Multifamily Development: Modeling Conservatively

With any real estate underwriting exercise, there will always be preferences on how things "should be done." I spent many hours thinking about how I should be accounting for many situations in the Tactica Financial Models.

It has always been ingrained in my DNA to always err on the side of conservative. If there are five ways to account for something "technically" correct, I will choose the most prudent path, even though it likely affects investment return metrics adversely.

Four different components can inflate returns and potentially fabricate the feasibility of a development opportunity.

Contents

Many times, the intricacies of a financial model can be complicated and hidden deep within formulas and logic. I want to be fully transparent about how the Tactica tools operate. The Tactica Development Model has a safety net of prudent features that help cut out over-exuberance and hopefully help sponsors over-deliver on their proforma projections.

Multifamily Development Equity Contributions

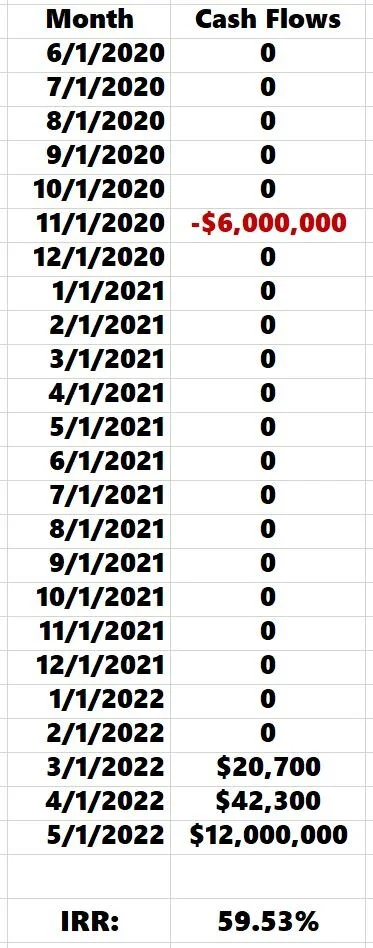

The IRR is all about the timing of cash outflows and inflows. The outflows are the funds put into the deal (negative cash flows). The inflows (positive cash flows) can be in the form of operations, refinance proceeds, or residual sale proceeds. There are different ways to account for these outflows and inflows.

In the Tactica Development Model, all equity is raised in Year 0. It is the only time there is a cash outflow (negative cash flow).

I have seen other development underwriting tools (typically more tailored for JV partnerships) that will slowly phase the equity into the project. The latter scenario significantly impacts the IRRs as an equity investor would benefit by contributing in smaller chunks over a longer time horizon.

For any development project, the sponsor will put the land under contract, get the land entitled, get construction plans put together, and move forward with construction from there. The sponsor takes on "pursuit risk" because they typically spend their money to initially vet the project feasibility (commonly in the predevelopment phase).

Common JV Development Model Structure

Let’s take an example scenario where $6,000,000 in equity is invested in the deal. The investors will get $12,000,000 in residual sale proceeds in precisely two years. There will be a couple of months of cash flow leading up to the sale month.

All the negative cash flows add up to -$6,000,000 in equity.

11/1/2020: Land Purchase (or land contribution)

5/1/2021 - 2/1/2022: Development costs supplemented by the construction loan

3/1/2021: The property begins producing marginal income

5/1/2022: Property sale

More sophisticated investors may want the IRR clock to start counting when the sponsor spends the first dollar. They will push out the land purchase as far out as possible, as this can boost the IRR. Once the project receives all approvals, they will find their equity partner and do a true-up on all previous expenses (usually everything spent before the land purchase). In the future, they will have their equity partner wire funds to them as the project progresses throughout the construction phases.

The Tactica Development Model

Most clients I work with are raising money from private investors (multiple) and requesting the funds upfront. It would be risky to expect numerous investors to wire funds to them every month, and it would be an administrative nightmare.

The $0s that come after the -$6,000,000 equity infusion are the construction costs supplemented by both the equity and the construction loan, which effectively net out to $0. The property begins producing marginal income in March 2022 and will sell in May 2022.

