Multifamily Underwriting: Modest Rent Growth is Not a Given

Death, taxes, and 3% rental growth from years 1-10 of the proforma. If you've underwritten multifamily real estate, many investors use a 3% annual rental increase in their DCF model.

But now, a new trend is emerging that could put apartment investors in a precarious situation—Red hot rent growth across the U.S. and compressing cap rates across investment asset classes.

Per Apartment List, rent increased by 17.8% on average across major U.S. metros in 2021.

Investors may be tempted to continue to underwrite rents at double-digit annual increases to see return metrics at suitable levels and ultimately make up for the uber-aggressive asset pricing. However, rising interest rates may cool rent growth and convince investors to underwrite more cautiously.

Rent Growth Compounds

The most significant danger of using a double-digit (10% +) rent escalator in Year 1 of the investment hold is that compounding will have massive effects. This compounding will inflate the residual sales value of the multifamily housing investment due to an inflated net operating income (NOI) you'll eventually cap.

I first became aware of this dilemma when frequently analyzing newly built multifamily deals. These particular properties were a lot different than the value-add projects. I think value-add is much easier to make a business plan for.

You have a rent roll, and you can study the comparable apartment set and determine the market rents. You can choose how much rehab capital is needed and then pick a rental premium that will catch rents up to the comps in the local market.

New construction underwriting is challenging. There is no upside or "forced appreciation" that can take place. You’re at the mercy of the rental market at the macro level. Historically (pre-Covid), a 3% - 5% rent growth assumption in Year 1 could put an investor in an excellent position to win a bidding war on a widely-marketed offering.

With inflationary pressures and record-setting rent growth etched in the rear-view mirror, the bar has been raised on what “modest” rent growth means and how you must underwrite it to win a deal.

Let's walk through a project and see how early rental growth assumptions can impact total return metrics.

Rental Growth & Return

Let's look at a fully stabilized 75-unit apartment with an average rent of $1,200 or $1.69 PSF.

The underwriting model in the images below is available for download if you need a proforma workbook.

I have made standard assumptions for other revenue line items and operating expenses in line with how I expect this deal to perform. The broker says, "To be competitive, you'll need to underwrite 10% rent growth in Year 1."

The deal is approximately a 3.65% cap on T3/T12 numbers but would be a 4.75% cap rate (tax-adjusted) after the 10% rental increase in Year 1.

Initially, you heed the broker's advice.

