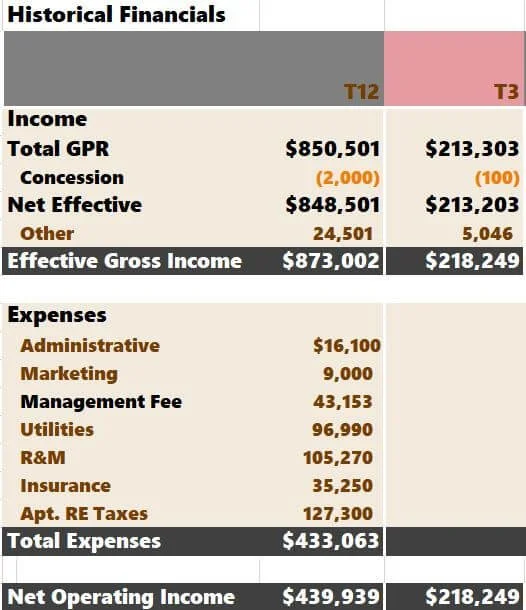

Entering historical financials is easily the most tedious aspect of underwriting a portfolio opportunity as one property. You must combine historical financials from three properties and input the aggregate total of each underwriting line item into the model.

Similarly to property taxes, I will usually aggregate these totals separately.

And then link to the line-items total from the "Financials" tab.

After tying the financials to an external Excel workbook, I like to copy and paste them as values so the workbook doesn't slow down (linking to external workbooks can do this).

Unit Renovations

The Unit Mix inputs is where the Value-Add Model and Redevelopment Model begin to differ.

Value-Add Model

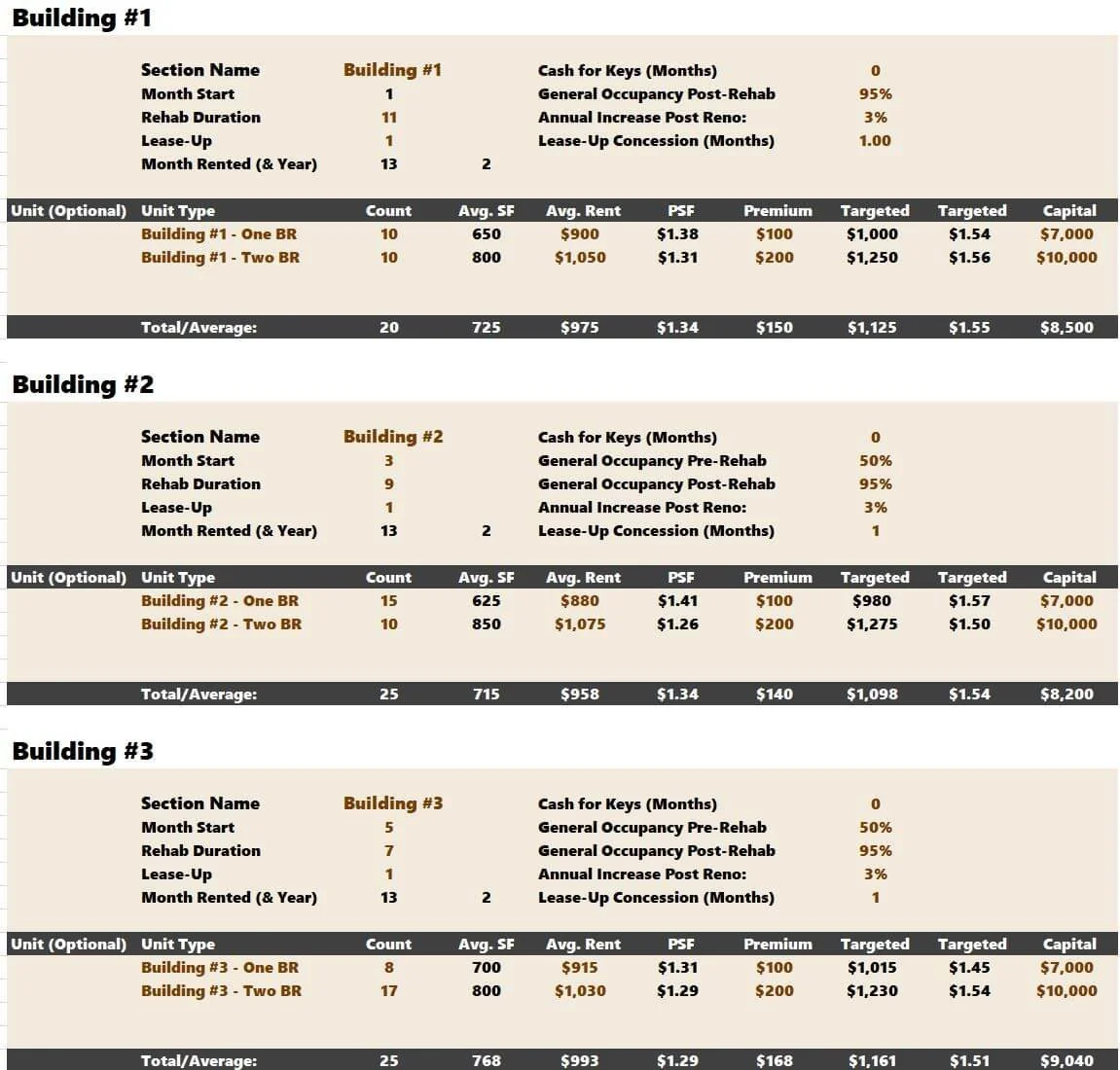

The process for renovations is relatively simple. You'd follow the same procedure detailed in the "Value-Add Tutorial Guide" in the "Renovations" section with one caveat:

You'd want to break out unit types by building.

Now you can assess the unit condition, CAPEX requirements, and potential rent premiums.

Redevelopment Model

For a redevelopment business plan, you could dedicate each "section" (eight total) to a building like below:

Now, you can control the renovation specifics very granularly for each unit in each building. In the example above, I do a more "general analysis," focusing on unit types like we had done previously in the Value-Add Model.

The Redevelopment model offers real estate investors a construction schedule input tab for common area expenses and other deferred maintenance. You could also break out the Capex by building/property on this tab.

Summarizing Multifamily Investment Portfolio Underwriting

Underwriting can greatly hinder portfolio investment opportunities if you must analyze each project individually. If you can avoid opening multiple Excel workbooks simultaneously, I’d advise doing so.

If properties possess:

The same asset classes

Similar vintages

Proximity

It may make sense to underwrite the individual properties as one investment. Depending on your business plan, Tactica offers two underwriting models that are ideal for this exercise.