Planning a 100+ Unit Multifamily Repositioning

This blog post will serve as a case study on how to model a large-scale multifamily repositioning effort using Tactica’s Redevelopment Model. I want to show you how to expeditiously model the repositioning effort without sacrificing accuracy.

You may know that Tactica’s Redevelopment allows you to get very granular down to the individual unit if you wish. Unfortunately, planning an interior rehab unit by unit is likely impossible if you are working on a larger property. You will probably want to “generalize” your renovation plan a bit. I’ll show you how you can accomplish this.

What is Redevelopment

Unlike the value-add strategy, which is a more "linear" endeavor from an underwriting standpoint, this tool will allow investors to get much more detailed with their rehab assumptions. Users can control the rehab down to the individual unit if desired (although this level of detail isn't necessary).

This blog post will show you how to accurately organize your renovation assumptions to depict your business plan. Tactica defines “redevelopment” opportunities as properties that are:

Distressed physically or from an occupancy standpoint

Not eligible for agency or bank financing due to the condition of the apartment complex

Displays dismal financial trend lines

Needing significant capital investment for unit interiors, common areas, and exteriors

When you want to take over the property, renovate it, and stabilize it as quickly as possible with the intent to sell or refinance at stabilization, the following steps will be perfect for your real estate analysis.

You can check out how Tactica differentiates Redevelopment and Value-Add business plans.

Unit Inputs Error Check

Perhaps you have already read the article describing the error check built into the “Reno Inputs” tab of the Redevelopment Model. If not, check that out first by clicking the link. It is less than a five-minute read. The error check helps avoid mistakes and data entry errors and unleashes a more streamlined underwriting process for unit renovations.

400-unit Multifamily Property Repositioning

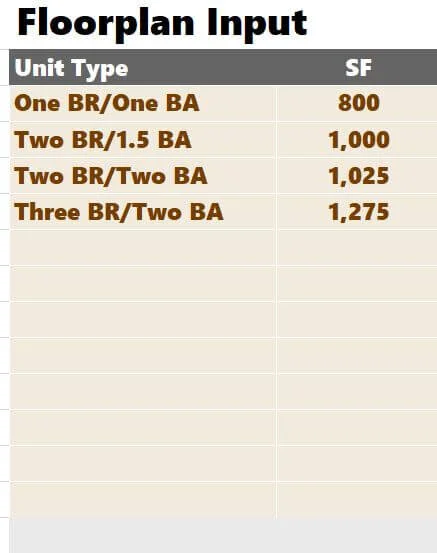

As always, Your first and second steps when commencing your renovation analysis are the same. You’d first input the unit types and square footage in the “Floorplan Input” section.

