Exploring Negative Interest Rates & Commercial Mortgages

In 2019, I wrote an article about negative interest rates and how they could affect residential mortgages. At that time, the U.S. economy was strong by most accounts, but inflation had been sluggish for many nations worldwide. The U.S. was in an advantageous position as domestic growth was more compelling than in other developed countries in Europe and Asia.

Countries like Denmark, Sweden, and Japan have already dabbled in negative rates. The Eurozone, headed by the European Central Bank (ECB), cut deposit rates negative as far back as 2014. The Bank of Japan (BOJ) did so in 2016. The idea behind this bold monetary policy is to punish banks and other depositors for hoarding cash.

Suppose savers are penalized for holding excessive cash reserves, in theory. In that case, they should be motivated to spend and invest their money, which can kickstart the economy, foster inflation, or at least avoid deflation, which is a death sentence for economic growth.

The United States Macro Environment - 2020

I last explored negative interest rates in the summer of 2019. It feels like decades ago with the onset of Coronavirus, stock market volatility, unemployment, social unrest, and overall economic uncertainty. The Federal Reserve cut the federal funds rate to target 0% - 0.25% in mid-March 2020 as a combative measure to counter the economic threat of COVID-19. Fed Chair Jerome Powell has clarified that negative interest rate cuts are not a policy tool in the Fed's arsenal to avoid a financial crisis.

The United States Macro Environment - 2022

When CPI reports started to show elevated inflation readings in late 2021, the Fed initially brushed it off as transitory. It became apparent that inflation was a big issue and would not subdue without hawkish Fed policy. In writing, the Fed has aggressively raised the Federal Funds rate and let MBS and Treasury roll off the balance sheet (quantitative tightening) to 90 billion per month. Overall inflation peaked at 9.1% in June, although core inflation (net of energy and food) is still rising as of the August inflation reading.

Transitioning to Negative Interest Rates

Negative rates are realistically not on anybody’s radar right now and for a good reason. The Fed is focused on returning to price stability and targeting an annual inflation percentage of 2%. Many macroeconomic pundits think the Fed will need to put the economy into a recession to accomplish the 2% benchmark. With a cooling employment market, less money supply, and a murkier economic outlook, the Fed could again begin cutting rates to stimulate growth.

While interest rates (benchmarked with the 10-year treasury) have been on a straight upward trajectory since the summer of 2020, it’s important to note that over the long term, interest rates have steadily declined since the early 1980s.

The chart below tracks the 10-year treasury yield the St. Louis Fed provided since 1982.

If the long-term trend continues over the upcoming decade, interest rates will be in negative territory.

Negative Mortgage Rates

It's bizarre to imagine a world where you theoretically would get compensated for taking on a mortgage. In my opinion, underwriting apartment deals would be exponentially more difficult. Returns would be inflated thanks to healthier after-debt cash flows. Reversion assumptions and residual cap rates would be nearly impossible to forecast, as the future buyer may not benefit from the same negative sub-zero interest rates.

For existing owners, as long as operations held somewhat steady, it would be a gift from the heavens. It would be a foolproof way to increase cash flow with no extra risk. Buyers seeking investment opportunities must be more careful when seeking leveraged real estate. I could see specific buyers finding themselves "underwater" as they may have bid too aggressively due to the advantageous mortgage terms. They ultimately get busted when rates normalize during their investment hold. Selling at a loss may be the only option.

Conceptualizing Negative Interest Rates in Real Estate

The best way to imagine negative rates is by looking at a "theoretical" acquisition opportunity of three identical properties. The only difference will be the loan terms. We'd look at offering the same price under three different scenarios:

Positive Interest Rate Debt

Free Debt (0% interest)

Negative Interest Rate Debt.

In the financial model, purchase price, operations, and residual assumptions will all be identical. We will compare the scenarios by analyzing the following:

Loan Amortization

Cash Flow After Debt

IRR

I first had to double-check to see if the Value-Add Model could handle negative interest rates in its current state. It does, whew!

