A Multifamily Underwriting Guide for Combining Rental Units

I just published an article about underwriting projects with an opportunity to add units in unused common spaces. A few groups that read this blog post asked, "What if we want to combine units instead?" Is that possible?

Note: I recommend reading the hyperlinked article above. The tutorial is more detailed and will cover aspects of the financial models I assume you already know.

Scenario: You're in escrow on a 60-unit apartment building and want to combine five one-bedroom and five two-bedroom units and re-lease them as five three-bedroom units.

Scope

Combine five 1BR and five 2BR units (total unit count = 55 post-renovation)

Construction timeline = 5 Months

Leasing timeline = 2 Months

Construction cost = $25,000/ new unit

Rent target = $3,500/unit

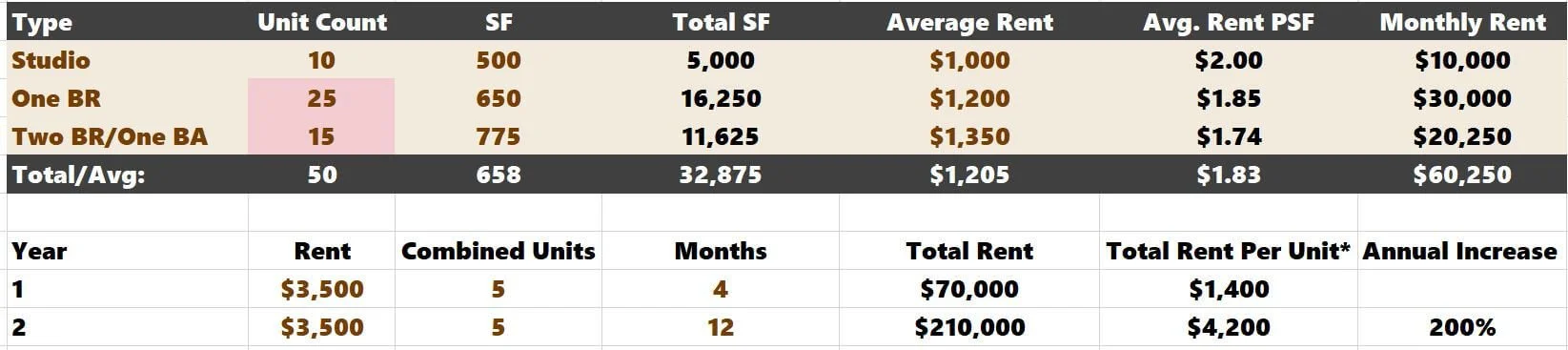

In this example, average rents for one-bedroom and two-bedroom units are:

One BR = $1,200

Two BR = $1,350

Total: $2,550

Combining them and renting out a 3BR for $3,500 creates a $950 monthly premium.

Three Underwriting Options

We offer website visitors three underwriting tools that could account for this scenario. They are ordered from least effective to most effective.

I define "effectiveness" as the model's ability to handle a scenario without incorporating significant alterations to the tool. Let's examine each workbook, and I'll show you how I would underwrite it.

Multifamily Underwriting Template

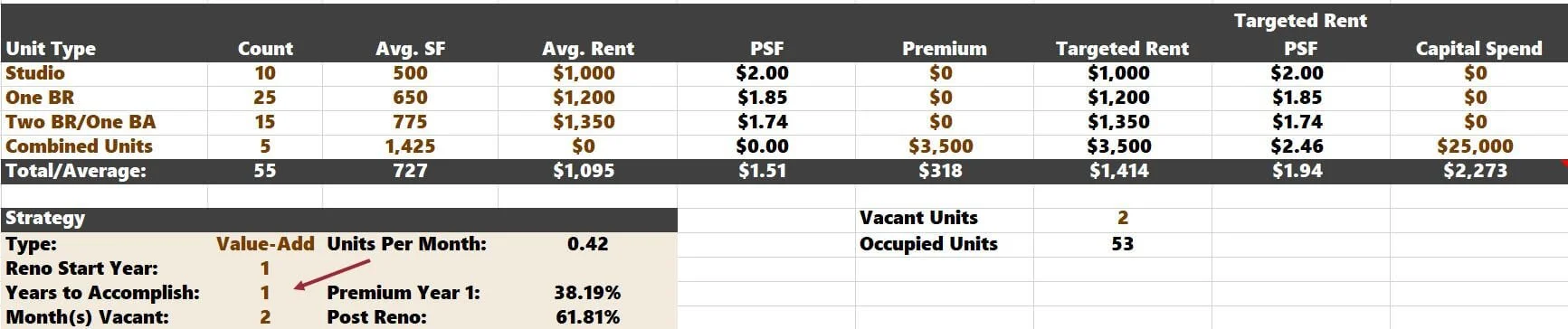

Below is the current, unaltered unit mix.

