Analyzing Fix & Flip Deals

This blog post strives to be an incredibly detailed tutorial that describes properly investigating, fixing, and flipping real estate investing opportunities. There will be many visuals throughout the article that are taken from the Tactica Residential Analysis Model.

Fix & Flip Deal Analyzer Tutorial Contents

This is the second article in a two-part series. Part #1 will cover using the Residential Analysis Model for turnkey investment opportunities. This article only covers the fix and flip deal analyzer spreadsheet tabs. If you haven’t yet visited part #1, I recommend you read that article first.

Fix and Flip Rehab Costs

Before you ever commit to purchasing a property, your first due diligence task will likely be determining a rehab budget. In the analysis tool Tactica uses for house flipping, the renovation budget showcases four essential metrics:

Understanding your all-in construction costs within reason is crucial during the property analysis. It will allow you to see at a very high level if:

Purchase Price + Total Rehab Cost = An Attractive Investment Basis

Assuming project costs plus the purchase price are below the market comps, you should feel comfortable continuing with the deal analysis.

Repair Timing

The timing of each repair can impact your interest expense, construction draw costs, and how much cash you will need to dip into before getting reimbursed by a construction lender or hard money lender. It's best to break out all individual repairs and estimate a start and completion date.

This process, in turn, will clarify how much rehab expense is happening each month and the corresponding loan draws needed each month.

Construction Draws

Construction draws usually cost money. Commonly, I've seen $200 - $500 for a draw request. Planning each repair item can help real estate investors maximize their draw schedules and avoid unnecessary expenses.

Interest Expense

The interest cost typically will begin ticking as soon as you make a draw. More draws early on will lead to higher overall interest expenses. Some lenders will "pre-draw" interest, starting the interest clock on day 1, and you will pay interest on all allocated funds, even if you have not yet drawn on them.

This differentiation can considerably impact total interest expense if you use creative financing that tends to have a higher interest rate than traditional financing products.

The example above assumes interest accruing after it's drawn from the lender. Draw costs are summarized as well.

Cash Management

A new investor may forget that construction financing acts as more of a reimbursement for repairs than an upfront loan. You would need to come up with funds to complete the repairs before the lender confirms the updates are completed and reimburses you.

I think it's crucial not only to understand how much money you need to close the deal but also to understand what the biggest projected construction draw is. You must fund that with cash, a revolving credit facility, or a credit card.

Analyzing these five factors will help you to formulate a clear picture of your all-in costs related to the renovation. Holding costs such as property taxes, insurance, utilities, and permits are also essential to account for during the rehab project.

The Tactica Residential Analysis Model allows you to make these kinds of assumptions monthly or annually.

Closing Assumptions

Closing assumptions are two-fold. What is the sale price you are willing to pay, and what is the price you can sell the investment property for once the renovation is complete? If:

Price Today + Rehab + Holding Costs < Future Sale Price

You're in business, and a house flip strategy may be formidable.

Along with the purchase price, it's also crucial that you factor in closing costs, financing costs (we will cover in great detail soon), and other miscellaneous expenses that will come up to successfully close on the property, such as legal fees and perhaps a finder’s fee. With this information, you'll likely know how much cash you'll need to bring to the closing table.

The “Future Sale Price” is called ARV or "As-Repaired Value." The ARV is a crucial component for many lenders investing in house flippers. Hopefully, there are comparable properties in the neighborhood that are in a similar condition to the future state of your rehab project.

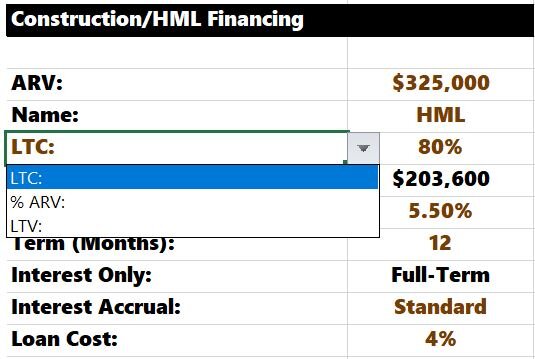

The Tactica tool includes an ARV assumption in the Financing section of the workbook, as some lenders may lend based on what the final repair value is projected to be.

