Multifamily Analysis: Why You Should Always Request T12 Financials

It was a terrible day when my boss would say, "I have another valuation assignment for you," and then hand me a piece of paper with illegible scribbles from the owner of an apartment building. The rent roll, balance sheet, and income statement, all hastily jotted down on both sides of an 8.5" x 11" sheet of notebook paper, was all I had to work off of sometimes.

"Get this is the financial model, and solve for a 5% cap rate," my boss would say. I would begin slowly piecing together the resemblance of a proforma with more questions than I had answers.

T12 Real Estate Investing Article Focus

Real Estate Financial Statements Primer

Many real estate investors think the towering "A+" asset-class properties are the most challenging to underwrite. That's false. The more minor "ma and pa" deals, which lack organization and proper record-keeping, will rob you of your precious time far more frequently. The downtown high-rise is generally a breeze (unless the building is pre-stabilized)!

I've seen all types of financial statements when underwriting multifamily properties.

Handwritten notes

Schedule E Federal tax returns

Archaic multifamily investment software

Over the years, as the industry has innovated, more owners have switched to multifamily software that offers more sophisticated financial reporting. This growing trend makes it easier to analyze deals more efficiently and accurately.

Related Post: How to Underwrite Multifamily Properties With Incomplete Financials

What is a T12?

T12 or T-12 is short for "Trailing Twelve Financials." Real estate industry participants will also refer to the T12 as the "Trailing Twelve-Month (TTM)," Both terminologies are used interchangeably. If I ask an owner or broker for the "latest T12," they will know to send me historical financials spanning twelve months from the current month.