In summary, the sponsor will get all the entitlements on their dime (before the land is officially purchased) and then request funds from their equity investors, typically when the land purchase closes. They will get reimbursed for their pursuit costs at this juncture.

The developer would count previously spent items as an "Up Front" expense on the "Budget & Draw" tab for modeling purposes. This is Year 0 in the Tactica model. There are no more equity contributions from here on. This logic will generally hurt the IRR as all investor equity is in the project longer than in the former scenario (59.54% IRR vs. 65.77%).

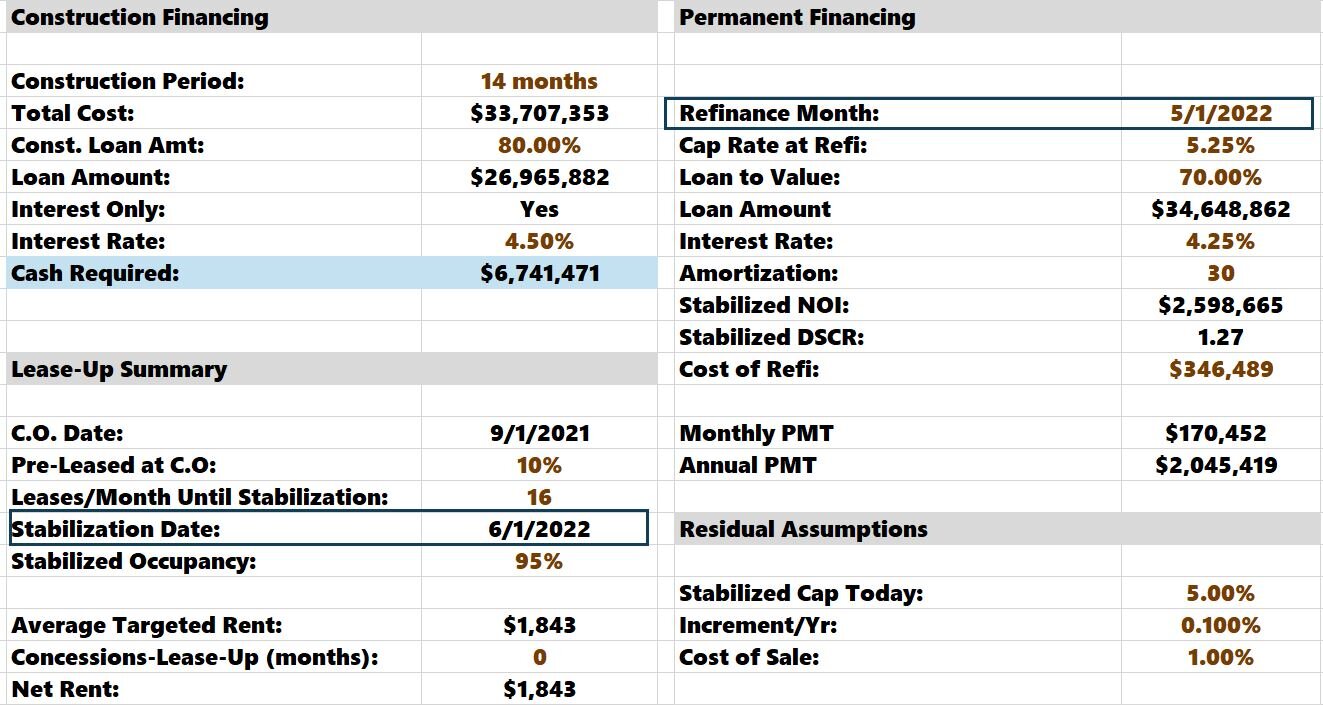