Financing Assumptions

Finally, getting multiple financing bids and understanding the fine print and the benefits of going with "Lender A" vs. "Lender B."

Lenders will typically determine the loan amount based on:

Loan to Cost (LTC)

ARV

Loan to Value (LTV)

LTC

A lender will take the purchase price + construction costs and give you loan proceeds calculated as a percentage of the total cost basis.

LTV

LTV is the most conservative, where a lender would give you loan proceeds calculated as a percentage of the purchase price.

ARV

ARV would be the most aggressive, and a lender would give you loan proceeds based on a percentage of the future improved value of the property.

Other Assumptions

Rehab financing is interest-only and typically has a short term (12-24 months) as it's meant to "bridge" the project from its current state to its stabilized highest and best use.

We discussed interest accrual being “standard” or “pre-funded.” “Standard” benefits the borrower as proceeds will not accrue interest until funds are deployed into the project.

Origination fees are charged to the borrower as a percentage of the loan amount. More speculative financing arrangements like private hard money will have much higher origination fees than traditional bank or agency financing.

The more successful real estate deals you execute with a particular lender, the more leverage you'll have to negotiate:

Cheaper origination fees

Lower interest rates

Deferred interest payments

Deferred origination and draw payments

Higher total loan proceeds.

Fix & Flip Proforma

Once I have a handle on rehab costs (including holding costs), cash management, closing assumptions, and financing assumptions, all this data should flow nicely into a proforma cash flow analysis.

Fix & Hold Proforma

I think it's essential to not only look at the quick flip of the property but also uncover what returns would look like if you instead refinanced the construction loan and kept the investment for multiple holding periods.

If you are already doing a fix and flip analysis, comparing the two takes three simple additional steps.

