Loan To Cost (LTC) Financing: How to Underwrite It

Many Tactica customers are value-add multifamily investors and seek out properties that need significant cosmetic renovations. It’s essential to know the difference between loan-to-value (LTV) financing and loan-to-cost (LTC) financing, how each loan type can benefit your project, and the potential consequences of each.

Contents

Loan to Cost Financing

In an LTC financing arrangement, the lender is willing to lend funds as a percentage of the underlying asset’s purchase price plus renovation/repair costs. This is distinct from LTV financing and does not account for renovation costs but only the underlying asset value. LTC financing is generally viewed as favorable for the borrower, albeit riskier, due to higher leverage, less debt service coverage, and renovation risk in the form of underbudgeting.

LTC vs. LTV

I think the best way to demonstrate the difference between LTV and LTC is with an example. Let's say a property costs $12,000,000 and requires $1,000,000 in construction costs.

Lender ABC is willing to give the borrower proceeds up to 70% of LTV

Lender XYZ is willing to give the borrower proceeds up to 70% of LTC

LTV Ratio

ABC Loan: 70% x $12,000,000 = $8,400,000 in loan proceeds

The buyer would be on the hook to bring $4,600,000 in equity ($13,000,000 - $8,400,000).

From the bank’s perspective, the $1,000,000 renovation budget is essentially ignored and would need to come from the borrower’s pocket.

LTC Ratio

XYZ Loan: 70% x $13,000,000 = $9,100,000 in loan proceeds

The buyer would be on the hook to bring $3,900,000 in equity ($13,000,000 - $9,100,000).

The lender's willingness to factor in the total project cost increases the loan amount, allowing the borrower to close on the deal with less equity than in the LTV scenario. LTC is riskier as overall leverage is higher, with the borrower having less skin in the game.

LTC Financial Modeling Application

Many commercial real estate models will default to an LTV option for financing. The Tactica financial models (our Free Template and Value-Add Model) do. However, creating a toggle that can switch back and forth seamlessly between LTV and LTC is an effortless adjustment.

LTV Input

The "Financing Summary" is presented as the following.

Note: For the interest rate assumption, the model doesn’t account for floating-rate debt. If you did get a variable-rate debt quote with an interest rate cap, you could underwrite the interest rate at the maximum capped interest rate amount.

Related: Why forecasting future interest rates based on the forward SOFR curve is dangerous.

The “Sources & Uses” section read as (miscellaneous expenses are $0 for the sake of this example):

In a standard LTV scenario, you can see that the renovation capital of $1,000,000 must be raised on the front end with equity.

