Uncovering Multifamily Property Tax Comps

Multifamily property taxes are frequently the most significant operating expense an investor must pay during the investment hold. Property taxes will account for more than 20% of the total revenue generated for many newer properties I've analyzed.

Understanding how to underwrite real estate taxes is crucial for acquisitions underwriting, and I've already written thorough guides on how to underwrite property taxes conservatively and accurately. This article intends to talk about an additional exercise to further vet property taxes for both new developments and existing properties—analyzing property taxes of comparable properties in the same submarket.

Property Comps Contents

Forgoing Property Tax Comp Research

Realistically, sometimes tax-comparable research is not worth the time investment. Property tax bills are not random. The local assessor has a method of valuing properties. In counties where commercial real estate is frequently traded and there is ample sale volume, investors know how property taxes will be affected post-sale.

For example, in my home county, Ramsey County, Minnesota, it's a certainty that property taxes will be reassessed at 100% of the purchase price.

If I decide to pay $10,000,000 for a multifamily property and the current applicable tax rate is 2%, I would underwrite proforma property taxes to be $200,000.

$10,000,000 x 2% = $200,000

Depending on the timing of the sale (which month), the proforma property taxes may take a year or two to phase in entirely (if I am paying above the current assessment), but I know they will increase to $200,000 eventually.

The process is straightforward. In Ramsey County, there is a steady flow of sales volume, and if you were to review all the comps, you'd see all properties reassessing at 95% - 100% of the sales price. Many counties in the United States have a similar rule of thumb that investors will know to follow to guide their proforma property tax underwriting.

Property Tax Comps Critical

Here are a few instances where spending a couple of hours scrapping tax intel from the county website is worth it. Let's dive into these three bullets for a deeper explanation.

Limited Sales Volume

If you are looking at property in a county where multifamily trades are rare, estimating property taxes upon taking over ownership will be hard. In many jurisdictions, some laws dictate that one sale doesn't constitute the market. In other words, if the property tax comps in a particular submarket are all assessed between $80,000 to $85,000 per unit, and you are under contract for $120,000 per unit, it’s not likely you will see a significant increase in the future assessment because "one sale does not constitute the market."

It may be okay to underwrite property taxes in line with the comps even though you are paying well above current submarket assessment levels. There would need to be multiple sales showing a $120,000 per unit barometer before the assessor could make the case that the actual market value is $120,000. One sale would not be sufficient evidence.

Note: I always advise calling the local assessor and talking to them directly. You don't need to talk about the specific subject property, but ask them questions like:

"If I pay "X" for a property, what should I expect to happen to my property taxes in the future?"

"Can I expect my assessment to be in line with properties "A," "B," and "C?"

"Does one sale constitute market?"

The property tax comp information should help you feel comfortable underwriting property taxes more aggressively (less expense) in your proforma and give you ammo if you need to contest your assessment upon taking ownership.

Record Pricing

Sometimes, I've looked at new properties in high-sales transaction markets that are just nicer and will trade well above any other comp. This uncertainty can get tricky. If the property will sell for 25% more than the next closest comp, is using a rule of thumb like 100% reassessment post-sale appropriate anymore? I argue it's not. You'd be better off picking up other A+ assets that are fully assessed and benchmarking proforma property taxes off of these assets.

Note: When seeking out tax comps for new properties, you need to make sure the comps are fully stabilized. A new apartment development usually takes two or more years to get to its fully stabilized assessment. Building the property and leasing it up takes time, and most assessors won't allocate a fully baked assessment until the property maximizes revenue potential. If you are picking tax comps that are still in lease-up, they will likely not have a fully stabilized assessment, which means the valuation will be understated and won’t be valuable for your tax comp exercise.

I still recommend calling the local assessor and picking their brain about a record pricing scenario. Like the first example, in most jurisdictions I work in, one sale does not constitute the market. Other properties that are also new but assessed lower may be a better gauge than assuming the property will automatically reassess at some percentage of the sales price.

Development

Tax comps are an absolute must if you are developing a new property. Property taxes will be a massive portion of your overall operating expenses, and understanding how stabilized taxes play out will be paramount. Other unique properties that are fully stabilized will be the best guide to predicting how your tax bill will look.

Related: Underwriting property taxes in a development proforma requires a slightly different mindset.

Property Tax Comps Research Tutorial

Let's go through a quick submarket tax comp analysis. I’ll show you how to use this information to populate the "Real Estate Tax Assumptions" section of Tactica's Multifamily Development Model.

Let's look at Random, Lake Wisconsin (the result I got when typing "Random Map" into Google).

These are not real apartment projects, but the overall point is the same. Here is where the subject development is proposed.

I would then pick out appropriate tax comps.

The same vintage (also "newer" construction)

Pure multifamily (if comping out mixed-use properties, you must break out and ignore the commercial component)

Similar communal amenities and finish levels

Not too new (all properties constructed in 2018/2019 (properties constructed in 2020/2021 won't have fully stabilized property tax assessment yet)