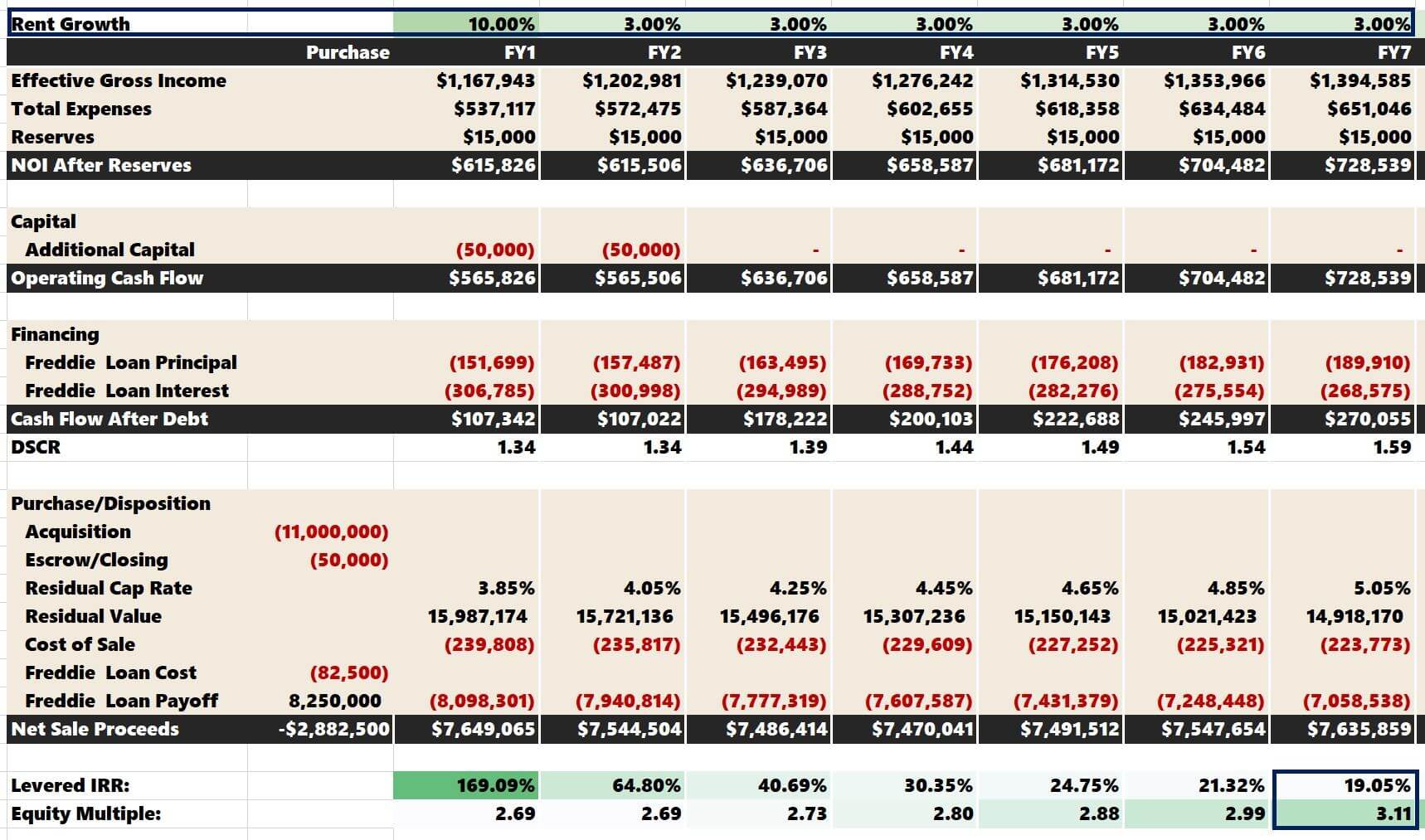

You can see in the image above that 10% rent growth is projected in Year 1 and then 3% rent growth after that. We are solving for a 5.05% residual cap rate in Year 7, which feels conservative given that we’d pay a 3.65% cap rate on the current owner’s historical financials.

A 19.05% 7-year IRR with a 3.11 equity multiple is a heck of a result if rent growth unfolds as projected.