As I mentioned before, all three proformas will be identical. The only difference will be in the interest rates:

Scenario 1: 0.75%

Scenario 2: 0.00%

Scenario 3: -0.75%

Other loan terms are:

Loan Amount: $9,000,000

LTV: 75%

Term: 10 Years

Amortization: 30 Years

*Loan is fully amortizing (No interest only)

The negative interest wouldn't technically be a payment to the borrower; instead, it would be a credit subtracted from the principal portion of the mortgage. For example, in Year 1, the principal paydown would be $333,772. However, due to the negative interest, only $267,421 would be paid to the lender.

Negative interest is almost easier to think of as a discount. Although you owe $333,772, the lender will subsidize $66,351 of that for you.

Loan Amortization

Let's look at some of the components of the loan amortization for the different interest rate thresholds:

As expected, the total payment would drop with the interest rates. However, the actual cost savings would be more significant if rates dropped from 0.75% to 0% than if they fell from 0% to -0.75%.

0.75% to 0%: $3,351,079 - $3,000,000 = $351,079

0% to -0.75%: $3,000,000 - $2,674,212 = $325,788

The balloon payment at the end of the 10-year term would also be considerably smaller for the negative-interest commercial mortage.

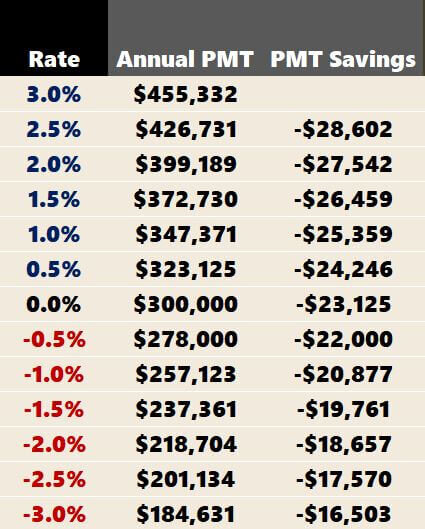

I was curious how this would look with a broader range, say 3% to -3%, with 50 bps increments in between.

While going deeper into the negative creates more savings, the gains begin diminishing. Stated differently, it would be better for the borrower to see a rate cut from 3% to 2.5% than -2.5% to -3%.

Food for Thought: How weird would 12 or 24 months of interest-only be (IO) here? You would be getting a payment from the lender (I think?). Or maybe the lender would credit you when you pay off the mortgage balance. I suppose it would be negotiable.

Cash Flow After Debt

The results from above directly correlate with the cash flow after debt.

I don't think I've ever seen a proforma pencil with a DSCR above 2.00 and an LTV as high as 75%. Typically, a DSCR in the 2.00+ territory is an institution buying something with 40%—50% leverage, and my model calculates DSCR just for fun, even though the loan will be a full-term interest only.

IRR

Finally, I’ll layer in the IRRs next.

Again, leveraged IRRs are significantly impacted by reduced financing costs, but the benefit diminishes as rates go further negative.

Negative Interest Rate Mortgage Final Thoughts

The reality is that the first negative-interest loans would likely only dip into negative territory slightly. With origination fees, points, and other administrative costs, the actual annual percentage rate (APR) could still be positive. Even in this analysis, a loan cost of 1% was plugged into the model, so a 0% loan isn’t technically free.

If negative yields ever became normal in multifamily capital markets, there would likely be far more significant operational concerns than this blog post covers. In contrast, I didn’t talk about property operations other than holding operations constant across the various debt scenarios.

I ran reasonably standard vacancy (5%), bad debt (0.50%), and no rental concessions. I also ran a modest value-add that would see a high 4% rent growth early in the investment hold. Although negative interest rates appear enticing, if the economic outlook is awful, it may be necessary to subsidize all the vacancy and rent loss.

I assume the sub-zero interest would be considered qualified interest income for Federal income tax purposes. That is strictly a hunch. It would be essential to huddle up with your tax professional and understand the tax consequences of negative interest if it did become the norm.

Summarizing Negative Mortgage Rates

Negative Interest rates are still almost impossible to fathom, especially with the Fed Funds on the rise. Most investors can agree that they’ve always considered the cost of debt to be finite because there is an interest rate below 0%.

As I saw investors rejoice as they locked in financing around 3%, I can’t help wondering if these rates will someday feel expensive or even absurd if negative interest rates ever become the norm. As we learned in 2020, surprises can be endless. While I don’t expect interest rates to go negative anytime soon, the potential of negative rates will always remain on my radar as things can change drastically in the relatively near-term.