Quantitative Tightening and its Effect on CRE Investment

June 2022 marked the beginning of the Federal Reserve’s quantitative tightening policy. This policy is a relatively unfamiliar territory, which has caused a lot of uncertainty and unease in the global financial markets. The last time the central bank toyed with it was in 2018, and it was relatively short-lived due to eroding financial conditions.

How Does Quantitative Tightening Work (The Short Answer)

Quantitative tightening (QT) is the Fed’s process of shrinking its balance sheet. In 2022, they began to taper asset purchases of treasuries, mortgage-backed securities (MBS), and corporate bonds by not reinvesting proceeds from maturing securities. Over time, the Fed’s balance sheet will hold fewer assets due to less purchasing activity, leading to less liquidity (money supply) flowing into the banking system.

Monetary Policy Tools

Before we dive into QT, let’s take a step back. The Federal Reserve Bank is currently enacting two major policy shifts that are grabbing all the headlines.

Increasing the Federal Funds Rate

Quantitative Tightening

Federal Funds Rate

The federal funds rate dictates the overnight interest rate commercial banks borrow and lend their excess reserves to meet compliance thresholds. The Federal Reserve controls this rate by using open market operations to buy and sell short-term treasuries that will influence the overnight interest rate between banks. This rate guidance drastically impacts short-term interest rates but tends to correlate strongly with rates further out on the yield curve (mortgages, auto loans, student loans).

During economic hardships, the Fed decreases the federal funds rate to stimulate growth and liquidity in the banking system. Lower interest rates across the yield curve mean cheaper capital, high demand for funding, and increased investment. During the pandemic, the Fed reduced benchmark guidance to 0.00%—0.25% (or 0 to 25 basis points).

During economic booms, the Fed can increase the fed funds rate to increase the cost of capital, lower the demand for funds, and decrease investment. The Fed is currently enacting gradual monthly rate hikes.

Consequences of rate hikes are seen in U.S. treasury yields presented on the St. Louis Fed website.

The 10-year treasury has had a noticeable impact on commercial real estate financing costs. Most loan products quote an interest rate over 2x higher than one could obtain years ago.

What is Quantitative Easing

Before getting into the nuts and bolts of QT, it’s helpful to discuss quantitative easing (QE), the policy that usually precedes QT and was prevalent during the pandemic years. Open market operations to promote a low benchmark rate may not be enough to kick-start the economy. QE is when the central bank purchases longer-term investment securities in the open market to infuse cash into the banking system, drive down fixed-income yields, and instill confidence in investors and businesses.

The Fed creates (or prints) money

The Fed purchases an assortment of securities further down on the yield curve (usually Treasury bonds and agency MBS)

The Fed holds these securities on its balance sheet while the money created to buy the investments is now in circulation

QE received much notoriety in the global financial crisis of 2008. The entire financial system was illiquid and locked up. QE was a handy tool to get money circulating again and aid the economy in recovery. More money in the financial system leads to:

Lower borrowing costs

More investment

Increased economic activity

Economic growth (higher GDP)

Inflation (problematic if too high)

We’ve seen all this play out post-COVID, with debt rates bottoming out in the late 2020s, rampant appreciation in stock markets, real estate assets, cryptocurrency, and other speculative “investments.” And unfortunately, we’ve seen rampant inflation across all sectors of the U.S. economy, including consumer staples.