LTC Input

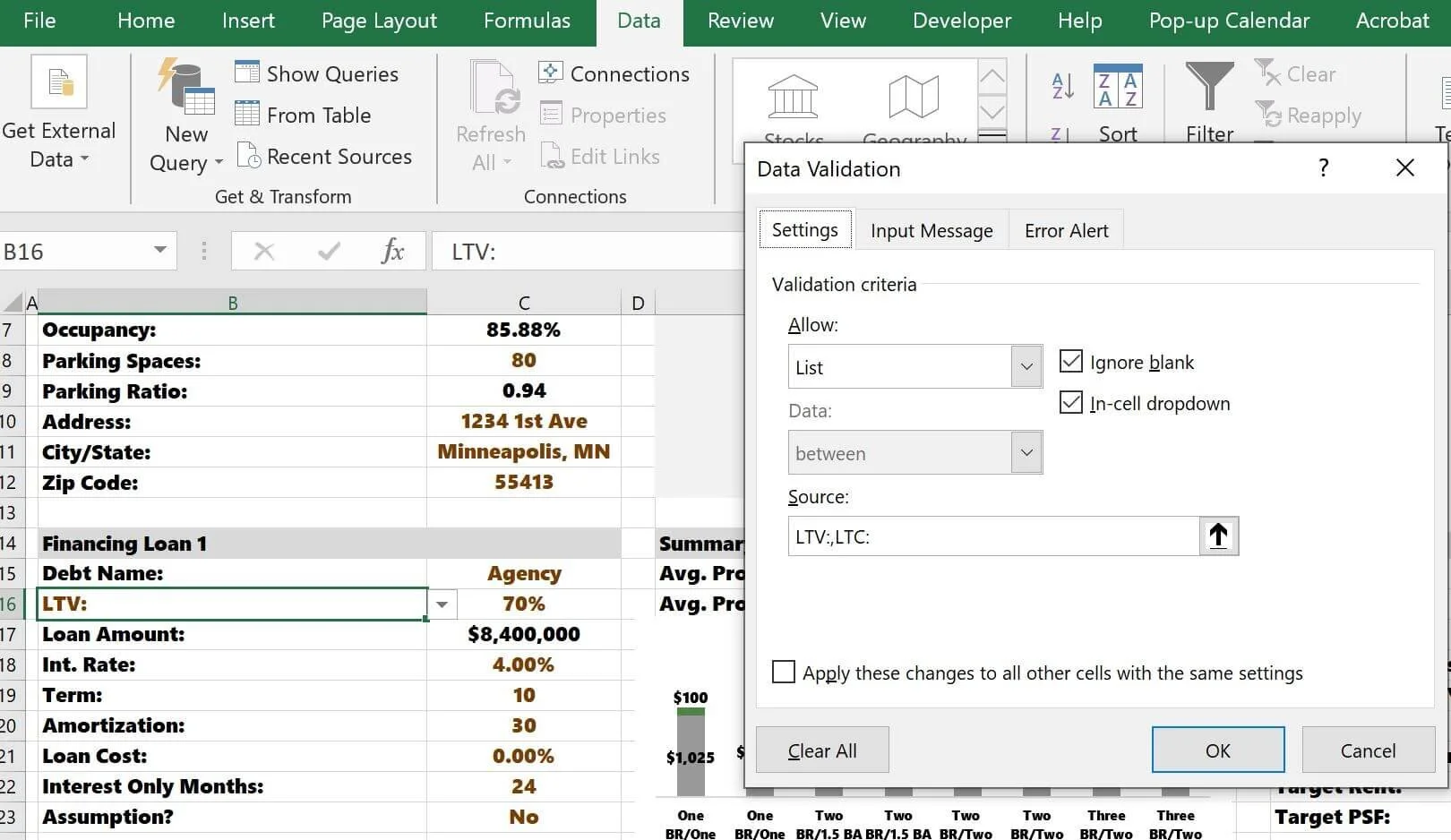

First, let's create a toggle allowing users to switch between LTV and LTC.

Let's make the "LTV" cell brown text, then in the main navigation, go to Data > Data Validation.

Step 1: In the “Allow” section, select: “List.”

Step 2: In the “Source” section, manually type: “LTV:, LTC:”

We do this to create a drop-down list allowing the user to choose between “LTV” and “LTC,” as seen below.

Now there is a drop-down list in cell B16 to choose either LTV or LTC.

We need to update the loan amount to calculate different amounts depending on whether LTV or LTC is chosen. We can do this by writing a simple "IF" function.

The formula reads:

If cell B16 = "LTV” then the Loan Amount = 70% x $12,000,000

If cell B16 = “LTC” then the Loan Amount = 70% x ($12,000,000 + $1,000,000)

Note: Cell F28 in the formula above hosts the $12,000,000 purchase price. Cell I21 in the formula bar above hosts the $1,000,000 renovation costs.

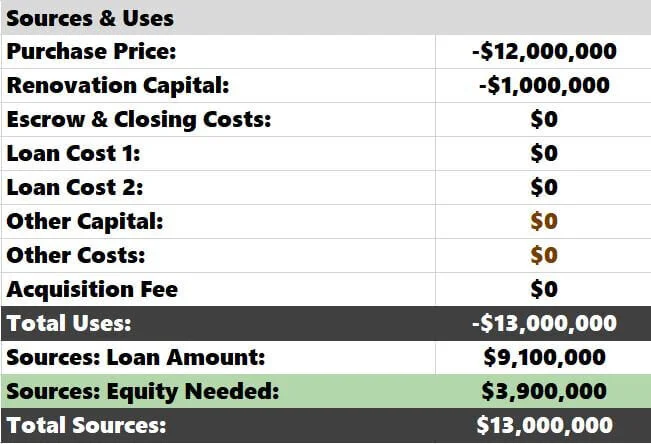

I will choose “LTC” in cell B16 and then look at the sources and uses.

The Uses look the same, but the Sources are adjusted to reflect financing 70% of the purchase price and construction budget. At closing, $3,900,000 in equity plus the $9,1000,000 in loan proceeds are required to purchase the property.

Note: A few Tactica models also have a “Financing Loan 2” section, which works great if you use a supplemental loan or are considering seller financing in addition to the first mortgage.

LTC Bridge Loans

Often, lenders are willing to offer LTC terms structured as a bridge loan. The loan is meant to be short-term to finance the rehab but then be blown out and replaced by permanent financing once the project is stabilized. This structure can be favorable for fix and flip investors who look to exit as soon as the project is completed. Standard features for these types of financing arrangements will include:

12-24 month terms

Higher interest rates

Full-term interest-only (IO)

Interest accrual only when drawn upon (like a construction loan)

Tactica offers investors a Redevelopment Model, which is meant for distressed properties needing extensive renovations utilizing bridge financing, with the intent to refinance or sell upon stabilization.

Related: In development, you could also benefit from the BSPRA credit to increase LTC lending proceeds.

Summarizing Loan-to-Cost Financing

Loan-to-cost financing is when the lender allows debt proceeds on a percentage of the purchase price and construction costs. From the borrower’s perspective, it is a way to take on more leverage and bring less equity to the closing table. However, it is riskier due to the increase in debt. While most real estate analysis models are equipped only to handle loan-to-value financing, creating a seamless toggle between “LTV” and “LTC” to calculate loan proceeds is a simple alteration.

Related: See how some lenders may depend on the debt yield when sizing multifamily loans.