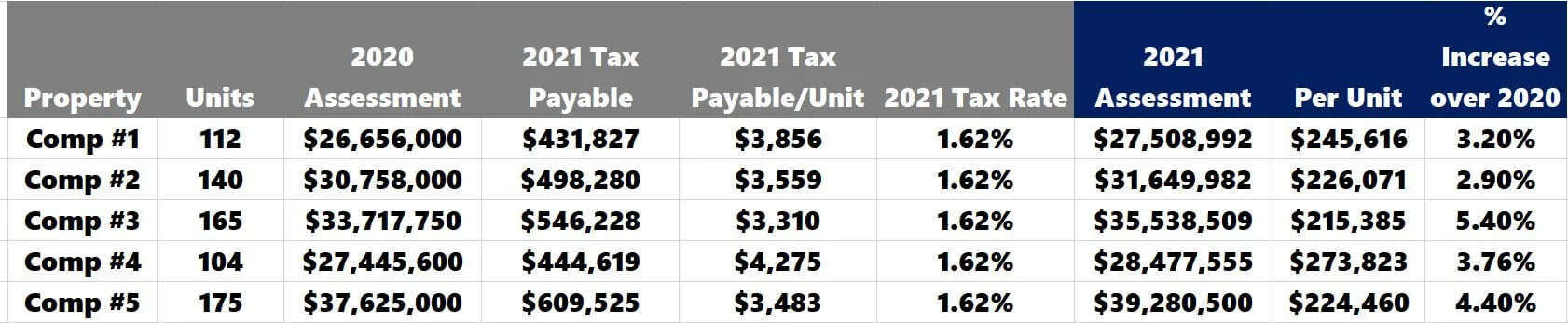

I then pull out the five comps' latest assessment and property tax information. The summarized data is the following:

A few things I pick out of this data set:

Property taxes per unit range from $3,310 to $4,275

2021 Assessments per unit range from $215,385 to $273,823

2021 Assessments have increased from 2.90% to 5.40% over 2020 Assessments (an average of 3.93%)

This information will allow me to estimate a reasonable stabilized property tax expense in a multifamily development proforma.

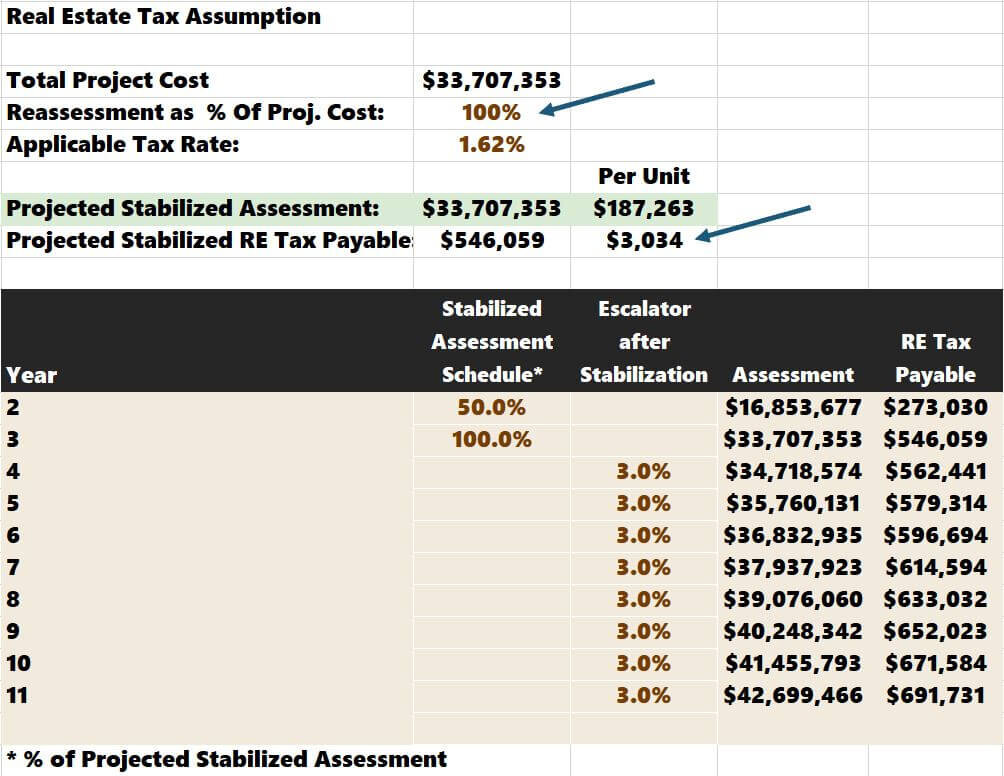

I will plug the applicable tax rate of 1.62% into the model.

I will now use the Reassessment as a % of the Project Cost assumption to back into the Projected Stabilized RE Tax Payable Per Unit.

I want to solve for approximately $4,700 per unit. Why?

The highest comp is $4,275 per unit, and assessments increased by 3.93% on average in 2021. The stabilized property tax in our proforma is a few years out, so I want to add an escalator to account for the likely inflation over the next two years.

$4,275 x 1.04 x 1.04 = $4,668/unit

A little trial and error on the Reassessment as a % of Project Cost of 154% gets us to $4,672/unit in stabilized property taxes.

I think this is a solid, conservative way to calculate property taxes.

I used the highest comp in the set

I applied two 4% annual increases to that comp

If you own the newest property on the block, it's wise to assume your tax bill will be the highest.

Note: You can see below that I project the property tax to be fully stabilized by Year 3:

The rationale is that in Year 2, the property will only be assessed at 50% of its full potential as construction will be completed this year, but the building would still be in lease-up. By Year 3, I have the entire property tax burden hitting the proforma. I have a separate blog post discussing property tax abatements.

Summarizing Property Tax Comps

Property tax comps can be very useful if you’re working in a county that doesn’t have a ton of sales volume, you are looking to pay a price that far exceeds any recent sales comps, or you’re developing a multifamily property ground-up. Searching for fully stabilized comps (for new properties) or comps that are the same vintage as the subject property should guide you on what proforma property taxes may resemble for your project.