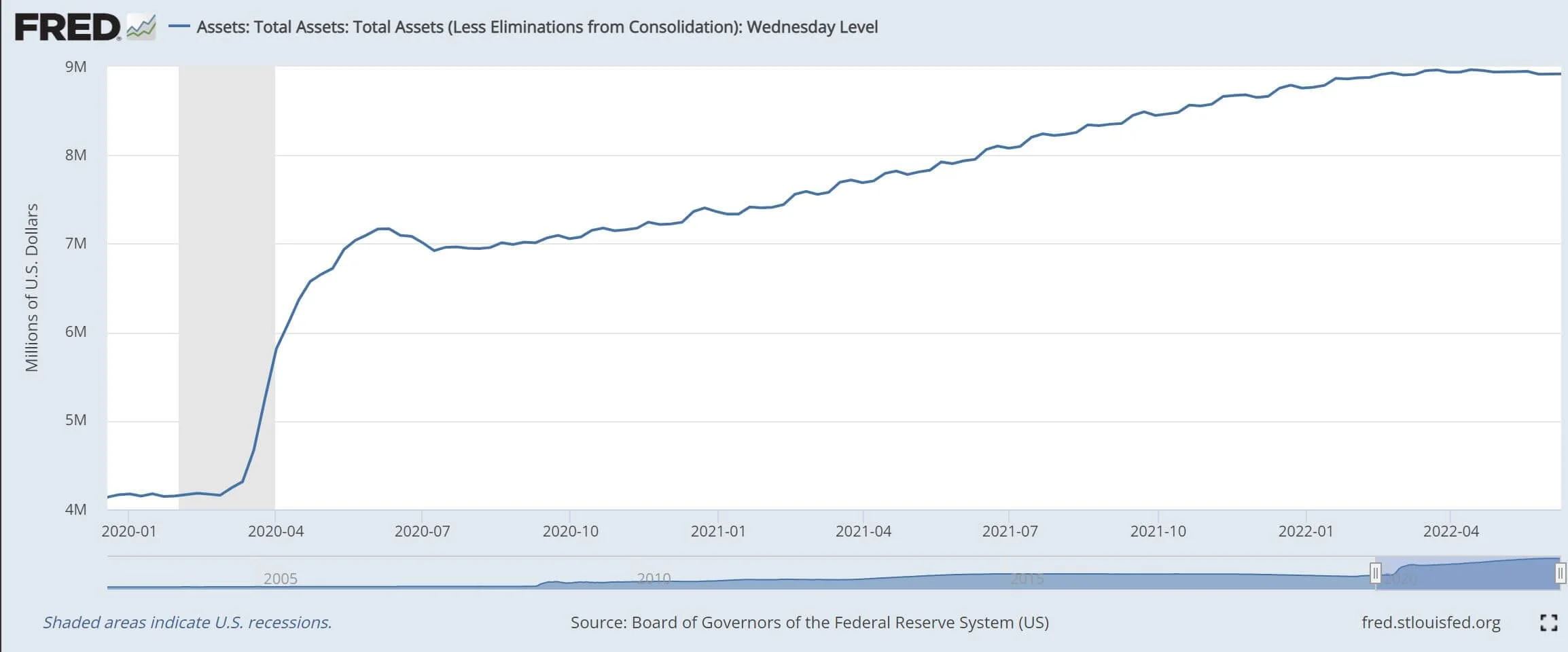

In response to COVID, the Fed’s QE target was to purchase around $120 billion of securities (primarily treasury securities) monthly, growing its balance sheet to nearly $9 trillion, charted by the St. Louis Fed.

QE was also a popular response in Europe as the European Central Bank (ECB) embarked on a €1.85 trillion buying spree in 2021 to help combat the pandemic.

When there’s always bond demand, thanks to the Fed being a prominent market participant, the bond market will see elevated valuations, which drive down bond yields and make credit cheaper for borrowers. It also is a massive signal of strength that promotes confidence and stability (some say the monetary cycle is the business cycle). It can also indirectly make other speculative asset classes more desirable, increasing asset prices and creating potential asset bubbles.

What is Quantitative Tightening

In Jerome Powell’s June 2022 presser, rampant inflation and a healthy labor market (highlighted by 3.6% unemployment) signal a transition to QT with rate hikes to battle the elevated inflation levels.

QT = Balance Sheet Normalization (shrinking the balance sheet)

Implementation of how you reduce the balance sheet can come in many forms. For example, suppose you owned a store and had perishable inventory. In that case, you’d probably take the firesale approach, flood the market with your merchandise, and try to sell every last one at whatever price a buyer would be willing to pay.

The Fed is avoiding this course of action. They do not plan to sell any of their securities in the open market (however, this could change). Flooding the market with bonds would create a massive supply glut and valuation carnage across all asset classes.

Fed Security Runoff Plan

They plan to take a more measured “runoff” approach. The Fed intends to discontinue bond reinvestment of particular securities as investments mature at a specific “cap.”

The “runoff” cap is the following:

Treasuries: $60 billion

Agency MBS: $35 billion

In other words, the Fed will only reinvest maturity proceeds that exceed the stipulated amounts above. This cap was phased in at 58% of the above quota in June, July, and August 2022 ($35 billion and $17.5 billion, respectively).

