Multifamily Construction Schedule Template

A critical section of Tactica's Multifamily Redevelopment Model is the "Capex Plan" tab. This template allows an investor to plan the construction schedule with estimates and timelines from the general contractor or internal maintenance teams.

What is Redevelopment?

Generally speaking, Tactica defines “redevelopment” investment opportunities as properties that are:

Distressed physically or from an occupancy standpoint

Not eligible for agency or bank financing due to the condition of the apartment complex

Displaying dismal financial trend lines

Needing significant capital investment for unit interiors, common areas, and exteriors

If the property isn’t distressed and doesn’t check the boxes above, it may be more suitable for the Value-Add Model, which is appropriate for turnkey assets or cosmetic in-unit improvements.

Related: Multifamily Value-Add vs. Redevelopment: Key Differences

CAPEX Definition

The emphasis of this blog post is to show you how the Redevelopment spreadsheet allocates CAPEX for common areas, deferred maintenance, and other miscellaneous nonrecurring costs such as:

Hallways

Plumbing

HVAC

Exteriors

Project Management

Construction Contingencies

Marketing (Lease-Up)

Interest Expense (Optional)

Interior Unit Renovations

Unit interior spending is summarized on this tab, although the assumptions for unit renovations are made on the "Reno Inputs" and involve some additional learning. You’ll find other articles related to unit inputs below:

Construction Schedule Template

The Excel construction template will give you complete control over your:

Budget

Construction Timelines

Start Dates (months)

End Dates (months)

The model will automatically calculate the "Project Duration." If you were to allocate $100,000 for hallway renovations and specify a timeline of:

Start Month: 1

End Month: 4

The model will evenly allocate $25,000 over the first four months of the project plan.

Like all Tactica financial models, the brown text cells are your responsibility. As you can see in the image above, “Unit Interiors,” “Cash For Keys,” and “Interest Expenses” are all black text which means they are calculated elsewhere.

The project schedule is extensive, costing $2,858,415, and spans 31 months.

Monthly Cash Flows

Off to the right, the template will detail the monthly cost of each expense line item. The gray row at the bottom totals the monthly cumulative capital expense of all budgeted expense items.

Note: The model allows for up to a 36-month renovation. In my experience, investors repositioning a property complete it much sooner (conservatively targeting 12 - 18 months). Anything over 36 months would require customizing the financial model and altering its functionality.

Interest Expense

The interest expense has a couple of nuances that I must explain more thoroughly.

First, the model assumes you will finance the real estate and improvements with a construction or bridge loan. If this is not the case, I would recommend checking out the Value-Add Model, which is helpful for cosmetic value-add on non-distressed properties that will likely utilize agency financing.

Because the property and the renovations will be financed by a construction or bridge loan, interest expense will be determined by the construction draw schedule and is assumed to be full-term interest only.

Draw Schedule: Standard or Pre-Drawn

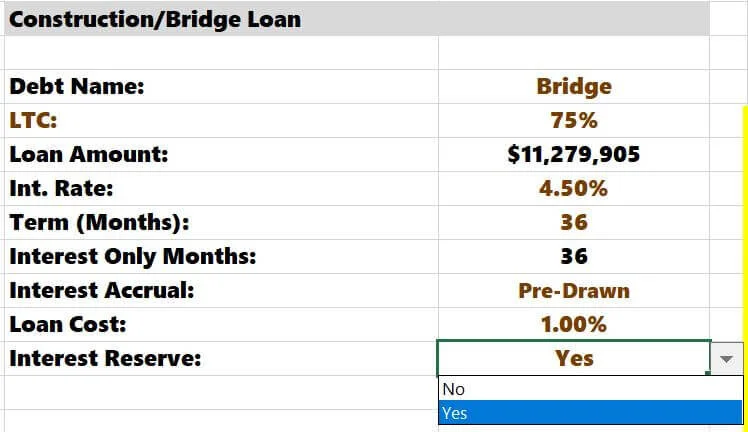

You must elect whether interest is "standard" or "pre-drawn."

The bridge/construction lender will determine this. “Standard” is the most common selection and implies that interest expense will accrue on funds drawn and put to use. Typically, investors will put all their cash into the project at closing. They will draw funds on the construction loan to close on the property and continually draw on the remaining loan proceeds during the commercial construction. This is the scenario I currently have selected. You can see that $8,285,396 was drawn initially at closing, and funds are continually drawn each month as more work is completed.

Interest expense increases monthly as more funds are drawn and the debt balance grows.

Some lenders will only offer “pre-drawn” terms. Unlike the standard approach, all loan proceeds will accrue interest immediately, even if they haven't been withdrawn. As an investor, “pre-drawn” interest is much less desirable as interest expense is more costly.

I will change the assumption to "pre-drawn" from the “Investment Summary” tab.

Interest is $42,300 every month until the construction financing is paid down.

$11,143,811 * 4.5% / 12

Paying interest on a starting balance of $11,143,811 vs. $8,258,396 will make a big difference in total interest expense over the life of the redevelopment.

Interest Reserve: Yes or No?

Cash flow will often be muted during construction when dealing with distressed real estate. Some lenders may calculate an interest expense reserve to cover the interest expense burden during the renovation years. On existing multifamily properties undergoing significant renovations, I have seen lender term sheets with interest reserve requirements and others requiring the investors to pay back interest each month with cash flow from the property—as you would see in more traditional financing arrangements.

Therefore, I have built in a toggle to choose whether there will be an interest reserve.

I currently have "Yes" selected. This means a lender would give you financing proceeds to support the property's purchase, the renovations, and an allocation of funds for the interest burden during the loan term. If we go to the "Returns Summary" tab, we'll see that the construction loan covers all construction capital ($2,858,415), including the capitalized interest.

If I select "No" for the interest reserve assumption, this is no longer the case.

Now, the loan draw excludes the interest expense reserve. Interest expense appears a few rows lower in the "Bridge Interest" line. The investor in this scenario would need to depend on the project's cash flow to make monthly interest payments to the lender.

Renovation Summary

All of this information inputted on the “CAPEX Plan” tab will flow into the "Reno Summary" tab, which details the annual cash flows of the project over a 10-year investment hold.

Furthermore, this data will flow into the overall project cash flow presented on the "Returns Summary" tab and highlight various returns metrics such as IRR, equity multiples, and cash-on-cash returns.

Summarizing Tactica’s Construction Schedule Template

Capex planning is an essential part of a multifamily redevelopment analysis business plan. The construction schedule built into Tactica’s Redevelopment Model should help you diligently plan the construction budget and timeline within the scope of the overall investment strategy. The model is easy to manipulate, and you can amend cost estimates as bids are received from contractors and subcontractors alike.

All assumptions in the "Capex Plan" tab flow into the redevelopment cash flow model. Investors can assess the financial feasibility of buying and renovating distressed multifamily real estate with relative ease and precision.