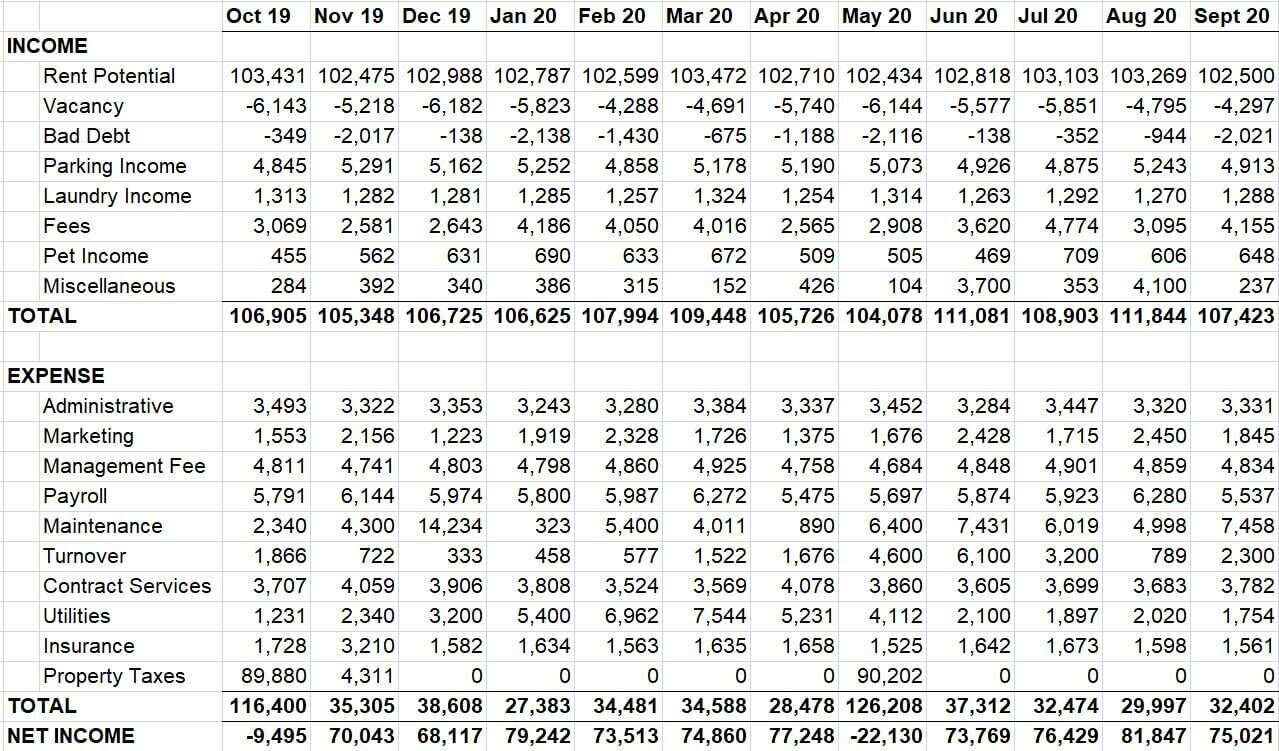

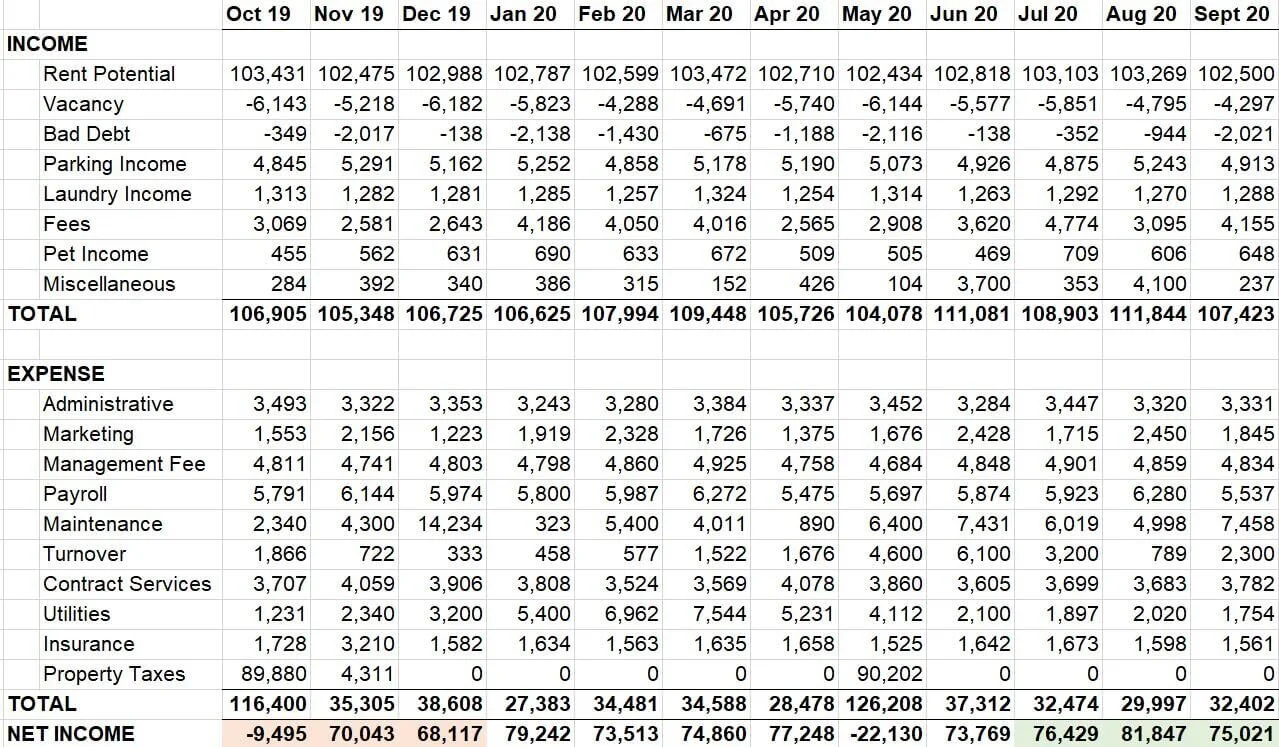

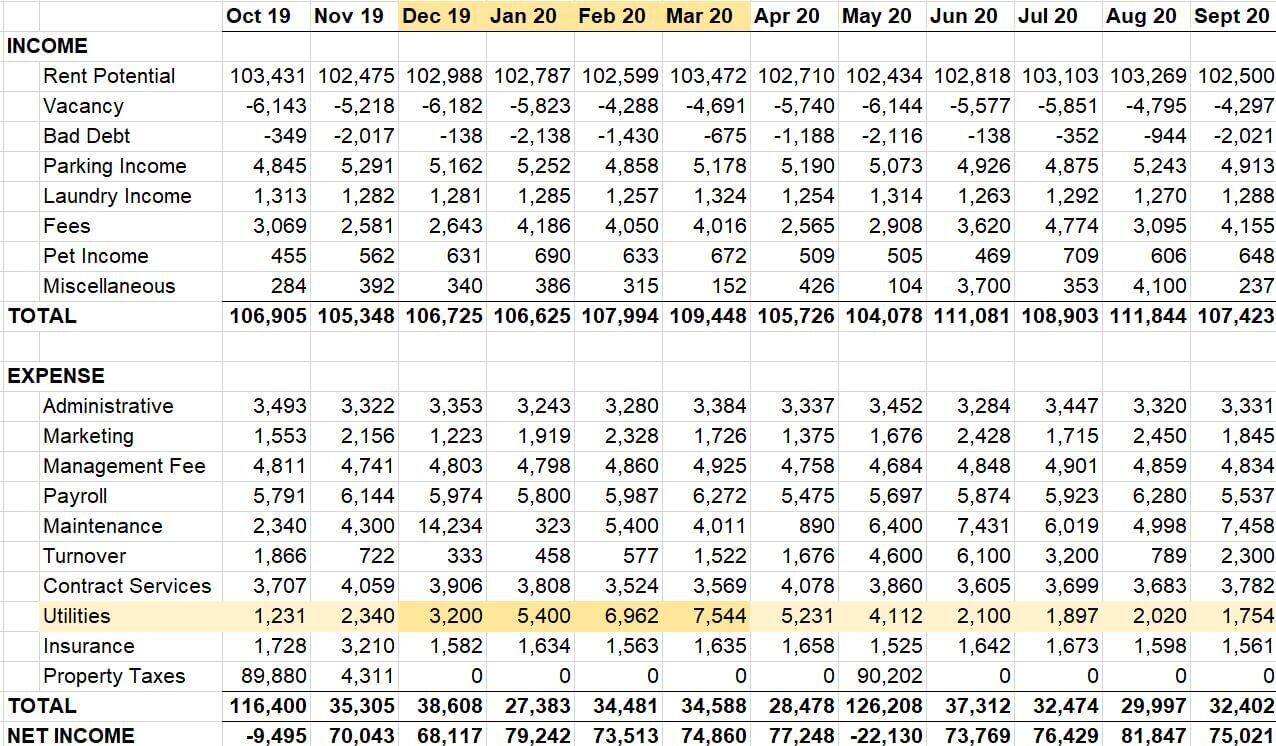

Example: It's October 8th, 2020, today. If I requested the latest T12 from a broker, they would send me financial statements from October 2019 through September 2020, as seen below:

Sometimes, owners will even include "below the line" items such as capital expenditures, while others may require you to request that data separately.

Non-cash expenses such as depreciation and amortization are typically excluded from T12 financials.

T12 in Real Estate Importance

In the image above, one year's worth of data is broken down monthly. The monthly breakdown is crucial for a few different reasons.

T-12 Trend Analysis

Formulating Questions

Noticing Non-Recurring Items

T-12 Trend Analysis

Seeing the monthly financials allows you to notice trends, such as why certain operating expenses increase monthly or why the net operating income (NOI) was lower at the beginning of the year vs. year-end.

Or you may want to look at the "trailing 3-month revenue" and see how it compares to the total T12 revenue.

