Hard Money Loans: A Practical Real-World Explanation

Many real estate investors will utilize hard money loans for rental properties at some point in their investing career. This article details the logistics of how these instruments are structured, drawn, and paid off. While I plan to touch on the high-level characteristics, the emphasis of this blog post is to show you the actual cash inflows and outflows of a hard money financing arrangement to underwrite and understand effectively.

Hard Money Rental Loans Focus Areas

Hard Money Lending For Rental Properties

When I started my commercial real estate career, I was mostly exposed to conventional financing arrangements offered by agencies, banks, and larger financial institutions. Whenever I heard the term "hard money," it made me cringe, mostly because I had little understanding of its purpose. I had this perception that hard money in real estate investing was similar to what payday loans offered by the local pawn shop. I thought they were predatory and that no respectable investor should ever immerse themselves in the dark underworld of private investors.

I was pretty naive. As I've become more familiar with private lending options for rental properties, I have lost the negative stereotype and have redefined hard money loans as "opportunistic on-demand financing." Private hard money is a tool that allows investors to move quickly to take advantage of fleeting investment opportunities.

Hard Money vs. Conventional Financing

Opportunity comes from short-term financing arrangements to purchase and rehab investment properties. Unlike traditional mortgages, hard money loans are less dependent on the borrower's credit scores and history and focus more on the underlying investment collateral. In other words, private lenders don't care as much about your student loans, credit card debt, or five other mortgages. They care more about the value of the asset you are borrowing for. They will want to see a track record of successful investments, potentially leading to more favorable loan terms.

With conventional financing, loan proceeds are commonly calculated using a loan-to-value ratio (LTV). The purchase price of the investment property will determine the maximum amount of loan proceeds as a percentage of the total value. Hard Money lenders commonly focus on the asset’s value after improvements (as repaired value) to determine their lending capacity.

Conventional LTV

Suppose the property costs $200,000 and needs a $50,000 renovation; a conventional lender may only lend up to 80% of the purchase price or $160,000 (80% * $200,000). The borrower would be on the look for $90,000 ($40,000 at closing + $50,000 in renovations).

Hard Money ARV

The hard money lender commonly uses the "after-repair value" (ARV). If the $200,000 rental property undergoes a $50,000 rehab and comparable properties support a $350,000 valuation post-renovation, the lender may loan up to 65% of the ARV or $227,500 (65% * $350,000). The hard money lender's willingness to realize the property's upside potential makes the upfront down payment much less burdensome for the borrower in the private scenario.

With that being said, some private lenders will still resort to an LTV or loan-to-cost (LTC) ratio if you are an unproven operator with no track record.

Hard Money: Fast

When working with hard money lenders, the loan application and approval process are often expedited. Traditional lenders may take months to approve a loan, and final approvals may hinge on appraisals and inspections. Hard money can be approved in a matter of days if a relationship has been established between the borrower and the lender.

Full-Term Interest-Only

Hard Money loans don’t usually amortize, meaning you are not responsible for paying the principal back while the loan is outstanding. You will only make interest payments during the renovation project. Once the remodel is complete, you’d pay off the outstanding loan balance with proceeds from a refinance or sale.

Hard Money: Higher Risk

The benefits of private money unequivocally make them riskier than traditional loans. This potential threat becomes apparent when comparing private and traditional money costs. Hard money loans will have much higher interest rates than standard mortgages. I've commonly seen rates between 8% - 12%. There will also be more substantial origination fees (frequently 2-3x larger than agency and bank loans).

The loan term is also much shorter, usually due in full somewhere between six to 18 months. Considering the higher interest rates, if a construction project goes past the estimated timeline, it can be costly.

The borrower must conduct diligence on the lender too. Private lenders don't face the same regulatory scrutiny as banks, agencies, and credit unions. It's essential to check references, talk to multiple lenders, verify liquidity, and be sure the lender is someone you are comfortable going into business with. As importantly, execute when you call on them for funding.

