The 4 Worst Job Markets in the U.S. at Coping with COVID

I recently published an article highlighting the "8 Best Job Markets in the U.S. Measured By COVID Resiliency." Researching metropolitan areas that defy the pandemic and excel during tumultuous economic times was refreshing. Today, we will look at job markets on the other end of the spectrum.

Tactica's Methodology

To determine our list of the eight worst employment markets, we used labor statistics provided by The Bureau of Labor Statistics (BLS). The BLS tracks critical regional economic metrics such as:

Gross Employment

Gross Labor Force

Unemployment Rates

We took it upon ourselves to analyze this data, uncover the historical trends, and figure out which metropolitan statistical areas (MSA) are falling behind the nation during the coronavirus pandemic.

We laid out three criteria:

MSA year-over-year employment decline in the U.S. Top 11

MSA year-over-year labor force decline in the U.S. Top 11

MSA unemployment rate is higher than the national unemployment rate

Disclaimer: We developed an interactive dashboard (that has since been discontinued) that utilizes the BLS data. All images depicted in this article are snapshots from this tool.

This article's purpose isn't to call out inferior submarkets. It's to show you the Labor Statistics Dashboard's power and what trends you can find once you are comfortable using it.

Criteria 1: Employment Decline

Jobs are an essential component of healthy economic fundamentals. Criteria #1 will examine gross employment in November 2020 vs. November 2019. Comparing this year to last is powerful because most cities have significantly declined. The fundamentals were solid in 2019, and finding the MSAs with exaggerated employment decline will be telling.

Criteria 2: Labor Force Decline

Labor force participation is underrated, in my opinion. So many of the headlines are focused on the unemployment rate. We discussed why the unemployment rate requires discretion in the article "Tracking Unemployment Trends."

We've seen that unemployment has been dropping lately, but in many instances, it’s because the labor force is dropping (unemployed persons are giving up). Seeking out the markets with a decreasing labor force is as concerning as jobs disappearing.

Criteria 3: Unemployment Rate

In the wake of the Coronavirus, where most cities have higher unemployment, we will look for cities with higher unemployment than the national average, assuming they lead the nation in employment and labor force decline.