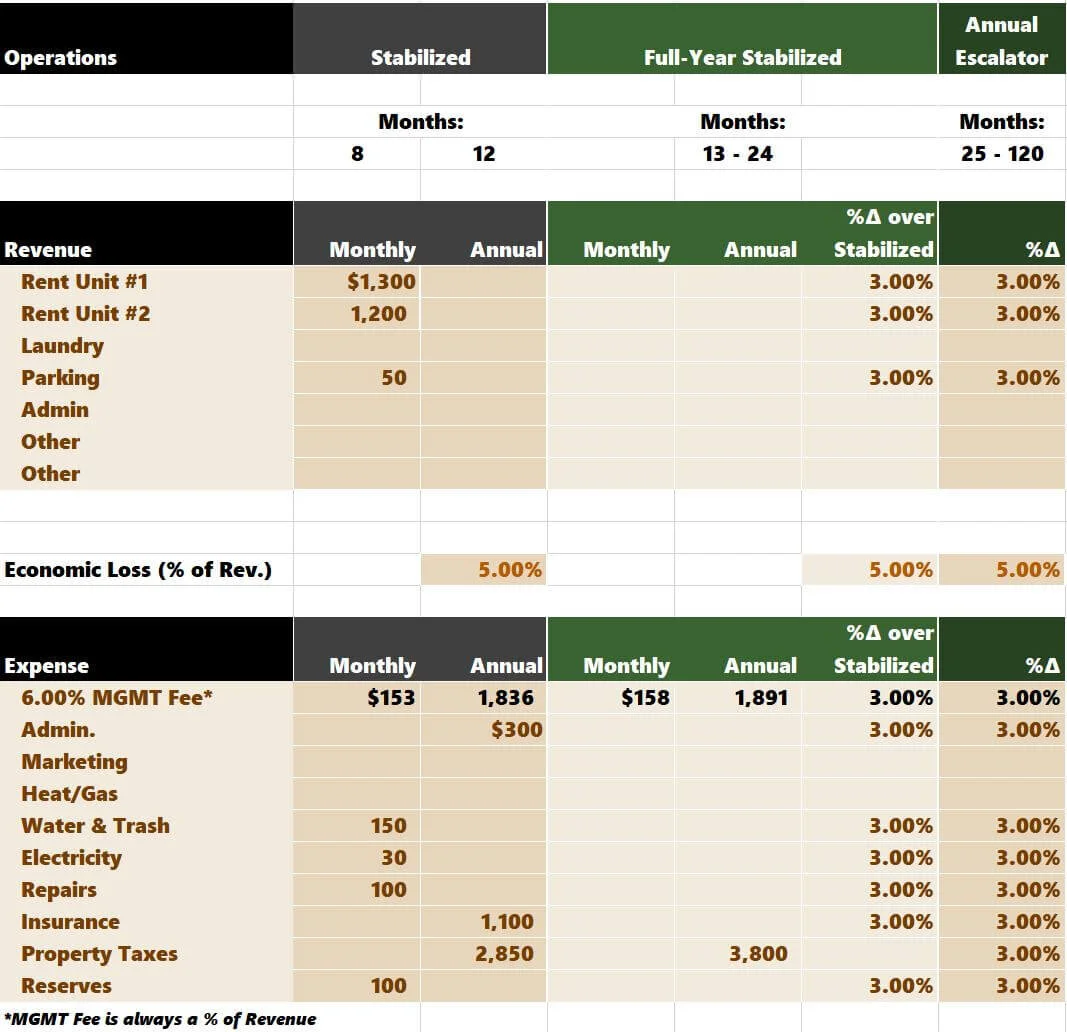

Stabilized Assumptions

What will you be able to rent the unit(s) for, and what do you project stabilized assumptions to be (grey column)? What do you project the annual escalator to be each year for both revenue and expenses (green columns)?

The stabilized assumptions above project a 3% annual escalator on every line item besides property taxes. Taxes will increase significantly in Year 2 to $3,800 from $2,850, and then see 3% increases from Years 3 - 10.

Blank rows (Marketing & Heat/Gas) will be assumed to be $0.

The model will summarize stabilized assumptions.

