Development Underwriting: Rolling Certificates of Occupancy

Over the years, a few developers have asked me if Tactica's Multifamily Development Model can handle "rolling certificate of occupancy" or "rolling COs."

For example, they may develop a project with 50 units, but five separate buildings will host 10 units each and finish at different times. Therefore, there will be five separate COs. Can Tactica's Model handle this?

What is the Certificate of Occupancy (CO)

After a new apartment building is finished, the local government issues the certificate of occupancy, verifying that the building is up to code and safe for habitation. Various inspections will generally occur to confirm safety items such as structural, fire, and electric, among others. This is generally the final stamp of approval before residents can begin moving in.

Tactica Development Model Logic

Tactica's model only supports one CO date. It cannot handle multiple COs and the staggered income/expense timeline for multiple buildings. There is a workaround that I've found to be suitable if you like the feel of the Tactica Model, but it will have multiple COs.

Using our example of 50 total units with five separate 10-unit buildings delivering at different times), an alternative solution could be:

Set the construction/CO Month to when the last building is delivered

Set a higher pre-lease percentage to account for the fact that the first phases have been leasing earlier.

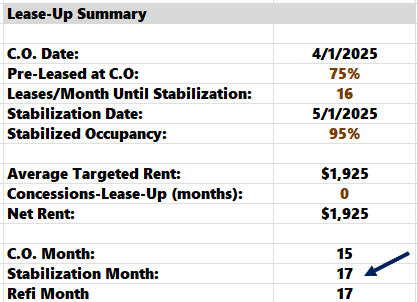

For example, the last building will be completed, inspected, and receive full CO in Month 15.

If four buildings have a head start on leasing before the 5th (and final) building is complete, you could see the pre-leasing amount to 75% to account for this.

Once the 5th building is delivered, the project should stabilize shortly after.

In the the above example, the property would get its CO in Month 15 and fully stabilized by Month 17.

Method Weaknesses

This method has some weaknesses. You cannot use revenues from the earlier phases to offset the construction costs of the later stages. However, this is a conservative way to underwrite it, and I think it could be explained to investors as upside potential to reap revenues earlier than projected in the proforma.

At the other end of the spectrum, there will also be operating reserves that need to be available for when earlier phases of the project are finished but not leased up sufficiently to support operating expenses like utilities, payroll, admin, contract services, and potentially some repairs.

It would be wise to beef up the operating reserve in projects with multiple phases to ensure funds are available to help hedge operating expenses before income ramps up.

Could Multiple COs Be a Future Upgrade?

I don't plan on implementing an updated version that will make it possible to handle multiple COs. I want to be transparent about that.

It would make the model exponentially more complicated. There would need to be essentially a separate financial model for every phase and tracking for each:

Construction timeline

Construction expenses

Unit mixes

Stabilized operations assumptions

Lease-up time frame.

Ultimately, the development model strives to answer the question:

Can developers create a more valuable project than its cost to build?

Tactica's Development model does this seamlessly. Whether your project has one CO or ten, it still fulfills its mission of helping investors determine whether a development is feasible.

Summarizing Underwriting Multiple COs

I cut my teeth working on multifamily development, usually with one certificate of occupancy (podium construction), and that’s what framed my mindset on how the logic should work within the proforma underwriting tool.

While in some projects, it’s common to have multiple buildings that will have different timeframes, you can still conservatively underwrite the project by implementing the following two steps:

Set the construction/CO Month to when the last building is delivered

Set a higher pre-lease percentage to account for the fact that the first phases have been leasing earlier.

While the cash flows may not be 100% accurate, it can be a more conservative way to underwrite a project, as income may be slightly understated.