Hard Money Loan Example

In summary, we know hard money loans tend to be:

Accessible and streamlined

Project-focused vs. borrower-focused

Expensive

Shorter in duration

Therefore, they are optimal when utilized as short-term loans to finance the acquisition and improvement of the property. Let’s go through a sample property undergoing renovation funded by a private hard money lender.

Hard Money Rehab Budget

After you tour the property, you put together a rehab budget and timeline.

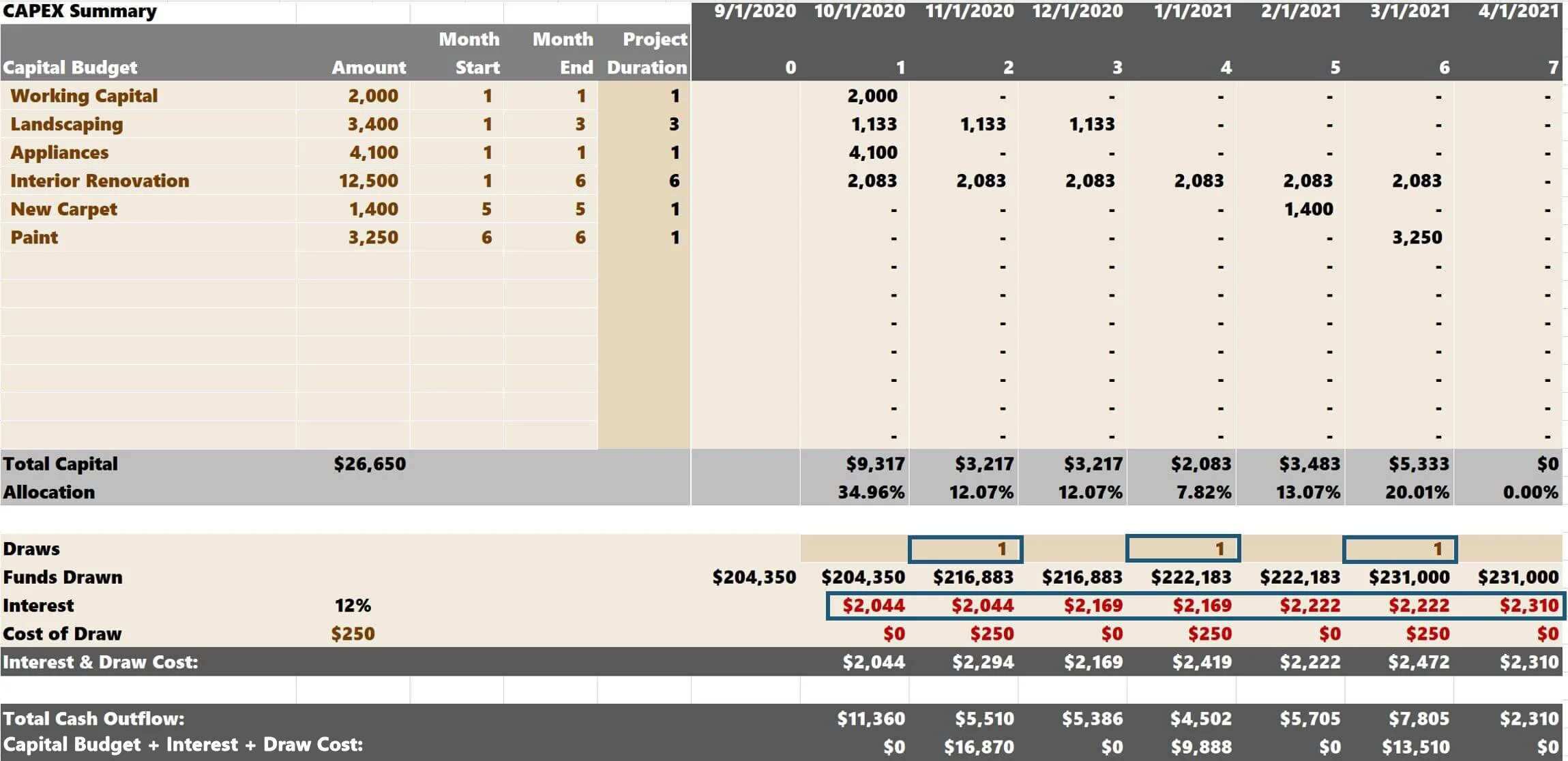

You conservatively estimate that the rehab will cost $26,650 and span six months. Notice that you should know what the monthly expenditures will be. This knowledge will be essential, as you will draw these funds during construction. We will touch on this shortly.