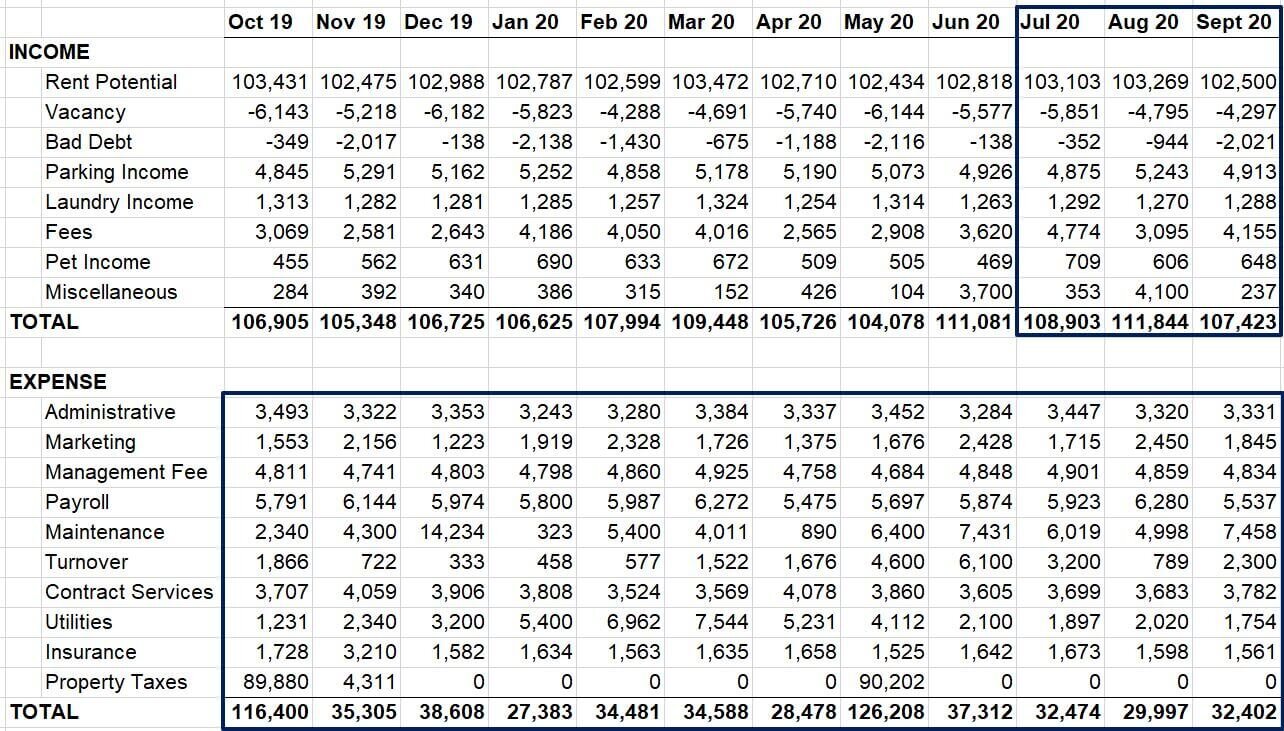

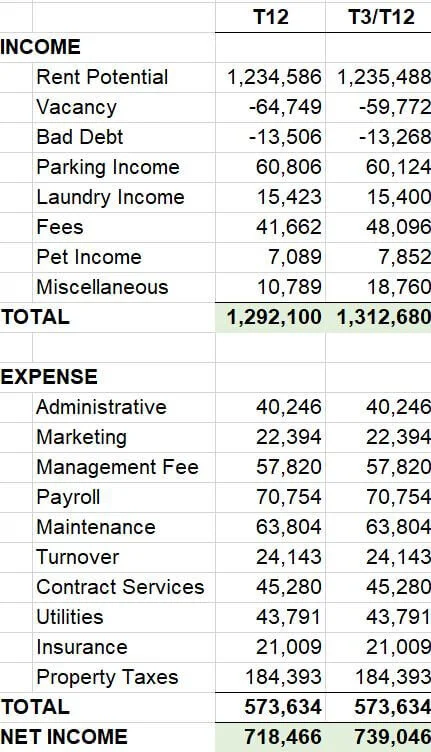

You could multiply the last three months of revenue by four and see how this annualized number compares to T12. Is T3 annualized income higher or lower? How is revenue trending at the property? What is the T3/T12 cap rate?

It's industry standard to annualize the most recent three months of data. When you hear the term "T3/T12," they are doing this. They pair the T3 "annualized" revenue with the T12 expense to calculate the "annualized trending NOI."

In this instance, NOI is up 2.86% when annualizing the T3.

$739,046 / $718,466 - 1 = 2.86%

Note: It's not wise to annualize expenses as they tend to be seasonal. For example, if you live in a cold climate, annualizing the summer months (June, July, and August) will understate expenses because of heating costs and snow removal expenditures that weren't present during the summer.

You can see how utilities spike in the middle of winter in the image below.

Formulating Questions

Seeing more data may help you formulate questions to ask the seller.

What constitutes “Fees”?

What is the miscellaneous income line item?

What were the two significant cash flows in June and August?

Can this income be counted on going forward?

What constitutes an "Administrative Expense?" Are there opportunities to cut any expense items?

The more granular the data, the more trends you’ll be able to spot, allowing you to ask more profound questions that can cultivate a deeper understanding of the property.

Noticing Non-Recurring Items

You may notice one month with unusually high repairs and maintenance expenses. Was this a one-time repair?

If the $14,234 expense were a one-time CAPEX replacement, you’d hate to count that against NOI in the proforma.

Or, on the flip side, you may notice a blip in revenue like the +/- $4,000 in the miscellaneous income from the example above. Perhaps this was payment for a cable contract that will not be available to the next owner or a unique fee charged to a tenant that is unlikely to happen again.

You want to be sure you are stripping out non-recurring revenue and expense items, as it will allow you to benchmark the property and its valuation more accurately with comps in the marketplace.

It may also be helpful when discussing financing terms with your lender and could ultimately lead to more debt proceeds if there’s a good reason certain expenses can be classified as non-recurring.

Look how much harder it is to unearth trends, formulate questions, and determine non-recurring expense and revenue items if the data is presented like this:

It's impossible! Sometimes, real estate financials may be incomplete, and you may not have a choice. You must deal with what a broker or owner provides interested buyers. Regardless, ask for the T12, as this will make your initial property vetting much more manageable and streamlined.

T-12 Real Estate Summary

Real estate investing is about profitability. You review financial statements, rent rolls, and property tax statements to estimate what the property cash flows will be when you take over ownership. The more detailed the financial information, the more comfortable you should feel with the property and what to expect once you take over.