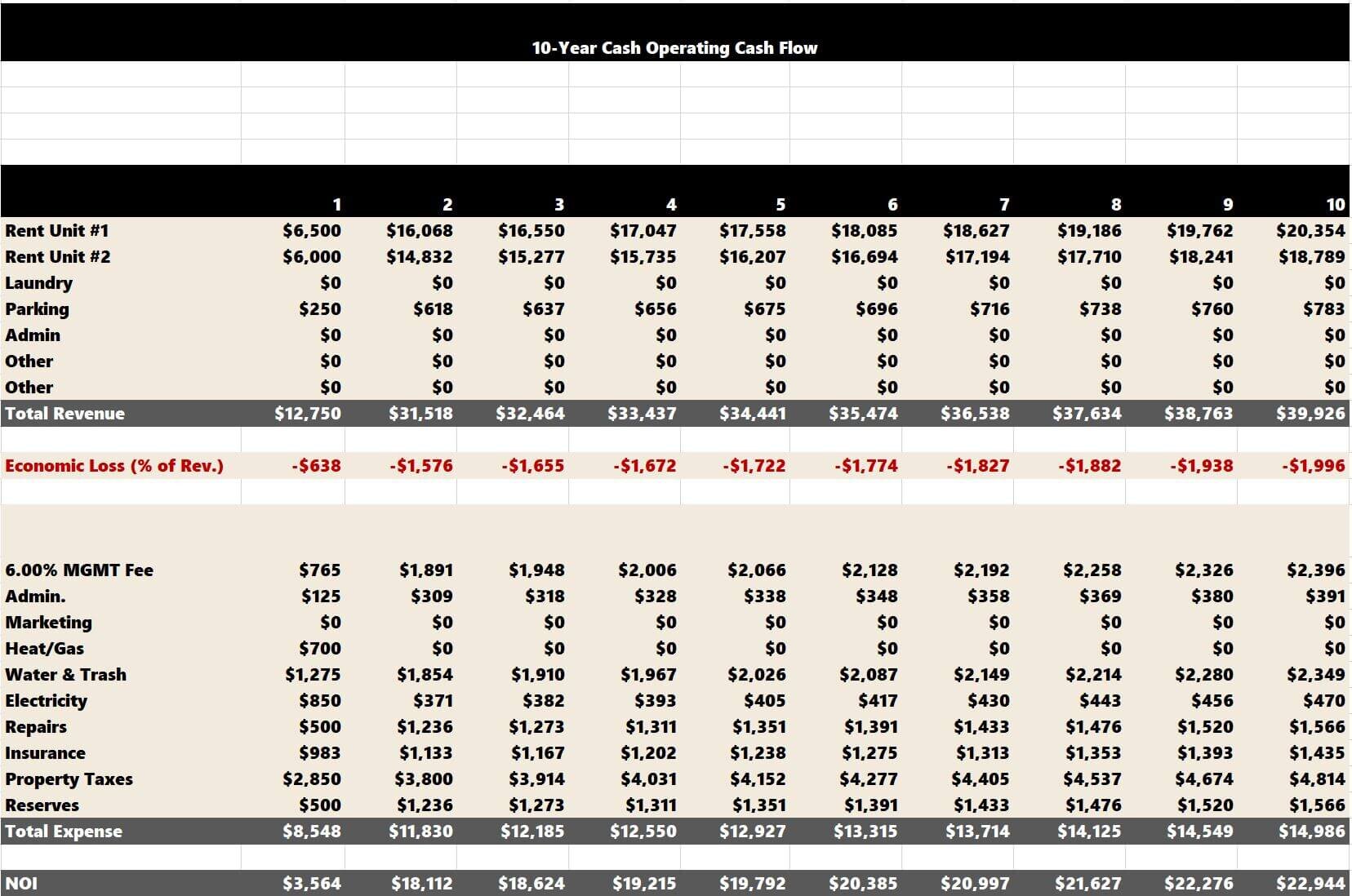

And the 10-Year operating cash flows.

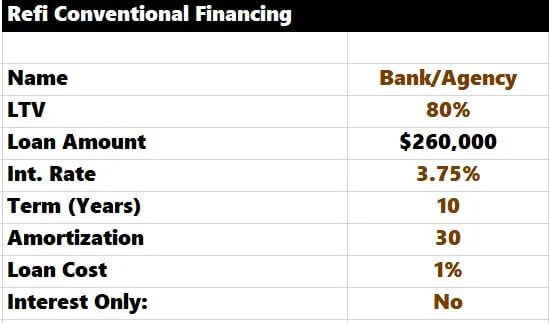

Refinance Assumptions

The hope is that you can lock-in conventional financing once the rehab is completed.

The model will summarize the key refinance metrics for you, too. There are no assumptions to be made in this section.

Appreciation Assumption

The ARV amount will determine the refinance proceeds. How much do you expect the property to appreciate annually post ARV? You can see below that I am assuming a modest 1%.

The investment dashboard is now complete. All the data points for fix/flip and fix/hold are in one central location.

After completing those three steps you can now compare flipping vs. holding.

In the example above, I compare a 7-month flip to rehabbing and holding for ten years. Would you prefer to make a quick and sizeable ROI? Or hold on to the investment for a more extended term but have a modest ROI? It will depend on your investment opportunities and whether or not you can recycle the capital earned on a flip into a new project that can make you higher returns.

Fix & Hold Summary

The final significant facet of the analysis is the “Fix & Hold Summary” tab. This is where all the various return metrics will populate, spanning multiple hold periods.

Every data point that you’ve inputted into the model is presented in the image above. If you sell in Year 1, the returns will match the “Fix & Flip” scenario.

Summarizing Fix & Flip Deal Analysis

This blog post walked you through a real-life fix/flip or fix/hold investment. I used the Tactica Residential Analysis Model to analyze an investment opportunity properly. There are moving pieces that a house flipping financial model must take into account, including:

Rehab Budget & Timing

Cash Management

Closing Assumptions

Financing Assumptions

Proforma Expectations

A well-constructed proforma will allow you to input this crucial information and stress the best and worst-case scenarios. This article only covers the fix and flip deal analyzer spreadsheet sections. There is also a “turnkey” component as well. If you haven’t yet visited part #1, I recommend you read that article now.