Risks in Using SOFR Forward Curve for Rate Projections

I received an inquiry asking if Tactica models allow for floating-rate debt assumptions and if I'd ever consider importing a SOFR forward curve to predict future interest rates.

The answer to both inquiries is: No

I plan to detail the dangers of speculating on interest rates and why the SOFR forward curve leaves much to be desired as a measuring stick of future rate expectations.

Contents

What is SOFR

Per the Federal Reserve of New York, the Secured Overnight Financing Rate (SOFR) measures the cost of borrowing Treasury-backed funds overnight.

SOFR has primarily replaced the London Interbank Offer Rate (LIBOR), which was heavily subject to manipulation as it depended on banks to quote what they'd theoretically charge other banks for overnight borrowing. SOFR, on the other hand, looks at actual transactions in the marketplace.

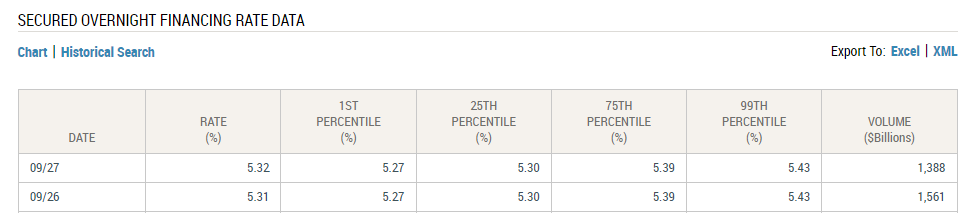

Source: NewYorkFed.org

Institutions use SOFR in commercial real estate lending as the primary benchmark for their floating-rate debt. A lender will often quote their financing rate at:

SOFR + Spread

The risk profile of the investment deal determines the “spread.” If the current SOFR index sits at 5.32% on 9/27 and the proposed spread above SOFR is 3.00%, then the total interest burden on the loan is 8.32%.

5.32% + 3.00% = 8.32%

As SOFR moves up/down, the loan's interest liability will also change at defined intervals (monthly, quarterly, bi-annually).

Forecasting Loan Payments From the SOFR Forward Curve

I once received an email asking me to implement a SOFR forward curve into Tactica's Multifamily models. The email included suggestions, article links, and a YouTube video showing the potential steps to build a SOFR curve into Tactica proformas. I read and watched everything presented to me and came away with profound conclusions.

First, let's talk about the SOFR Forward Curve.

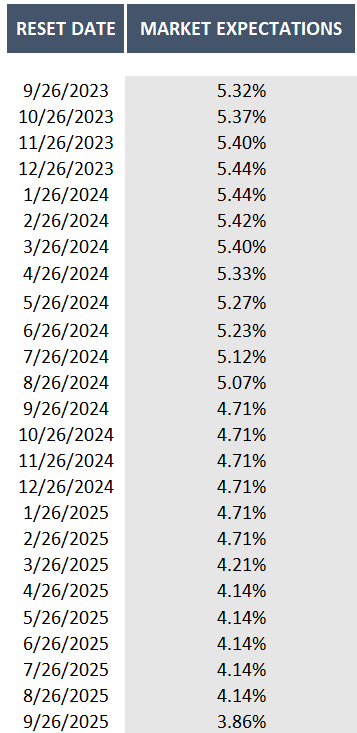

There are a few resources that track future SOFR projections. I liked Pensford, which offers website visitors a free SOFR monthly forward curve download. Pensford looks at SOFR future contracts to formulate the forward-looking SOFR expectations. It's updated daily with the latest information.

Focusing on the 1-month term SOFR, they list the projected SOFR monthly expectations for the next ten years from today’s date. The image below details the next two years.

Source: Pensford, LLC

We'd want to input this data into the proforma model if we were modeling the SOFR forward curve as part of our financing assumption.

The same projections are also graphed over the next three years (and allow for you to “shock” predictions by +/- one or two standard deviations).

Source: Pensford, LLC

Warning: This data is constantly changing. What we look at today won't be the same tomorrow. Economic factors will refine investors' expectations of future SOFR. I will show a real example of how dramatically this data can change and why depending on it for future interest rate projections is a total crapshoot.

SOFR Hindsight

As I mentioned, I received an email from someone imploring me to add a SOFR forward curve to Tactica proformas. One video he shared with me featured an investor underwriting a deal in 2021 with floating-rate debt. The investor pulled SOFR data into his proforma template to estimate future interest rates spanning the next ten years.

In the spring of 2021, SOFR was near all-time lows (around 0%). By the fall of 2023, SOFR was projected to be about 0.65%. Because this estimation was significantly higher than the current SOFR levels at that time, it probably felt "conservative."