The Analysis

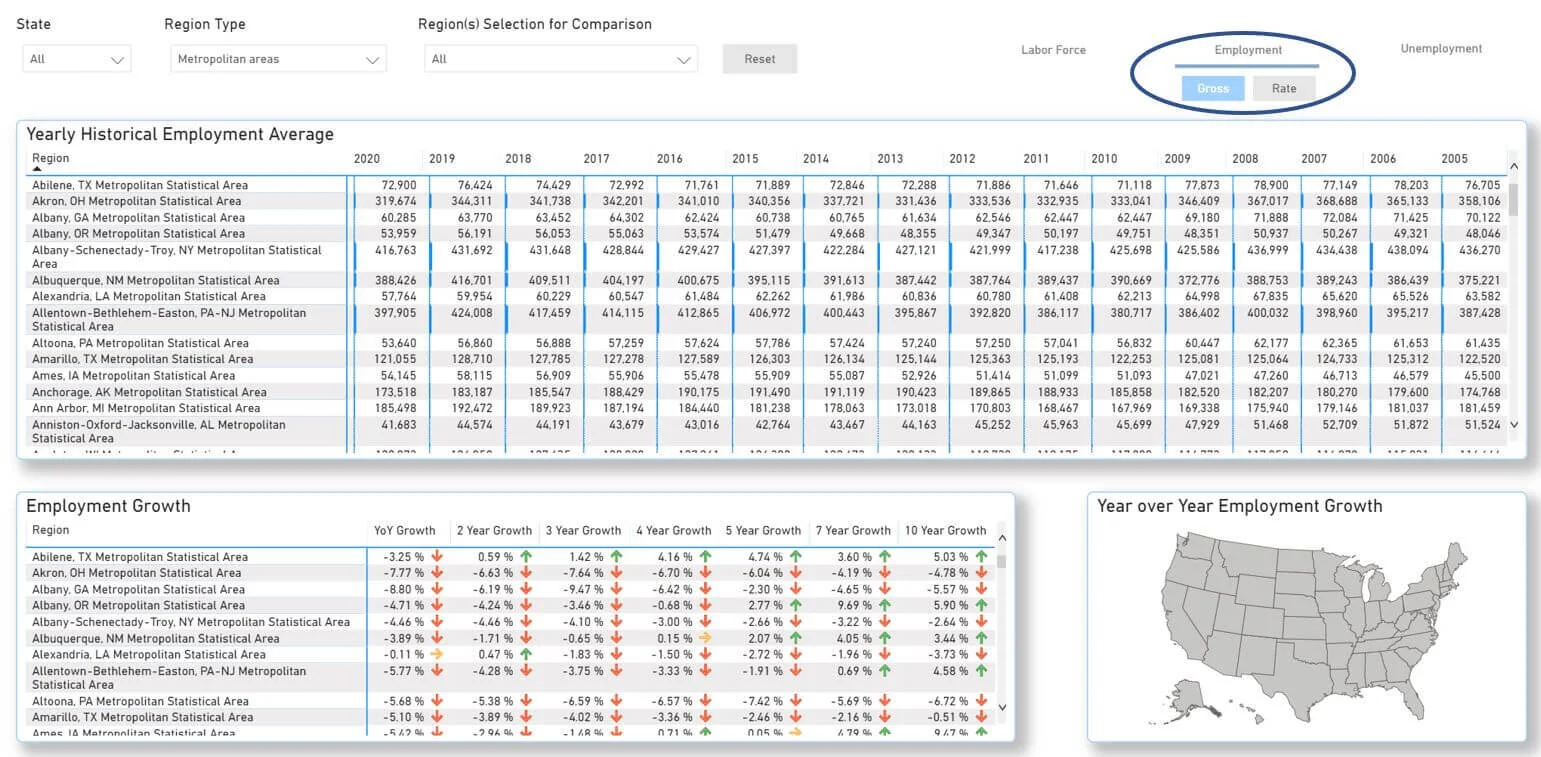

First, I want to filter all my data to include only metropolitan areas. If I don't do this, thousands of cities, counties, and MSAs will be included.

I don't want to see data for counties with a few hundred residents. I only want to see the major MSAs. Filtering here will weed out all the little cities and counties with a small sample size to calculate any meaningful data.

Employment Decline

You can see that MSAs are listed in alphabetical order. I first want to analyze employment decline. I will click the "Employment" hyperlink as seen in the image below.

Now, I will go down to the bottom left grid and sort (by clicking the column header). The lowest year-over-year data (YOY) will be shown first.

Rationale: The latest data BLS was published in November 2020. The employment market in November of 2019 was strong. 2020 has been challenging due to the pandemic. Most submarkets nationwide have seen a declining employment market over the past 12 months. By filtering decline, we can see the markets that have been hit the hardest during the Covid era.

Kahului-Wailuku-Lahaina, Hawaii, leads the nation in employment decline for the most recent YOY period. I took a snapshot of these MSA (the image above) and then analyzed them. Significant employment decline is troubling. Next, we will check out the labor force decline and unemployment rates.

Labor Force Decline

With the data already filtered from worst to best, I need to click "Labor Force" on the dashboard page.

Now we can see the national leaders in YOY labor force decline.

Let's now compare the Top 11 for both employment and labor force decline and jot down all the MSAs that crack the top of both. They are:

