Calculating the Interest Reserve on a Construction Loan

It's no mystery that when you borrow money for commercial real estate investment, you will owe the lender interest on the borrowed sum. For a stabilized property that provides positive cash flow, you can deduce that the interest expense will be paid with the monies generated from the operations. However, loan payments on construction financing involve a different process because a property won't generate cash flow during the construction period.

Without talking to a lender, there are some ways to estimate the interest reserve. However, it is crucial to recognize that all lenders will have different reserve fund requirements. It's best to make an assumption and fine-tune it once you have more clarity on the lender's requirements.

Interest Reserve Contents

Construction Loan Interest Primer

There are a few different ways to go about calculating construction interest. Before I dive into the details, let me explain a few quick high-level observations about construction mortgages.

They are drawn periodically over the construction period, typically in monthly disbursements.

They are interest-only (principal paydown is not required until a capital event).

They are meant to be short-term debt instruments.

They have a higher interest rate than traditional permanent agency financing.

The first bullet is crucial to conceptualize because it's not like a standard real estate loan where all the loan funds will be dispersed on Day 1. Instead, they are distributed as work is being completed. Early on, interest expense will be minimal because only a fraction of the loan proceeds will accrue interest. Towards the end of the construction period, interest will ramp up considerably as the loan balance approaches being maxed out.

Due to the state of the property and lack of cash flow, the principal paydown is not required each month. This isn't optimal for a lender and adds risk. There could be cost overruns, changing market fundamentals, or other factors affecting the borrowers' ability to repay the lender in full. Therefore, loans are made over short time horizons (12 -24 months) with higher interest rates to consider this additional risk.

Interest Reserve Expense Estimate

The most common interest reserve estimate I've seen is the following, with more detailed explanations below.

Interest Reserve = ((50% x Loan Amount x Interest Rate) / 12) x Months of Construction

50% is a rough estimate of the average outstanding loan proceeds over the entire construction period. A percentage higher than 50% is more conservative. This conservative approach may be appropriate if the construction costs are heavily front-loaded.

Loan Amount: This is financing for hard costs, soft costs, land (purchase or contribution), impact fees, finance, title, and other miscellaneous cost items (but not interest expense)

Interest Rate: The estimated interest rate quoted by a lender

You then divide by 12 to make the annualized interest rate a monthly rate.

The final step is multiplying by the projected construction period (typically 12 - 16 months)

Interest Expense Example Calculation

Let's say we have the following Information:

Loan Proceeds: $26,000,000

Loan Interest Rate: 4.5%

Construction Period: 14 months

Interest Reserve = ( ( 50% x $26,000,000 x 4.5%) / 12 ) x 14

Interest Reserve = $682,500

Construction Loan Calculator

The Tactica Development Model has a construction loan calculator built into its framework.

Not only can the model calculate the financing proceeds for you (as a percentage of total construction costs), but it will also seamlessly:

Calculate monthly construction loan payments that are dependent on the construction draw schedule

Calculate the capitalized interest reserve dependent on the construction draw schedule, construction loan payments, and total loan proceeds.

If a lender were to give the example amount of loan proceeds ($26,965,882) in the example above, you could use the “construction loan amount” toggle to back into the correct loan amount.

Capitalized Interest Reserve Calculation

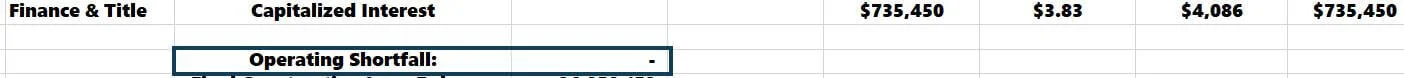

The Tactica Development Model will calculate the interest reserve for you. A line item in the construction budget is dedicated to this titled "Capitalized Interest."

You must decide all the other project costs and when each will be funded during the construction period. The model knows to utilize investor equity first and only draw on construction financing once all equity has been exhausted.

You can see monthly interest expense ticking up as more proceeds are drawn. The cumulative total sums each month are effectively the "capitalized interest" in the image above.

Note: The capitalized reserve calculator is circular, so "iterative calculations" must be enabled upon opening the workbook in Excel. Capitalized interest depends on how much the total project costs, which depends on how much interest expense is borrowed. Excel will solve this algebra problem if you enable iterative calculations.

The model will also let you know if there is an operating shortfall.

This shortfall can happen if the project is slow to lease up and operations are negative when the construction loan is maxed out. If there is a shortfall, it would be wise to raise extra funds to bridge the gap between lease-up and refinancing into a permanent loan.

You may have noticed that the capitalized interest in the model of $735,450 is close to the "estimate" we made earlier of $682,500. I used approximately the same numbers in the estimate (rounding down the loan amount), which are reasonably close.

Related: Deferring a development fee could help cut down capitalized interest expense.

Differing Lending Terms

When reviewing multiple bank term sheets, construction lending terms can be all over the board. I've been tasked with plugging multiple debt quotes into the model and seeing how they impact returns. Interest reserve quotes from banks can be 2x more or less than another term sheet!

It seems like the interest reserve can be much more of a "feel" thing than a science. It's one of the many levers a lender can use to mitigate risk. A lender requiring a lower interest reserve may not offer as much leverage, or they might quote a higher interest rate. I see it as a giant balancing act.

The banker I frequently talk to told me he would leave the interest reserve lingo vague on an initial term sheet. The language will say, “The bank will require a pre-funded or capitalized interest reserve which is sufficient to cover ‘x’ months of interest payment.”

This will force the borrower to create a realistic draw schedule. The bank will then review it, ensure it’s reasonable, and check off on it.

When you get to the point where you begin soliciting financing, and you see a discrepancy between what the model is calculating and what the lender is suggesting, please know that this is common. Many lenders will be relieved to know you put the time and thought into planning your scheduled draws and forecasted interest expense payments.

Adjusting the Capitalized Interest Reserve

In the example we were using earlier, Tactica estimated capitalized interest of $735,450. What if your lender requires an $800,000 interest reserve? It's a relatively simple adjustment. I would add a budget expense line above the capital interest reserve that is already being calculated. I would name it "Interest Reserve Contingency." I would budget for the difference between what the model calculates vs. the lender's requirement.

$800,000 - $735,450 = $64,550

I would then drag formulas over this new line item and set it as funding "Upfront."

The financial model conservatively accounts for $800,000 in interest payments (actually, it’s a little more than $800,000 as the capitalized interest line item is slightly higher than before).

The hope would be to complete your project according to the construction budget and “draw plan” you have laid out. If everything goes accordingly, the bank will be ecstatic that you didn't have to utilize all the projected interest, and you should have an extra cash cushion in case other aspects of the project go awry.

Summarizing the Capitalized Interest Reserve

The interest reserve is a simple concept but is much more complicated when you get into the nuances of calculating it. When looking at a construction proforma, you should be able to determine whether the interest reserve is calculated with a "rule of thumb" calculation or a sophisticated analysis that factors a construction draw schedule.

If you are ever stuck on where to settle, assume the interest reserve will be more significant. This overstatement will impact the proforma negatively as you'll need more equity, construction costs will be higher, and returns will be lower. Erring on the side of caution is always the correct course of action when unsure of a specific assumption in a real estate proforma.

If you need a simple multifamily development tool, click the image below to download our “Back of Napkin” analysis tool.