Property Operations

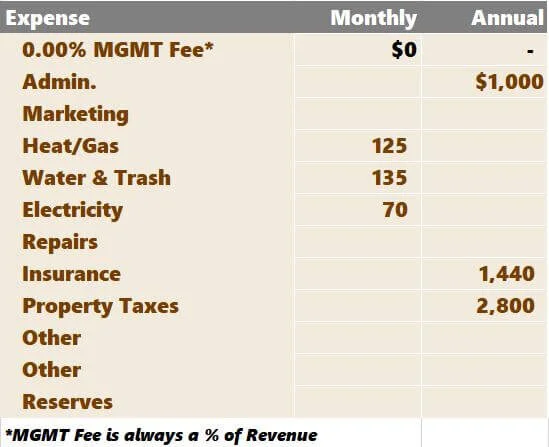

You'll also need to forecast the operating expenses during the rehab. You likely won't be earning any revenue but will be on the hook for items such as:

Heat

Electricity

Water

Insurance

Permits/Misc Fees/Admin

You can see in Tactica’s residential fix/flip model that I can project these items either monthly or annually.

This data, along with the rehab budget, will flow into a monthly proforma.

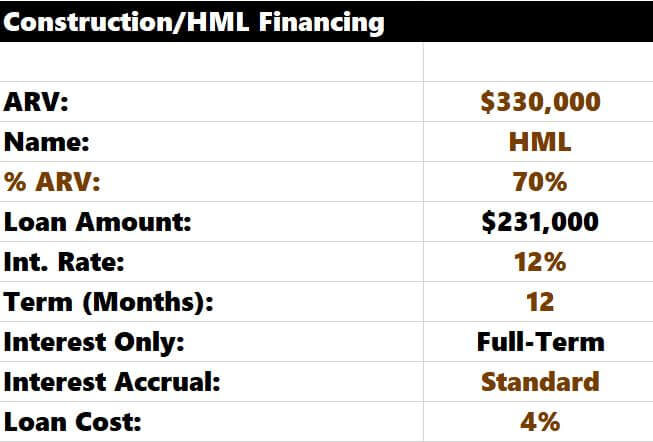

After speaking with multiple private lenders, you settle on the financing terms presented below.

They are willing to lend on the "As Repaired Value" (ARV), which means a loan amount of $231,000 (70% * $330,000). You'll also be on the hook for upfront loan and closing costs. Sources and uses are the following:

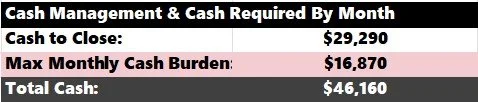

You'll be responsible for bringing $29,290 in cash to close the deal (highlighted in green). In theory, you may be able to finance loan costs and pay them down upon completion of the rehab and sale. That could be negotiated with the lender and will be more realistic once you build a solid rapport with them.

Hard Money Draws & Fees

Let's revisit the CAPEX plan. You'll need to plan out your draws. My financial model does this as indicated by a "1" in the cell below the monthly column.

The “1” designates a construction draw every other month.

Note: Construction draws are typically treated as reimbursements. This definition is essential for a couple of different reasons:

You will need to have the cash to pay for repairs and updates taking place initially. After the work is complete, you will request a draw. The lender will generally verify that the work is done and then reimburse you.

The order of operations is crucial. If you plan your renovations thoughtfully, you can continually recycle the reimbursed funds from the first draw to pay for the remaining work. Tactica’s residential fix and flip model will calculate the most significant draw and classify it as “max monthly cash burden.” It’s wise to plan for the most sizeable draw to happen first.