Salinas, California

Flagstaff, Arizona

Yuba City, California

Santa Cruz-Watsonville, California

Brunswick, Georgia

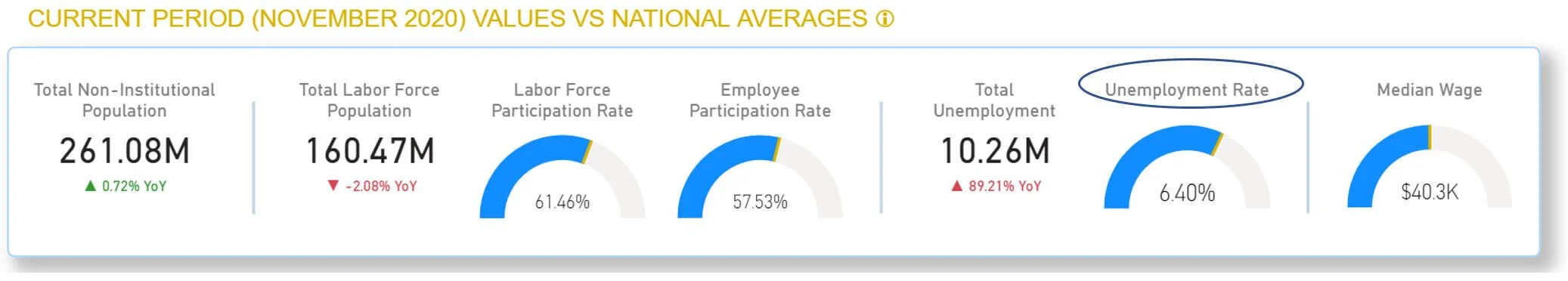

The final step is determining if each MSA's unemployment is less than the national average of 6.40% in November.

To do this, the dashboard has a helpful regional search function where we can quickly search and select all of the bulleted MSAs above.

Searching and selecting all the MSAs should take less than 30 seconds. We have effectively cut out the irrelevant MSAs, and our data set is focused on only the five MSAs we selected.

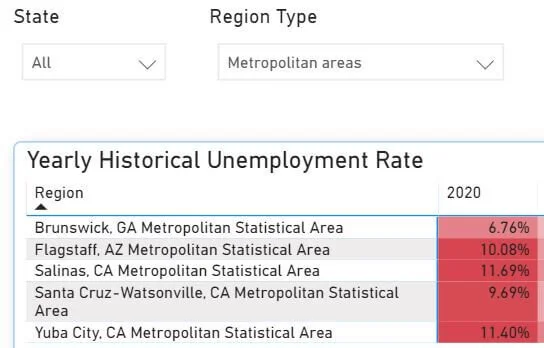

Unemployment Rate

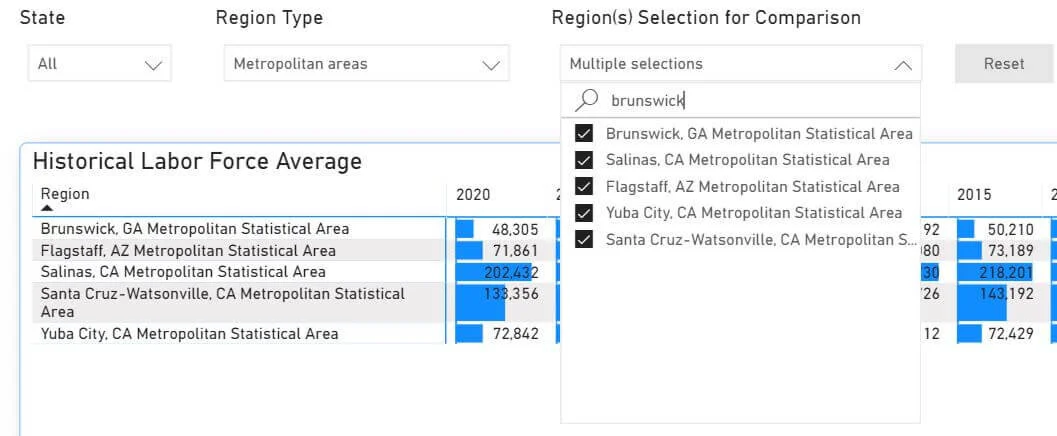

Now click the "Unemployment" in the upper right-hand corner and then the "Rate" button below it.

We can see the 2020 rolling unemployment average.

This doesn't tell us everything we need about unemployment, but it gets us close.

Flagstaff, Yuba, and Salinas had higher unemployment in 2020 than the other MSAs. But this is just a rolling average. It’s averaging out all 2020 months. We need to see the actual November unemployment to compare each MSA's unemployment rate to the national average.