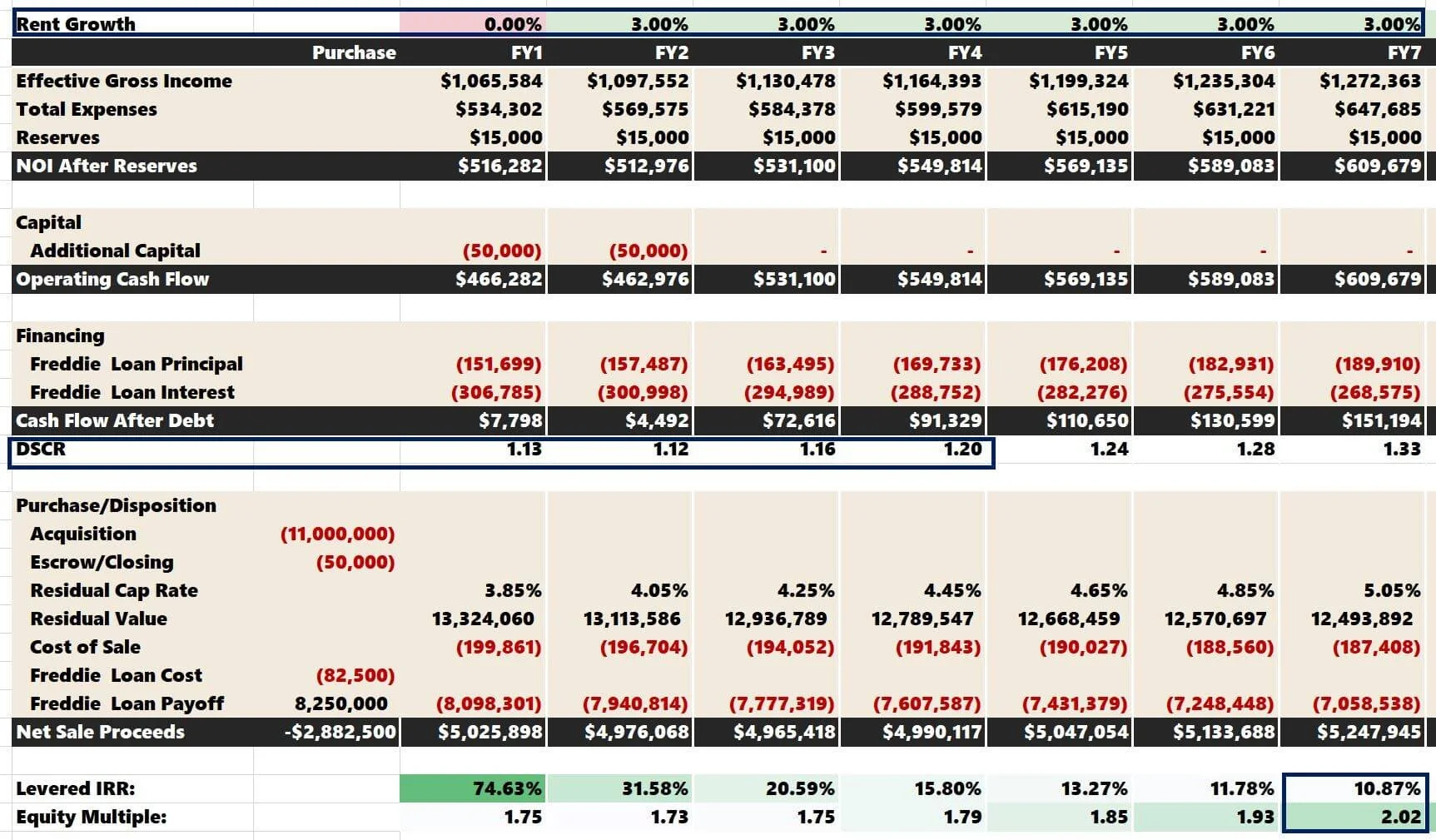

But what if that 10% rent growth doesn’t come to fruition? Now, let's look at how the IRR and equity multiple change if, in Year 1, rent growth is 0%.

The IRR plummets to 10.87%.

Also, notice the debt coverage. Although I have agency loan terms inputted into the model, no agency lender would check off on a DSCR under 1.20.

Agency lenders are forced to use in-place rents for their loan underwriting. To get around this, I’ve heard of investors using short-term bridge debt to close on the property. If the 10% rent growth happens, it’s a simple refinance into a Freddie or Fannie agency loan.

However, if the operations stumble, like in the example above, it could mean big problems, as bridge financing is more expensive and requires short-term repayment.

