Real Estate Investing in Top Tourism Cities Around the U.S.

At the onset of COVID-19, American investors had no idea the effects on the real estate markets, especially in cities dependent on tourism and hospitality. I wanted to take a moment to reflect on some popular tourist destinations to see how they have rebounded about 1.5 years into the pandemic.

Best Cities for Real Estate Investment

I love keeping tabs on various labor metrics across the USA. Occasionally, I'll do a "Top 10" check quickly to see which submarkets around the country are the leaders in employment, labor force growth, unemployment, and labor participation. Markets strong in these areas tend to correlate with solid investment submarkets.

In November 2020, I published an article about eight job markets defying the COVID-19 pandemic. These markets had lower unemployment than the national average and were in the Top 10 employment and labor force growth.

The markets that had the best data surprised me. None were well-known cities such as San Francisco, Austin, Seattle, Chicago, or New York City. Rather, MSAs in Utah, Wisconsin, Louisiana, Mississippi, and Idaho were outshining everywhere else.

Unfortunately, the cities hosting the most renowned tourist attractions were nowhere to be found.

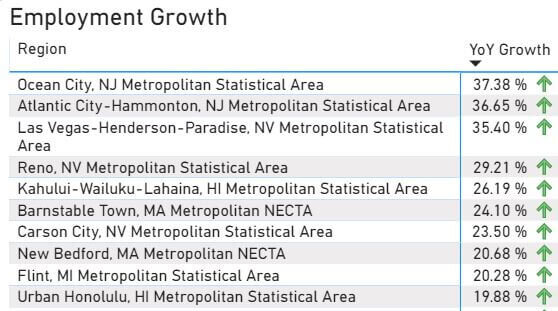

Fast forward to August of 2021, and you review the “Top 10” year-over-year (YOY) employment-growth markets, you see primarily markets dedicated to tourism.

Highlights include:

Reno and Las Vegas, Nevada (gaming/entertainment destinations)

Ocean City and Atlantic City, New Jersey (boardwalk/beach and gaming/entertainment destinations)

Barnstable Town and New Bedford, Massachusetts (Cape Cod and Buzzards Bay)

Honolulu and Maui, Hawaii

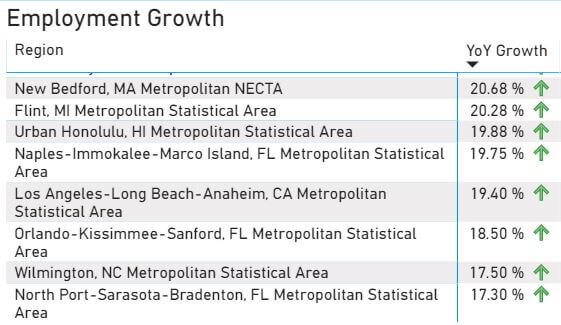

Even slightly outside of the Top 10, you have:

Naples, Florida

Orlando, Florida (home of Walt Disney World)

Sarasota, Florida

Miami, Florida (a few slots below Sarasota)

Los Angeles, California (home of Hollywood and Disney Land)

Randomly, Flint, Michigan, was sprinkled into the Top 10 for good measure!

What it Means

Any real estate investor in any of the bulleted markets above knows that gaming, nightlife, theme parks, bucket list beaches, and weather make them fantastic tourist destinations. This allures people from all over the country and world, creating jobs to run attractions, lodging, tours, transportation, dining, and more.

These are the same jobs that support the multifamily rental markets that make apartment investing a feasible and profitable endeavor. People working in the tourism industry need places to live. In the future, successful investments in these markets will depend on waning COVID cases, reopening closed businesses, and limited restrictions that support local businesses of all sizes.

Are We In the Clear?

Are tourist-heavy cities ripe for real estate investment and development? Unfortunately, it's too early to say. Variants of COVID are becoming more prevalent, and many of the cities mentioned above are rolling out renewed mask mandates and limiting indoor capacities. Nobody can say how COVID-19 has evolved and what this can mean for travel and tourism.

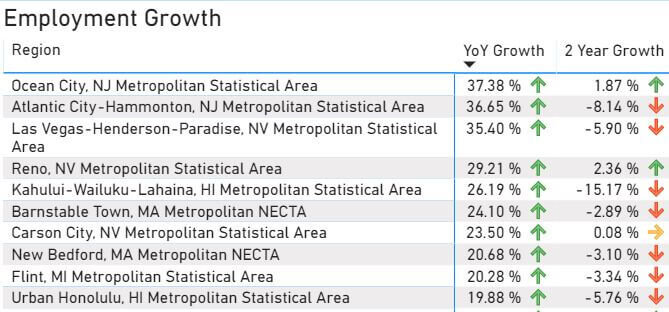

While the YOY employment growth is impressive, these were also some of the hardest-hit cities regarding layoffs. The recent explosion in employment is exacerbated by how far employment fell during peak restrictions. For example, in Las Vegas, Honolulu, and Atlantic City, unemployment increased by 30% to 35% in the spring of 2020!

Looking at the 2-year employment growth, most cities are still in negative territory. While there is progress as of late, there is still work to do.

Many U.S. cities are still climbing out of a hole. With that being said, it is a breath of fresh air to see labor recoveries in the main tourist hubs of America. Ideally, with time, tourism will recover 100% of the jobs lost in 2020, but we are likely a few years away from that happening. I will continue to monitor this in the upcoming months.

Markets supported by tourism have kept me busy working with real estate investors/developers over the last few years. Getting these cities’ labor statistics back on track will be essential for the economy's overall health.