Determining What is a Good Cap Rate

A capitalization rate (cap rate) on its own means nothing. “Good” is relative, and without defined research and analysis, deciphering “good” from “bad” is impossible. This article aims to teach you specific steps to combine market research with deal analysis to give you the confidence to determine if an investment opportunity is, in fact, a reasonable cap rate.

What is a Good Cap Rate?

A good cap rate is when the subject property’s cap rate is higher than recently sold comparable properties on a set of “normalized” operating revenues and expenses. An example would be if you were to purchase a multifamily property at a 6% cap when three neighboring properties built in the same era as your real estate asset recently sold between 5.50% - 5.75% cap rates.

Contents

Cap Rate Calculation

The cap rate formula for commercial real estate properties is a simple one:

Cap Rate = Net Operating Income / Sale Price

The cap rate metric is most useful on properties with some scale, such as apartment buildings or commercial assets like hotels, offices, industrial or retail properties.

A higher cap rate tends to correlate with higher-risk assets as an investor would pay less for a risky income stream (lower denominator) with the potential for a higher return on investment. On the contrary, a lower cap rate correlates with safer assets as an investor would pay a premium for a lower-risk income stream (higher denominator) and an excellent probability of profitability.

When assessing the cap rate equation, the purchase price of a property is relatively straightforward and is widely public information. However, the NOI of a property can be open to interpretation. I will discuss this in greater detail as we progress through the article.

5-Step Cap Rate Analysis

Knowing whether a cap rate is “good” or bad” comes down to a few steps:

Understanding at a high level the market value (in cap rate terms) in the city you are interested in (via cap rate surveys)

Refining the “reasonable” cap rate range with sales comps (ideally from multiple local brokers or CoStar)

Adjusting historical financials to smooth over any anomalies and account for increased property tax liability

Assessing deferred capital, altering the cap rate formula to a stabilized return on cost, comparing the ROC to the cap rate, sales comps, and loan constant

Revaluating the cap rate to determine if it is higher (good) or lower (bad) than what should be reasonably expected in the marketplace

Step 1: Cap Rate Surveys

In another Tactica article, I describe how individual cap rates can be misleading, but cap rate data in bulk can be beneficial in seeking out pricing trends in:

Geography

Asset class

Timeline

You’ll control negotiations for the best possible deal as a real estate investor. However, you have no control over what other investors are doing. The thousands of sales in North America are essentially “setting the market value,” and it’s then up to you to assess this data and find an investment opportunity that ideally beats the status quo. However, you can’t overachieve if you don’t know the current market value!

The first place to start is by looking at the cap rate surveys published by major brokerage shops around the U.S. and Canada.

Brokers like CBRE, JLL, Marcus & Millichap, and Newmark are involved with vast volumes of sales data. They can produce cap rate reports that give you a solid pulse on different real estate investment classes by location.

Here is an example of Newmark’s Q1 2022 North American Market Survey Report. They cover a variety of asset classes. I’ll focus on multifamily. They will break down cap rate ranges for different property types:

Class A

Class B

In both the central business district (CBD) and the suburbs. They also provide you with how investors are underwriting the residual sales cap, expense growth, and market rent growth, which would also be helpful for your cash flow analysis.

If you are a Phoenix suburb value-add investor, you’d see the baseline cap rate in Q1 was 5.25%, and they are projecting this to hold steady in Q2 of 2022.

Note: I believe the “discount rate” is the all-cash internal rate of return (IRR) investors are underwriting for.

This initial data will give you a baseline. I would go further, get more cap rate survey data from multiple brokers, and average the data to find a more solidified average cap rate benchmark for your desired investment property.

Step 2: Sales Comps

Now it’s time to dig deeper and get richer market intel. Any local broker will track their sales. Simply being on a broker’s distribution list should keep you apprised of pertinent sales comps.

Email brokerage shops and ask for a list of sales for the last over the past two years. They should have a neatly curated list of deals that includes:

Name/Address of property

Construction year

Date of sale

Sale Price

Cap Rate

With these bullets, you can widdle the list down to similar properties that are actual comps of your desired investment class. I would pull pertinent comps from the glossy PDF and import them into my own Excel. In the example below, I pulled out the 13 best comps sold within the last year.

Note: The data below is, for example, purposes only.

The average price per unit and cap rate are highlighted at the bottom for the 13 recent sales.

Cap Rate Baseline

Phoenix Cap Rate Survey: 5.25%

Brokerage Sales Comps Avg: 4.90%

With this data, we should feel pretty good that a reasonable cap rate range for suburban Class B in Phoenix is 4.90% - 5.25%

Therefore, identifying any multifamily investment greater than 5.25% would likely qualify as a high cap rate in the Phoenix real estate market.

Step 3: Operating Adjustments

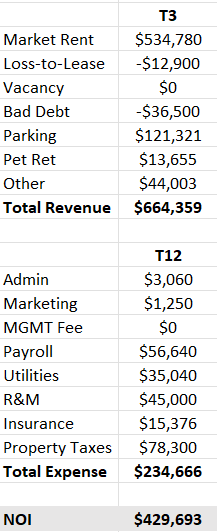

Now, you are looking at T3/T12 property financials and deciding whether you want to make an offer. The financials are the following:

The broker’s pricing guidance is $7,800,000, and the NOI is $429,693.