The first step is to subtract five units from the One BR and Two BR totals.

Let's manually calculate the extra income in years one and two of the proforma from combining the units. We can do this directly on the "Unit Mix" tab below the grid.

In Year 1, we'd only see four months of revenue from the new units (4 months x 5 units x $3,500) or $70,000.

In Year 2, we'd see the full impact (12 months x 5 units x $3,500) or $210,000

Notice: I set up columns for "Per Unit" and the "Annual Increase." We will eventually use the highlighted calculations in our assumptions on the "Financials" tab.

Per Unit in Year 1 = $70,000 / 50 = $1,400

Per Unit in Year 2 = $210,000/ 50 = $4,200

Annual Increase in Year 2 = $210,000 / $70,000 - 1 = 200%

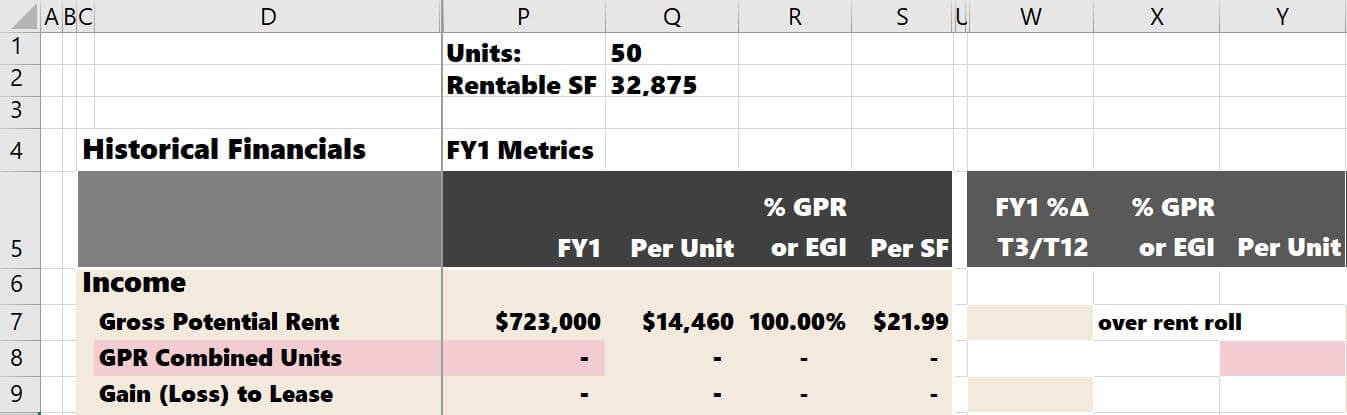

Now, let's visit the "Financials" tab to make some adjustments. It may be worth a quick refresher on making proforma assumptions via the tutorial blog post on this tab.

First, I added a row (row 8) under GPR called "GPR Combined Units." The formula in cell "P8" is:

Cells: "Y8" x "Q1"

or

Per Unit Revenue x Total Units

We will then grab the $1,400 per unit we just calculated on the "Unit Mix" tab and plug it into the red "Y8" cell.

The model works correctly as Year 1 "GPR Combined Units" = $70,000.