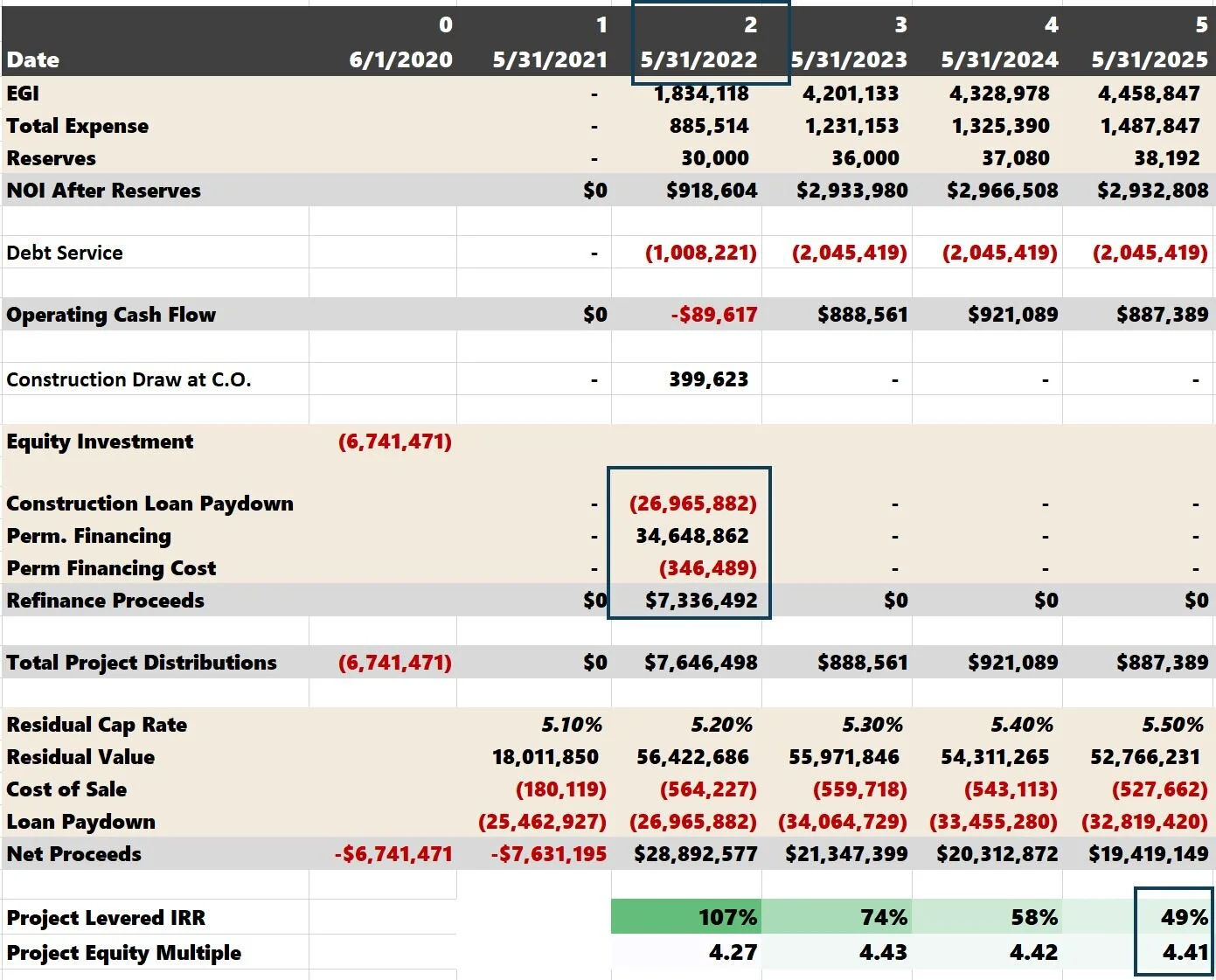

Multifamily Development Refinance Timing

In the Tactica Model, no matter what year a refinance happens, the proceeds won't be paid out until the end of that year. A successful refinance can be a big boon to investment metrics. Since the IRR is a time-sensitive metric, it is beneficial to receive refi proceeds sooner. Let's say the sponsor raised $6,741,471 in June of 2020. In June of 2022 (month 25), the sponsor blows out the construction loan and receives significant refinancing proceeds. In the Tactica model, the refinance wouldn’t be distributed until the end of proforma Year 3 (even though month 25 is the 1st month of the 3rd year).