The $16,870 highlighted in pink includes all construction costs, interest expenses, and the $250 fee leading up to the first construction draw.

I've heard of flippers using credit cards or a revolving credit facility to fund the first round of renovations leading up to the first draw. After the hard money lender reimburses them, they will immediately pay down the balances. They will continually repeat this process until they complete the rehab.

Loan draws can be costly. Make sure you understand what the cost of each draw is. Fewer draws are better. You can see I am assuming a draw would cost $250. Therefore, I have loan draws every other month to cut costs.

Interest will accrue as loan funds are drawn. The loan balance in this example starts at $204,350. To close on the deal, you already drew down $204,350 out of the total $231,000 in available loan proceeds in Month 0.

That leaves $26,650 in loan proceeds remaining for the construction project. Interest is due on outstanding loan amounts the following month (one month in arrears). You can see interest expense ticking up the month after draws take place.

Hard Money Interest Expense

Hard money financing terms can exhibit a "Standard" or "Pre-Drawn" interest accrual. For the sake of this example, I have selected “Standard” below.

Typically, interest will not accrue on funding until you officially draw it. If this is the case, “Standard” is the appropriate election. However, I have heard of instances where lenders will start the clock on all loan proceeds on day 1 (or "Pre-Drawn"). In the scope of the project, we are currently modeling, if 100% of funds were pre-drawn, you'd be paying $2,310 in interest every month, which creates an additional $992 in interest expense over the life of the investment.

Pre-Drawn Interest = $231,000 * 12% / 12 = $2,310

For a deal that has a larger construction budget and a longer construction timeline, a lender that pre-draws interest in tandem with higher interest rates could add thousands in total interest expense. Don't forget to read the fine print of your loan docs!

This scenario assumes the renovation takes six months, and the property is sold the following month (Month 7). A formidable option at this juncture could also be to refinance into a lower interest rate offered by traditional bank financing. The hold/sell analysis is beyond this blog post's scope, but I think assessing it is essential.

Hard Money Refinance or Sale

When the property is improved, a borrower will sell or refinance into a conventional loan. So, a hard money loan is genuinely just a bridge loan that "bridges" the gap between purchase/fixing and stabilization. Once that is accomplished, the hard money lender is paid back in full via sale/refi proceeds, and the borrower gets to reap the upside of the new and improved real estate investment.

Let's talk about the proper underwriting process for a hard money loan. Let's assume you want to purchase a single-family home well below market value. It is a perfect opportunity for a flipper.

The residential rental property costs $220,000 in Dallas, Texas. With a modest renovation, the property's value could sell for $330,000 per your sale comp analysis. Due to your intention to rehab the property as quickly as possible and then sell immediately, this would be a perfect opportunity to consider hard money.

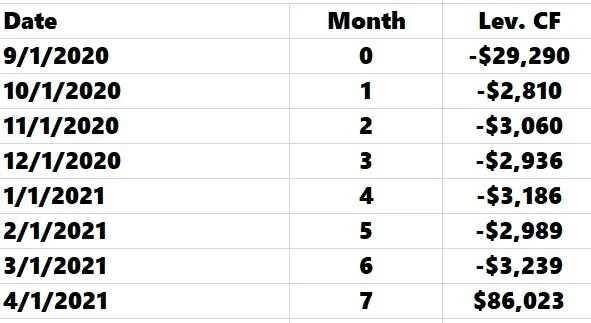

For the sake of this example, let’s say selling in Month 7 is the exit strategy. All relevant cash flows are summarized in the proforma.

Summarizing Hard Money Rental Loans

Hard money real estate loans can allow you to pounce on a fleeting investment opportunity. High interest rates and costly origination fees are more common in private, hard money lending than traditional loans. However, the speed of funding, increased leverage, and a focus on the asset’s valuation can offset a more burdensome cost structure.

You can sign up below if you need a tool to analyze cash-flowing residential real estate. Don’t forget to check out the “how-to” residential analysis tutorial.