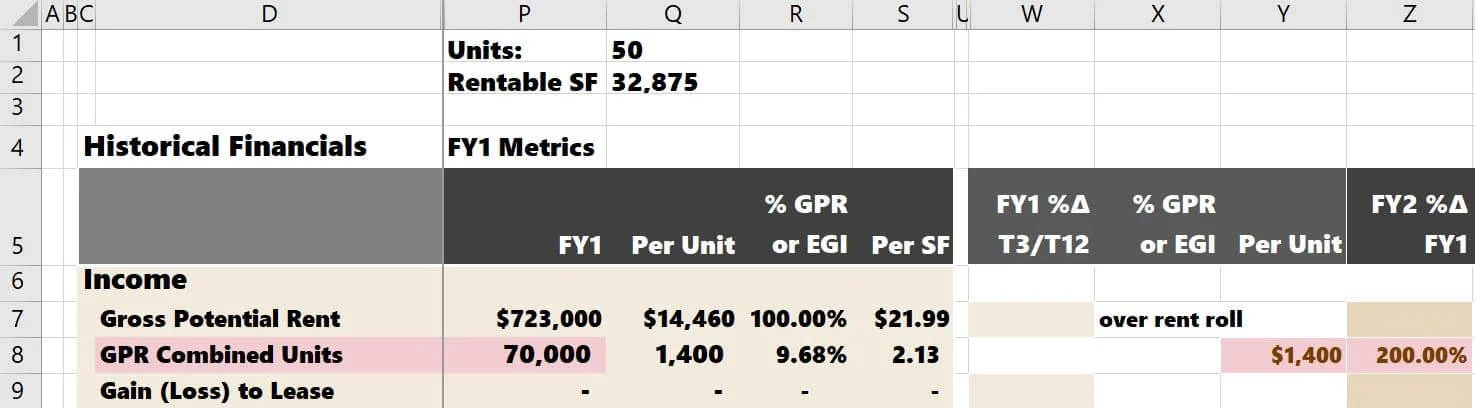

In Year 2, we need to grab the growth rate of 200% we calculated earlier and plug that in the $ increase assumption.

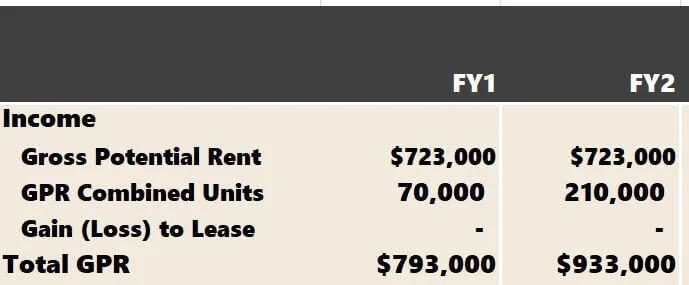

If we scroll over to the "10-Year Cash Flow Summary" section, we can see that the increase has been accounted for accurately.

The $70,000 increases to $210,000 in Year 2.

Note: Remember to alter the vacancy formula to account for the additional GPR line hosting the combined unit revenue. I talk about this process in greater detail here.

The final step is accounting for the CAPEX. In the free model, there is one way to do this. You'd input $125,000 as the "Working Capital" amount on the "Valuation" tab (cell "C10").

$25,000/unit x 5 units = $125,000

That concludes how to deal with additional units in the free multifamily template.

Multifamily Value-Add

If you use the Tactica Value-Add Model, a few options exist for adding more units in your proforma underwriting. It would be best to ask yourself two questions to determine the best action.

Is there a renovation program for the existing units?

Will the renovation timeline for the existing units be the same as the combined units?

If the answer is "Yes" for Question #1 but "No" for Question #2, you will follow our exact process for the free model. If “Yes” for both, the Value-Add Model may be a good fit.

The Value-Add Model offers a tab dedicated to unit renovations. If we continue running with the previous scenario of combining ten units on this tab, the renovation analysis won't be accurate if:

Combining New Unit Timeline ≠ Renovation of Existing Unit Timeline

Logic

See the “Logic” section of our Underwriting Guide for Adding Units to fully understand how the renovation logic works in the Value-Add Model.

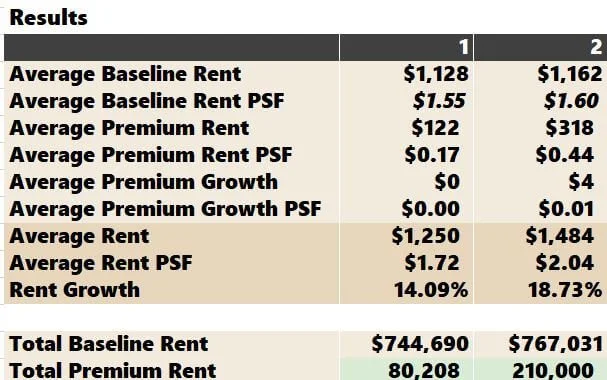

Correct Entry

The units are combined in Year 1, and the duration is one year. The new 3BR rents are fully phased in by Year 2.

The proforma is not perfectly accurate. As you can see, the Renovation Premium in Year 1 is slightly overstated by about $10,000.

Year 1 should be $70,000. However, by Year 2, it is $210,000, the proforma is back on track, and the Year 1 discrepancy is largely immaterial. All the capital is accounted for as we specified the "capital cost per unit" of $25,000 in the "Renovation Input Grid."

Multifamily Redevelopment

Tactica's Redevelopment Model is tailored to deal with the messiest property repositioning underwriting efforts. Combining units is a simple component for this model to handle.