If all goes to plan, this will shed approximately $1.1 trillion in securities annually from the Fed balance sheet.

Here is the Fed’s progress thus far in 2024, as reported by the fred.stlouisfed.org.

Fed balance sheet asset levels have fallen to $7.57 trillion as of March 2024.

May 2024 Fed Policy Change

The Fed announced that starting in June 2024, it will be scaling back its quantitive tightening program to:

Treasuries: $25 billion

Agency MBS: $35 billion

Note: Agency MBS remains unchanged from previous levels, but overall, this would be a 37% reduction of total security runoff. This action, in theory, should help lower long-term rates.

Quantitative Tightening with Smaller Numbers

I’ll be the first to admit that it’s hard to conceptualize what this means and how it impacts the global economy. Imagine you own ten government bond holdings worth $1,000 each, paying a semi-annual coupon rate of 5%. They all have a 1-year maturity (for simplicity).

Total Bond Portfolio = 10 x $1,000 = $10,000

Total Annual Payment = 5% x $10,000 = $500

Historically, when these bonds mature, you will take all $10,000 and reinvest them back into the bond market. You don’t care about the current bond prices, coupon payments, or economic fundamentals. You keep recycling the funds and buying new bonds no matter what.

However, you will only reinvest $8,000 of the $10,000 this year. With the $2,000 you don’t want to reinvest, you will destroy it via a shredder. That $2,000 will no longer be in circulation. It’s erased from the financial system.

The following year, when the $8,000 in bonds matures, you will only reinvest $6,000, and again, you will shred the $2,000 you won’t reinvest.

This strategy would be impactful if you were one of the largest bond investors in the world. Someone else would need to backfill that demand you left behind ($2,000). If there isn’t demand, the price of the bonds will drop, and the impact will be felt everywhere.

The Fed is the same bond buyer but on a much larger monthly scale. Instead of reinvesting and growing their balance sheet, they will keep the cash on the sidelines at maturity and remove those funds from circulation.

QT Real Estate Investment Consequences

Nobody knows how QT will impact real estate over the medium and long term. The Fed can change its action anytime, which also muddies the waters. However, some trends are playing out that are likely going to solidify:

Expensive Debt

Interest rates across all commercial loan types are over double what they were years ago, and many lending institutions have halted funding. Not only is debt expensive, but in some cases, it is incredibly challenging to obtain.

It’s a good guess that rates will likely stay elevated until the Fed changes its policy trajectory and financial institutions gain more comfort with the economic outlook in the current climate.

Deteriorating Asset Valuations

2022 Asset Analysis

Most asset classes have been getting bludgeoned as of late:

Stocks: S&P 500 is down over 20% from all-time highs

Bonds: The aggregate bond index (AGG) is down nearly 17% from all-time highs

REITs: Many residential REITs are down 20% - 30% from all-time highs

Unfortunately, the probability is high that private real estate projects will see pricing corrections in 2022 and 2023. It’s best to stress your deal using a residual cap rate that may seem obnoxiously high in the current environment as an extra safety net. Cash flow trumps capital events (refinances and sales) in this environment.

2024 Asset Analysis

Stocks: The S&P 500 has recovered and is brushing up against all-time highs as of March 2024

Bonds: The aggregate bond index (AGG) is still down nearly 18% from all-time highs

REITs: Many residential REITs are down 30% - 50% from all-time highs

As I predicted, private real estate valuation followed the REIT valuations, and many brokers and multifamily professionals are seeing 20 - 30% price corrections (varies by market).

Interestingly, public REIT markets have declined further since 2022, which could mean multifamily assets have more to correct in 2024/2025, although REITs have seen a nice bounce upward late in 2023.

Stagflation

If QT hampers economic productivity while driving up the unemployment rate but fails to tame inflation, stagflation is a real risk.

Summarizing Quantitative Tightening

The Federal Reserve is at a crossroads. Inflation wreaked havoc on U.S. consumers as too much money chased too few goods. While there’s been progress in taming inflation, as of March 2024, the most recent 3.1% annual CPI reading is still well above the Fed’s 2.0% mandate.

Quantitative tightening is a policy tool intended to thwart inflation. The Fed tapers asset purchases of treasuries and mortgage-backed securities (MBS) by not reinvesting proceeds from maturing securities.

Over time, the Fed’s balance sheet will steadily decrease, leading to less money supply flowing into the banking system.