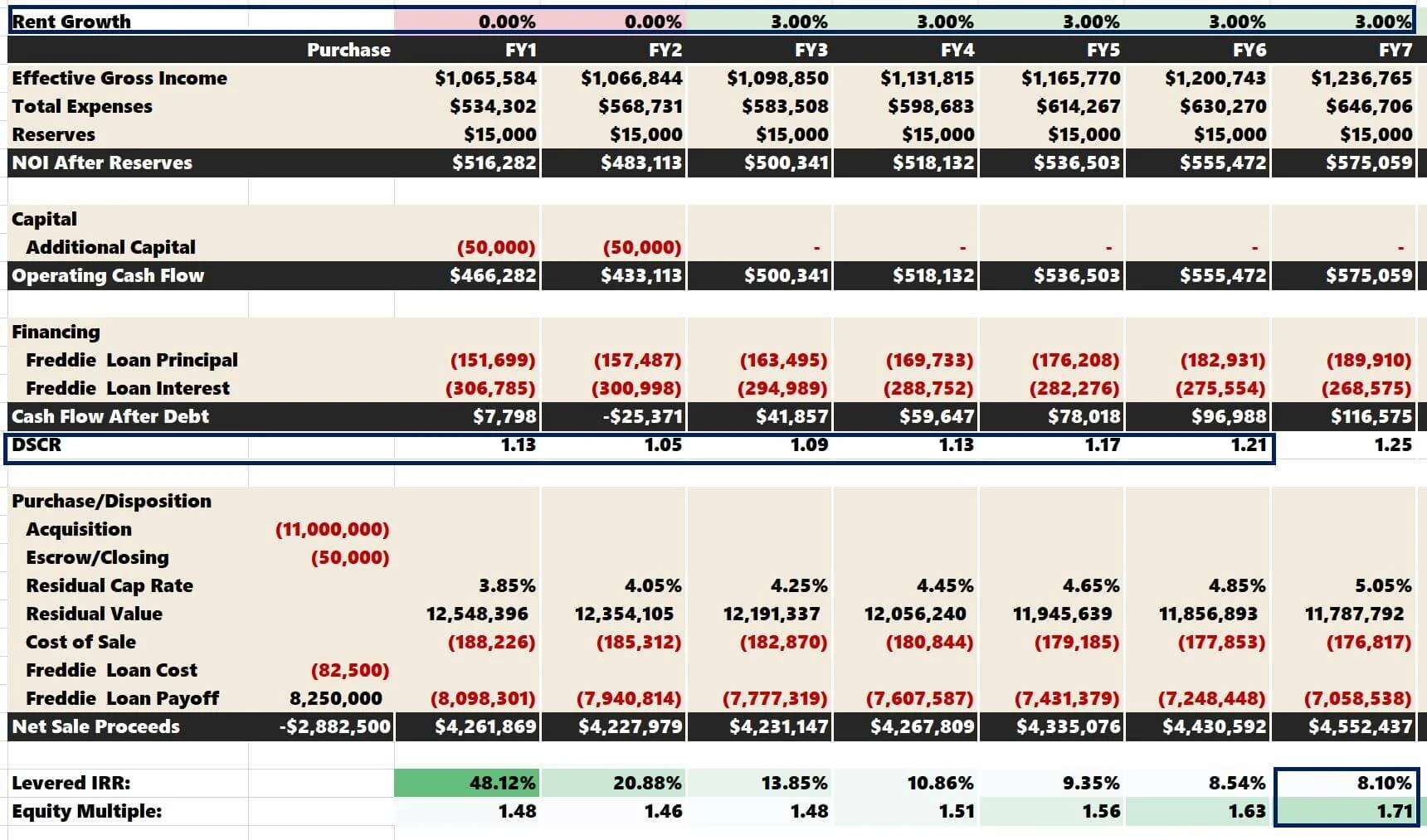

What happens if Year 2 also realizes 0% rent growth?

Now, the IRR is down to 8.10%.

The DSCR won’t get to 1.20 until Year 6. Had you taken out a bridge loan in this scenario, you would be in a predicament, as a refinance wouldn’t likely be an option.