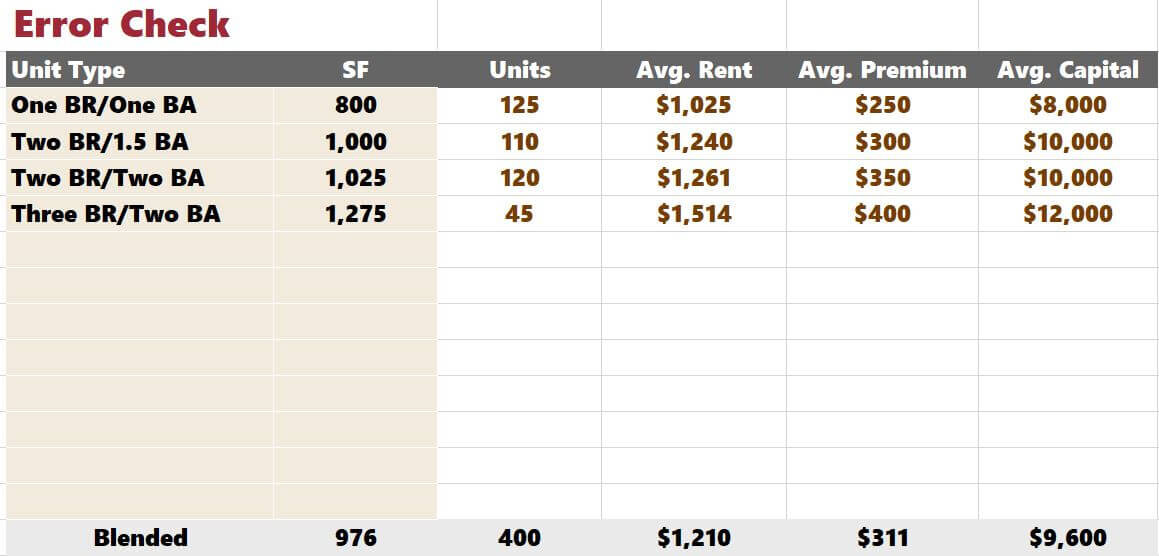

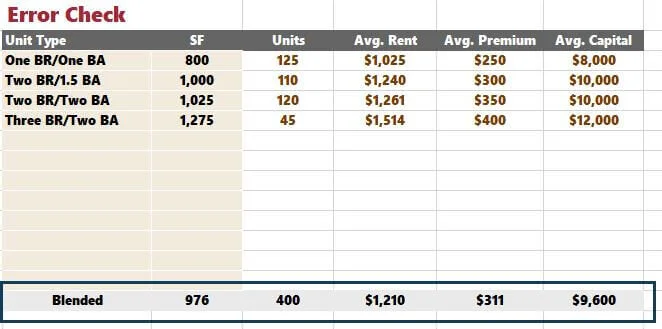

You then enter all the high-level unit mix and renovation information in the “Error Check Section.”

The grid looks like this.

The glowing red cells are natural; we have not input the renovation plan. The error check is working as intended.

The Renovation Pan

Units: 400

Timing: 24 Months

Reno Input Sections Used: 8 (the maximum allowed)

Timing

This aggressive renovation plan tends to be par for the course when using the Redevelopment Model. Before entering any unit-specific data, let’s set up the timing.

400 units spread over eight separate renovation sections = 50 units per section

A 24-month rehabilitation plan / eight sections is = three months per 50 units.

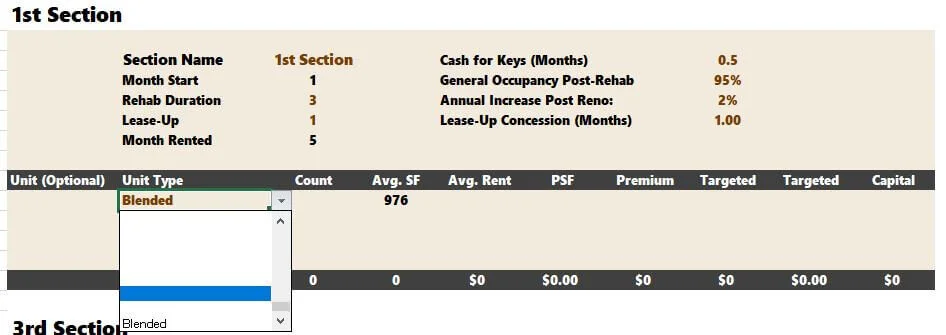

The renovation timing is set up for each section in the blue boxes. The “Month Start” is a formula that you can overwrite. The formula looks at when the previous section wraps up construction and will immediately begin the following month—Rehab Duration = three months.

Note: The “rehab duration” and “lease-up” assumptions must be an integer for the model to work correctly.

I also assume the lease-up will take one month on average.

Other Assumptions

I assume the following:

Cash for keys (paying residents to vacate early) will equal 0.5 months of the average pre-renovated rent

General occupancy pre-rehab will be 90%

General occupancy post-rehab will be 95%

Rents will increase by 2% annually after renovations are completed

Lease-up concessions will average 1-month of post-renovated rent (you’ll give the tenant one month of free rent)

Note: I copied and pasted these assumptions from one section to another. The first section is slightly different as it doesn’t have a “General Occupancy Pre-Rehab Assumption" like sections 2-7. Everything else is identical.

Unit Inputs

This is where the error check will save a massive amount of time. Inputting individual units for a large property would be impossible (unless you want to dedicate days to this proforma). Even grouping units by floorplan would be tedious with so many units.

I will grab the summarized floorplans, square footage, floorplan counts, rents, premiums, and CAPEX from the “Error Check” portion below.

And paste it into each of the eight sections.

Let’s set up the unit entries in the 1st section. From there, we can copy and paste.

First, I will grab the “Blended” Unit Type Option from the drop-down list.

The blended unit square footage will populate automatically. I will copy the other inputs from the “Error Check into “Section 1.”

Remember, we are allocating 50 units per section. Count = 50.

And then, I will copy and paste the same data into every section.

Renovations Summary

And with that, the renovation inputs are complete. You can check out the summary on the “Renovation Summary” tab:

You can go back to the “Reno Inputs” tab and tweak occupancy assumptions, concessions, or the overall timing of the renovation to see how it affects the numbers. The next step would be determining your capital spending for common areas and exteriors.

Summarizing Large Multifamily Repositioning Efforts

This article used the Redevelopment Model to expedite the underwriting for a larger apartment complex's repositioning effort. Using the error check and plugging in your high-level assumptions can pave the way to completing the “Renovation Inputs” tab in less than 10 minutes. If you are underwriting multiple large deals simultaneously, this will likely be your go-to method.