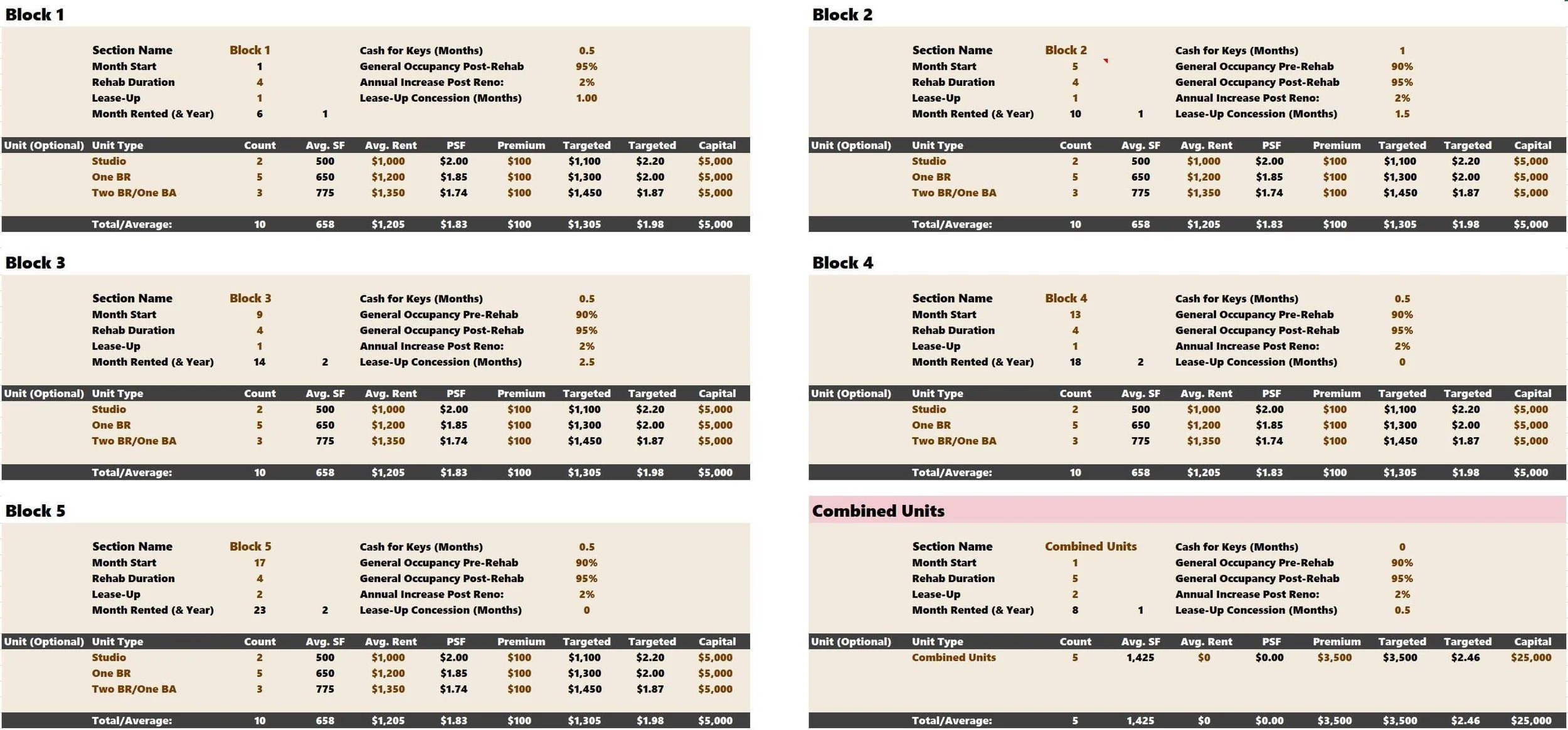

The "Reno Inputs" tab gives you eight different "sections" to organize and execute the renovation strategy. It doesn't matter if you renovate all 50 units; dedicating a section to "combined units" is an effortless entry. Below, the entire renovation scope is included:

Renovating 50 units over two years (using Blocks 1 - 5) and solving for a $100 premium with a $5,000 CAPEX spend

Combining ten 1BR/2BR units in "Block 6" (to create five 3 BR units) will begin cash flowing in Month 8

Notice: I dedicated a section solely to "Combined Units."

The model is equipped to handle this with no alterations or custom formulas.

Summary

Three Tactica Excel workbooks are equipped to handle combining units when reviewing acquisition opportunities. Depending on your model, it may require a little more thought and be more labor-intensive, especially in the free template.

The Redevelopment Model is the best equipped to handle more complicated renovation scenarios than any other Tactica offerings and should be the model you use if this is a recurring scenario in your business plan.