We do this from the "Regional Comparison" Dashboard tab.

Note: This page will default to Washington, D.C. (it saves time for the dashboard to load data). Feel free to uncheck it once you begin selecting your cities.

We will search for each of our five bulleted MSAs and expand the 2020 data in the first column.

Now, we can see the unemployment data from a more granular level. All November unemployment rates are higher than the national average of 6.40% except for Brunswick, Georgia. Let's remove it from our list:

Salinas, California

Flagstaff, Arizona

Yuba City, California

Santa Cruz-Watsonville, California

Benchmark the MSA

I don't have experience working in the MSAs bulleted above. What I like to do next is compare unfamiliar MSAs with an MSA I am familiar with. I will use the Twin Cities, Minnesota.

This is the Minneapolis, St. Paul, and Bloomington MSA in the dashboard. Around the nation, the Twin Cities is lauded for having 16 Fortune 500 companies, including a few Healthcare behemoths (Medtronic, United Health Group, and St. Jude Medical, now absorbed by Abbott Labs). It has also been a national leader in the unemployment rate pre-Covid, offers substantial starting salaries for fledgling professionals, and exhibits moderate living costs.

I have a strong pulse on the local employment market in the Twin Cities. That will serve as an excellent benchmark to compare to. If you're more familiar with Portland, Orlando, New York City, or whatever city(s) you are knowledgeable about, drop it into the analysis!

Let’s return to the dashboard's “Historical Comparison” tab.

Unemployment

As I expected, The Twin Cities compares favorably to the four MSAs. 5.91% of November unemployment is below the national average.

Employment

When looking at YOY employment decline, the Twin Cities looks much better than the other four submarkets. Anecdotally, the Twin Cities is relatively stable in the current COVID environment. Most people have been fortunate to maintain gainful employment in 2020, but there isn’t a shortage of qualified labor.

I can’t imagine the feeling in submarkets experiencing a YOY decline that is 3x greater than in my hometown.

Labor Force

Again, The Twin Cities is positioned much better. These submarkets (except for the Twin Cities) appear to have declined well before COVID-19 reared its ugly head.

MSA Wage Analysis

Now it's time to switch gears and research what is actually happening within the MSAs. The "Wage Analysis" tab will dive into occupations, employment numbers, and wages in our dashboard.

Let's look at California, given that three cities in the greatest employment decline are located there.

If you expand California by clicking the little "+" sign, you can see a regional breakdown of:

Employment totals

Employment % (of state)

Average median Wage

Delta between the regional median wage and state median

As you'd expect, Los Angeles and San Francisco MSAs host the lion’s share of employment opportunities in California (outside of the frame of the above image).

You can see that Salinas accounts for about 1% of total California occupations. We can go further. If we click on Salinas, you’ll uncover:

Employment total by occupation

Employment percentage by occupation

Median wage by occupation

Delta between median wage by occupation and median regional wage

I wish BLS provided data on industries; unfortunately, they do not! You'll need to dig for information on employment composition within a given sector. The Census Bureau will also have much essential submarket-specific information.

The Census Bureau is where I would figure out which occupations have been disappearing. If farming/fishing/forestry occupations (18.35% of all occupations in Salinas) have been the hardest hit, it would be a severe cause for concern.

Additional MSA Research

The last step I would take is to spend some time researching MSAs outside of the dashboard data. If the employment metrics check out, it'd be wise to figure out the significant industries, employers, future job outlooks (such as a proposed Amazon fulfillment center), and other prevalent socio-economic factors in a given MSA.

It may be worth logging into employment aggregators like LinkedIn or Glassdoor and perusing the job openings in your markets of interest to get a feel for the quality and quantity of work available. And don't forget to research housing affordability! Housing affordability can significantly hinder apartment development feasibility.

Summarizing Four Struggling MSAs

This blog post uncovered four MSAs whose labor markets have sputtered during a global pandemic.

Employment metrics and population trends are always my first analysis items when digging into an unfamiliar metro. As I see it, if the underlying macroeconomic fundamentals are in peril, it will be tough to justify investment in real estate over the long term and see sustained success.