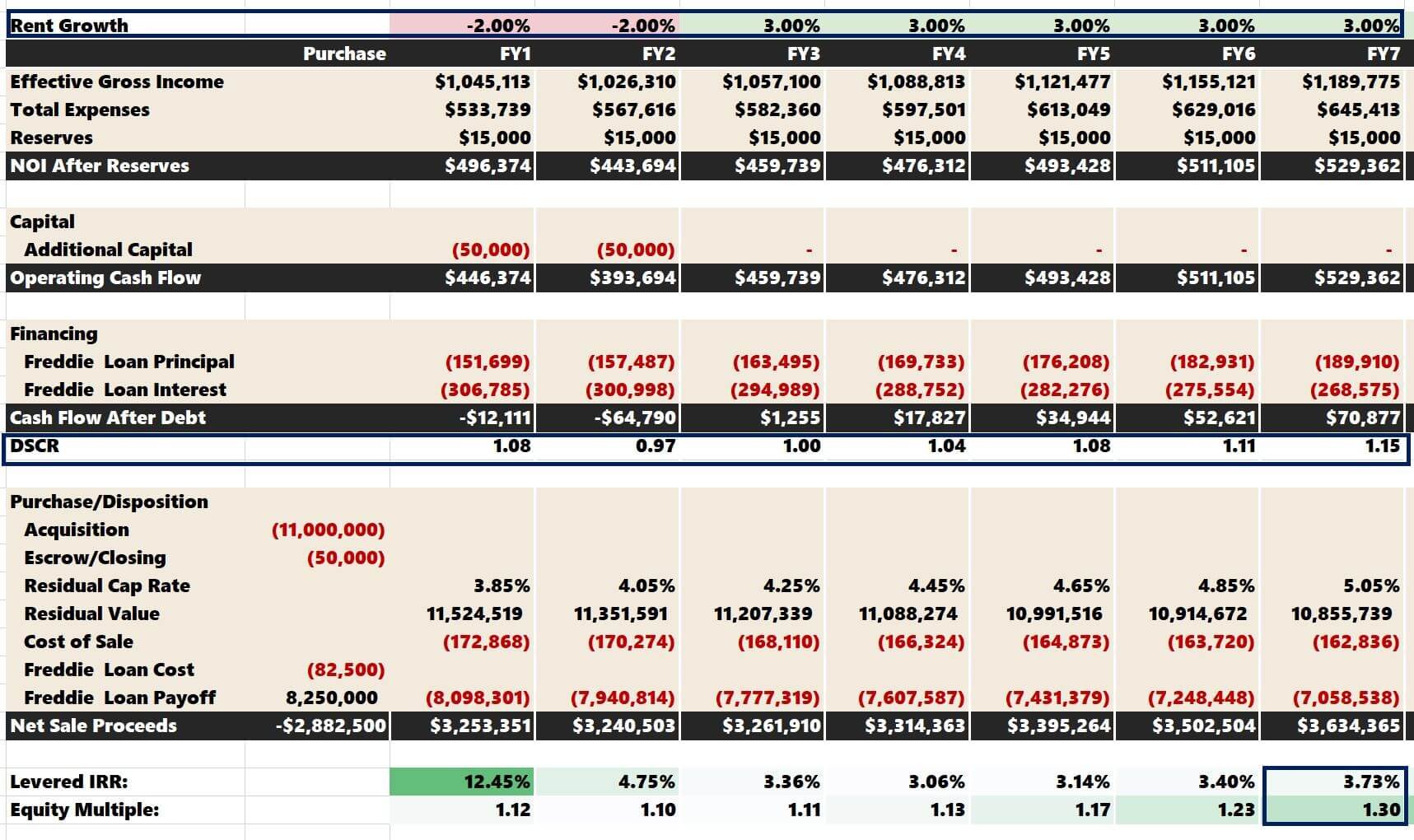

Finally, what if there is some negative rent growth in the first two years, let’s say -2.00%?

The IRR decreases to 3.73%.

Cash flow is negative in Year 1 and Year 2. If you didn’t have cash reserves, this could be a capital call if you sponsored the deal with LP equity.

With some operating adversity, the proforma is dead after two years. Ownership must figure out how they would dig themselves out of this mess!

Note: The rent growth in Years 3 - 8 in all scenarios I presented was 3%. I only altered the first two years, significantly impacting the overall return. The deterioration of the IRR would be exacerbated by a more extended hold period. Also, in a submarket where rent growth is stagnant or negative, market cap rates would likely increase to offset poor rental trends, which puts even more pressure on the proforma results.

Avoiding Multifamily Underwriting Blunders

These are some ways to ensure rent growth assumptions are well-vetted.

Stressing the Deal

As I did above, always plug in random, underachieving growth rates and see how they affect return metrics. If a couple of years of 0% - 2% increases craters the deal's outlook and makes you feel uneasy, it may be best to pass.

Higher Residual Cap Rate

Stressing the residual cap is always a great idea. A higher residual cap rate will have a similar consequence on the IRR and equity multiple as rents modestly escalate.

Understand the Resident Demographics

Do you know the incomes of the renters at the property? Is the current owner tracking this data? If so, you can determine the average income-to-rent ratio at the property. The higher the ratio, the more the rental pool will be able to absorb future rent increases. All the 3rd party research data may point to rent growth, and the rent comps may support it too, but if the resident base is struggling to make ends meet at the current rent levels, it's unlikely they will be able to stay when they receive their annual rental increase notice.

Understand the Rent Comps

I briefly touched on this above. What are similar projects renting for? Are they renting for more but offering less? Are there upside opportunities at the subject property that would justify higher rents? You must understand the rent comps and the subject property if you want to underwrite future rent growth accurately.

Summarizing Rental Growth

As a multifamily underwriter, you must know how crucial it is to give reasonable, realistic assumptions in the early years of the proforma analysis. Being too ambitious will set your business plan up for failure before you even get started. The longer you anticipate your hold period, the bigger your initial assumptions will impact the aggregate proforma. Don’t follow the herd. Be thoughtful, and always be sure to rationalize your underwriting assumptions.