Modeling Multifamily Housing Development Grants

Low-income requirements for affordable housing projects can make new construction impossible without assistance from grant programs, tax credits, or other government incentives.

Occasionally, I get asked by developers if the Tactica Development Model can handle underwriting additional funding sources beyond debt and equity.

I plan to answer this question and show you some model alterations that may be helpful.

Real Estate Grants Contents

Tactica's Multifmaily Housing Development Model

Market-Rate Multifamily

The Tactica Development Model is a market-rate rental housing model. It works seamlessly for multifamily development business plans that go the traditional route of construction financing combined with investor equity targeting a refinance to conventional debt at stabilization.

Strictly Affordable Multifamily

Generally speaking, tax credit programs like low-income housing tax credits (LIHTC) are beyond what the Tactica model can handle. Thankfully, specialty consultants specializing in LIHTC provide sophisticated proforma modeling as a service and help clients navigate the complex, affordable multifamily space.

Generally speaking, our development model isn't equipped to handle projects with complex capital stacks and multiple financing arrangements.

If you're working on a complicated tax credit deal with numerous funding sources and debt arrangements, you will benefit by going directly to the affordability consultants. They also provide underwriting assistance and niche expertise.

Hybrid Market-Rate Multifamily

There is potential to use the Tactica Development tool if you have a project that will be primarily market rate with an allocation of mission-driven units such as:

Low-income tenants

Tenants with disabilities

Elderly tenants

And could make a project eligible for grants or other gov incentives.

I've talked to some investors who think the Tactica model's functionality is a gray area for their operation. It is close to what they are looking for and can account for a unit mix split between market-rate and mission-driven. However, the baseline version of the model doesn't account for grants.

Multifamily Housing Grants

If you have a funding source(s) that doesn't need to be paid back, there are some adjustments you can make to the model to account for these programs relatively quickly.

Multifamily Development Grants Scenario

You're considering apartment development in a rural area where 10% of the unit mix will be restricted at 30% of the area median income limit (AMI).

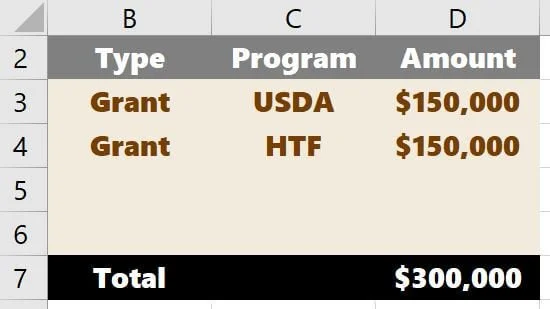

Eligibility Potential: Two Grants

A $150,000 grant is available by the USDA (as part of their multifamily housing programs) to entice rural development, and another $150,000 grant from the Housing Trust Fund to keep 10% of the units as "very" affordable rental housing.

Lender/Loan Program: HUD 221(d)(4) - 3% interest rate that will begin amortizing when occupancy stabilizes

Disclaimer: Awardees should always consult with their tax professionals to determine if the grants are tax-exempt (often only for non-profit developers).

Incorporating Multifamily Housing Grants in Proforma

Loan Alterations

The Tactica model is set up for a conventional construction loan refinanced into an amortizing conventional loan at property stabilization. To account for a unique FHA loan product like HUD 221(d)(4), I suggest following this tutorial to learn the proper model alteration steps.

Housing Grants Tab

Adding a new tab listing the "free" funding sources will make sense for organizational reasons. I will call this tab "Grants" and have a simple grid showing details about each program and the grant amount.

We will need to reference the total cell of $300,000 (cell D7) in the next step.

Equity Adjustment

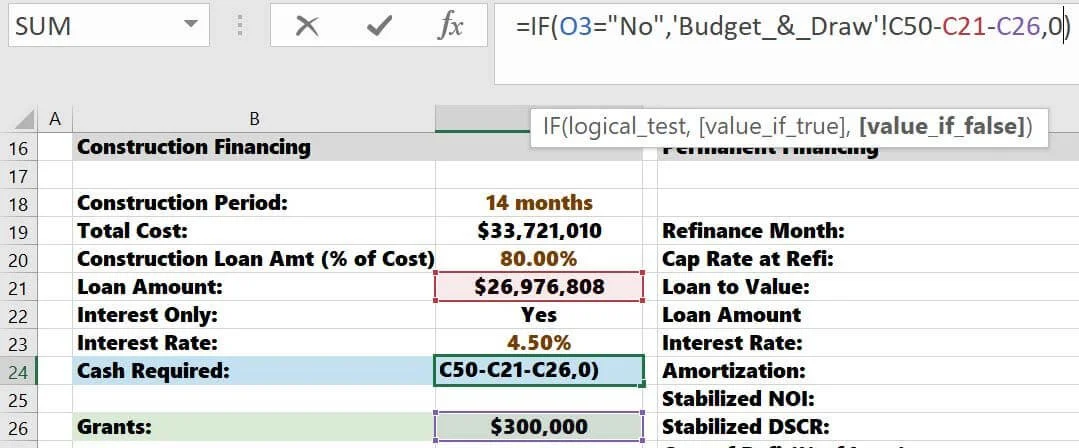

On the "Project Summary," I will add a row dedicated to grants in the "Construction Financing" section. Thankfully, there are some blank rows below the "Lease-Up Summary" section, so I'll slide that section down a few rows to make space.

The $300,000 grants are linked to cell D7 on the new tab we created in the previous step.

Currently, the "Cash Required" amount is a function of:

Cash Required = Total Project Cost - Loan Amount

We need to adjust this formula to:

Cash Required = Total Project Cost - Loan Amount - Grants

This addition is now stipulated in the formula above.

After this change, the cash requirement will decrease as you add more grants/free funding sources on the "Grants" tab.

Construction Schedule Adjustment

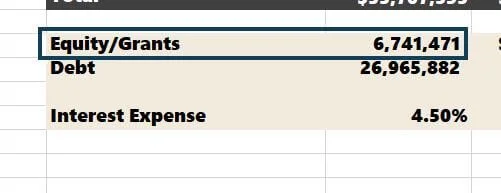

The final adjustment takes place on the "Budget & Draw" tab.

We must change the label from "Equity" to "Equity & Grants."

Then, we must alter the formula to take both Cash Required and Grant totals from the "Project Summary" tab.

$6,741,471 = $6,441,471 + $300,000

Now, the model is set up to account for the construction loan, cash provided by investors, and grants/funding sources that do not need to be paid back.

Note: Equity and grants are accounted for in one bucket. Theoretically, you could separate them to detail precisely what funds go into the project and when. However, in how the Tactica Model is built, the IRR starts on the analysis start date (When all equity contributions occur), stipulated on the "project summary" tab.

Therefore, phasing grants into the project before investor cash could impact the IRR in real-life applications. However, it won't affect the IRR or other time-sensitive return metrics in the Tactica model (more conservative).

Summarizing Grant for Multifamily Housing

The Tactica Development Model won't best fit for complex, affordable projects with multiple funding sources and various financing arrangements. However, suppose you have a primarily market-rate project that may be eligible for a grant or other free funding. In that case, the Tactica Development Model could fit your business plan, as I demonstrated above.