If this person were underwriting a SOFR + 250 loan, they would be forecasting a total interest rate of 3.15% in 2023:

0.65% + 2.50% = 3.15%

At writing, SOFR is about 5.30%. Assuming he locked down those loan terms, the actual total interest rate in 2023 would be:

5.30% +2.50% = 7.80%

If the outstanding loan balance is $10 million, and the term is 30 years, the difference in annual debt service is:

Annual Loan PMT at 3.15% Interest Rate: $515,684

Annual Loan PMT at 7.80% Interest Rate: $863,845

How extreme of a difference is this?

If the 2023 NOI were $775,000 in your original proforma, you'd expect to cover the debt service at 1.50x (well above the standard acceptability threshold of 1.20x).

$775,000 / $515,684 = 1.50x

Even if you achieved that NOI, with the actual SOFR increase, you'd be bleeding nearly $90,000 annually.

$775,000 - $863,845 = -$88,845

You'd need to use reserve funds or raise outside money just to pay your monthly floating-rate loan payment.

In the video, the investor mentioned that their firm uses a rate cap to hedge interest rate increases, which would have been a lifesaver and very wise on their part!

Interest Rate Speculation

Repeat after me: "NOBODY knows which direction future interest rates will move."

Economists don't know, investors don't know, and the guru on CNBC doesn't know. The committee members of the U.S. Federal Reserve don't even know. The FOMC gathers eight times a year to discuss monetary policy. Every quarter, the committee members estimates where interest rates will end each year for the foreseeable future.

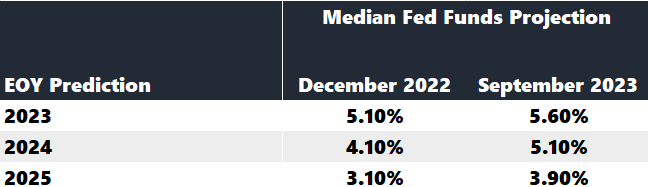

Here are the future interest rate projections made in December 2022 (opens as PDF). You may hear this report called the "Fed Dot Plot."

Just nine months later, here are the interest rate projections from September 2023 (opens as PDF).

It's more intuitive to see the data side by side.

Summary: Expectations have changed dramatically in the last nine months for the Fed Funds rate to go higher and stay higher for longer. In 2024, expectations have changed by one whole point (up to 5.10% from 4.10%). While the Fed doesn’t control SOFR, its policy is thought to correlate strongly with the SOFR movement.

Any real estate investor pretending to show conviction on future rate movement is full of it. They'd trade bonds and make a fortune with minimal effort if they truly knew where rates would go.

We saw how tragically inaccurate a proforma was because floating-rate debt was underwritten based on the SOFR forward curve. Because interest rates are something investors have no control over, I don't want their future movement to be a focal point in any of Tactica's proforma models.

Proforma Purpose

Tactica tools intend to evaluate real-estate-related assumptions that investors have control over. From there, we can stress those assumptions to ensure financial survival in a "worst-case" scenario. While I have thought about altering certain proformas to account for the floating rate, I ultimately decided against it because it encourages interest rate speculation vs. focusing on more controllable investment assumptions like:

You must make other judgments that depend on the macro environment, such as a residual cap rate assumption or projecting refinance debt terms in the multifamily development and redevelopment models.

However, I also include investment metrics more focused on cash flow and less dependent on the macroeconomic climate, such as the unlevered yield on cost and cash-on-cash return. It seems unnecessary and overly risky to speculate on interest rate movements when you can hedge your downside with an interest rate cap if you choose floating-rate financing.

Interest Rate Cap

If you are using floating-rate debt, you could explore purchasing a rate cap and underwriting the loan interest rate at the strike price of the cap (essentially, inputting the worst-case scenario for financing into the proforma model).

You should only entertain purchasing the investment property if your deal makes financial sense when the maximum interest payment is at the cap amount.

We published an extensive guide on protecting your real estate investment with an interest rate cap that includes the following pieces of information:

Floating Rate Loan Primer

Interest Rate Cap Components

Interest Rate Cap Example

Interest Rate Cap Providers

Underwriting an Interest Rate Cap

Summarizing the SOFR Forward Curve

SOFR is the primary benchmark lenders reference in their floating rate loans. SOFR is constantly changing, and some firms track the forward curve, which makes it possible to underwrite floating rate debt on future interest rate predictions.

It's crucial to realize that interest rate predictions are futile. Nobody knows what the future will bring, and relying on the SOFR forward curve isn't insightful (as you saw in an example from 2021 revisited in 2023).

If you want floating rate debt, the best action is to get an interest rate cap to protect your max-downside and underwrite your debt's interest rate at that capped amount (as if it were "fixed"). This action is the most conservative and strips out all uncertainty of future rate movements.