T3/T12 Cap Rate = $429,693 / $7,800,000

Cap Rate = 5.51%

At first glance, the broker saying the deal is a 5.51% cap on T3/T12 seems like a terrific deal for a suburban Phoenix property needing renovations. However, taking a closer look at the financials, some items must be vetted and smoothed over.

Here are a few big things that jump out at me when looking at the financials:

Occupancy has been 100% for the past three months

Bad debt is unreasonably high

Other income seems too high for a property of this size (30 units)

Property taxes are not indicative of what they will increase to post-sale

There is no property management fee

Occupancy

The average property monthly vacancy has averaged 2.5% over the past three years. The timing of the financials and the lack of any recent lease expirations is a bit of an anomaly. Let’s use a 2.5% vacancy as a safety buffer. It’s also important to note that the lender will underwrite a vacancy buffer when determining debt sizing, interest rate, and monthly mortgage payments.

Bad Debt

Historically, there has been very little bad debt at the property. However, last month, management officially decided to write off bad debt for the past twelve months, and this “annualized” amount of write-offs is likely exaggerated. In the revised T3/T12, we will run bad debt at 1% of market rent, in line with where this property has operated historically.

Other Income

You ask the broker for more details about “other income” and find out there is a cable contract that was an upfront payment to the current ownership group, and you would not see any income as the new owner. It is also being exaggerated due to the T3 annualizing this income stream. We will subtract that out.

Management Fee

The seller self-manages the property and doesn’t pay herself a fee. You will hire a 3rd party manager who will charge 5% of total revenue, which is commonplace for a multifamily investment of this size.

Property Taxes

Finally, once you purchase this property, you know the property will be reassessed at 100% of the sales price. The current property county valuation is $4,250,000. The applicable tax rate is 1.84%. Taxes will increase significantly if you pay $6,300,000 for the asset.

You can read about properly underwriting future property taxes here.

After making these adjustments to “normalize” the revenues and operating expenses, the adjusted NOI is $337,514.

If we re-run the cap rate calculation:

$337,514 / $7,800,000 = 4.33% cap rate

This is a very aggressively priced asset as the property’s adjusted net income is much lower, primarily due to the owner withholding the 5% management fee and property taxes nearly doubling. The asset value would need to decrease significantly to pay a reasonable cap rate.

A 5.5% cap rate would be excellent in this market. We can rearrange the cap rate formula and solve for the purchase price:

NOI / Cap Rate = Purchase Price

$337,514 / 5.5% = $6,136,618

You’d need nearly a $1.7 million price reduction to hit a 5.5% cap. Your investment decision will likely hinge on the investment strategy, how much you can increase monthly rents and future expense cuts. However, 4.33% is a low cap rate for this asset class (proven by empirical cap rate data), and you’re probably not getting a good deal unless you bring a ton of upside to the table via operations.

Step 4: Assessing Deferred Capital

Finally, internally, you must assess the deferred capital a project requires to be viable. Suppose a property in Phoenix is valued at $10,000,000 with a $550,000 adjusted NOI. Is it a 5.5% cap if the property needs $2,000,000 in roof replacements, siding, parking lot resurfacing, and structural repairs?

These fixes don’t correlate with increased gross rental income like cosmetic renovations (kitchens, counters, fixtures, etc.). I’d argue that a more appropriate cap rate calculation is:

$550,000 / $12,000,000 = 4.58%

Realistically, if the seller allowed $2,000,000 of capital expenditures to accrue during their ownership tenure, they likely left some rental and operational upside on the table.

The most intelligent investors I know will add CAPEX to the denominator of the cap rate equation and adjust the NOI for operating upside (rent growth, occupancy improvements, RUBS, expense cutting, etc.).

They’ll call this revised cap rate metric for their potential investment “the stabilized return on cost (ROC).” Is the ROC:

Higher or lower than the cap rate?

Higher or lower than the market cap rates of the sales comps?

Higher than the loan constant?

In capital-intensive investment opportunities, the cap rate becomes less prevalent. Other return metrics, such as the stabilized yield on cost or cash-on-cash return, could be more insightful.

Related: In Tactica’s “Back of the Envelope” Multifamily Analysis Template, cap rate, return on cost, and cash-on-cash return are all summarized so investors can compare the three metrics.

Step 5: Reevaluating the Cap Rate

After completing the proceeding steps, it’s time to evaluate the property cap rate. Is the property’s cap rate higher than recently sold comparable properties on “normalized” operating revenues and expenses? Are the deferred capital requirements minimal?

If so, you can pat yourself on the back, as you likely found yourself a suitable property. If not, go back to the grind to find a hidden gem!

Video: Are You Buying at a Reasonable Cap Rate

Summarizing a Good Cap Rate

Knowing whether a cap rate is “good” or bad” comes down to a few steps:

Understanding at a high level the market value (in cap rate terms) in the city you are interested in (via cap rate surveys)

Refining the “reasonable” cap rate range with sales comps (ideally from multiple local brokers or CoStar)

Adjusting historical financials to smooth over any anomalies and account for increased property tax liability

Assessing deferred capital, altering the cap rate formula to a stabilized return on cost, comparing the ROC to the cap rate, sales comps, and loan constant

Revaluating the cap rate to determine if it is higher (good) or lower (bad) than what should be reasonably expected in the marketplace

You’ll be challenged to find relevant pricing insights without a straightforward process to objectively determine “good” or “bad” cap rates in a submarket.