Realistically, the sponsor wouldn’t let those proceeds sit in the bank for 11 more months. They would pay them back to investors!

The “Refinance Month” on the "Project Summary" tab can be adjusted. You can overwrite it while it ties to the “Stabilization Date” via a formula. In this instance, it may make sense to manually set the “Refinance Month” as 5/1/2022, so the refi monies hit the proforma in Year 2 instead of in Year 3, like in the example above.

The difference in IRR from refinancing in Year 2 or 3 during a 5-year hold significantly impacts the IRR (but not so much on the equity multiple).

Note: the date in the “Refi Date” must match the day of the “Analysis Start Date (for example, 09/01/2020 and 05/01/2022) for the model to work correctly if you use a custom date.

I would always recommend erring on the side of caution and assuming the refinance happens later.

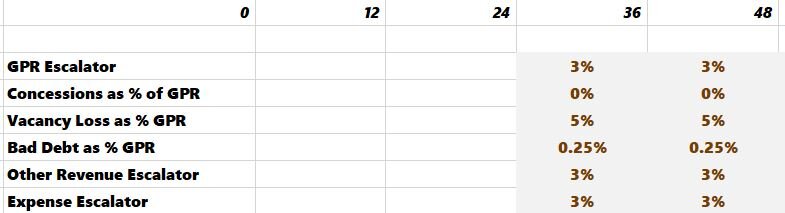

Multifamily Development Rent Growth

The Tactica model will not allow you to increase the rent until the property is stabilized. Other models out there will increase rents while the property is still in lease-up. If the asset takes a long time to lease up (longer than projected), it is likely because proforma rents are too high. It wouldn't be prudent to phase in any rent escalator while first-generation leases are still being signed.

Furthermore, if the property stabilized in Year 3 (Month 25, for example), the rent escalator won't be factored in for the following year (Year 4). There is conditional formatting in the model that makes this very clear.

Technically, some of the first leased apartment units signed early in the lease-up could be increased in Year 3, leading to some rent growth, but you wouldn't see the bulk of it until the following year, regardless. I've worked in models where rents will increase at the certificate of occupancy date through lease-up well before the property is stabilized. While this impact will be minimal on the operations, it will have a sizable effect on the residual sales value on long-term hold.

If the property stabilizes, say in Month 24, the model will let you apply a rent escalator to Year 3.

Until stabilization, all revenue items will align with your assumptions in the “Stabilized NOI” section. After stabilization, you will completely control the line-item assumptions each year.

If you think rents should be more aggressive, input higher rents on the "Unit Mix" tab.

Note: Since publishing this blog post, due to popular requests, I have added a toggle that allows the user to increase rents during the construction period. Use this input with caution.

Expenses assumptions follow the same logic as revenue assumptions. Hence, it’s essential to solve what you think the stabilized expense load will be after the project is completed and stabilized. This will likely be more costly than what you’d expect today.

Debt Service Coverage Ratio

This last safety net is a little more subtle but still significant. It can be hard to gauge the debt coverage once the apartment building stabilizes. Typically, real estate taxes will take multiple years to stabilize. The property will generate fully projected rents, but property taxes will be just a fraction of their fully assessed liability early in the investment hold.

Different submarkets will also see property taxes stabilizing over various timelines, and controlling how your property taxes phase in is simple with the Tactica model. You have complete control over each year.

It is important to note that the DSCR on the "Project Summary" tab is calculated based on your fully stabilized real estate tax assumption.

The DSCR clearance may look much lower than reality, given that you will likely get permanent financing before property taxes stabilize. To see the true DSCR each year, you can check out the chart on the "Project Summary" tab detailing the DSCR from years 1-10.

Multifamily Development Modeling Conclusion

Taking a prudent approach to investment underwriting pays off the most when the project faces adversity. Multifamily development is inherently risky, and building conservative logic into the framework of the model is paramount. The four areas of focus in this article are:

Equity Contributions

Refinance Timing

Rent Growth

DSCR

Erring on the conservative side for the bullets above may help ensure your multifamily real estate development is a success.