How to Underwrite Multifamily Properties With Incomplete Financials

Commercial real estate analysis is more straightforward when you build a proforma from a perfectly curated T12 financial statement. While more owners are utilizing sophisticated software, many are still using systems that export financial statements that are less than optimal for us analysts, making multifamily underwriting a challenge.

This blog post will describe how Tactica has historically handled underwriting when utilizing incomplete year-to-date (YTD) income statements and stale financials; the project is not yet stabilized, or there are no historical financials.

Contents

Multifamily Rent Roll

When it comes to requesting financial documents from an owner or broker, make no mistake: the rent roll is undoubtedly the most crucial.

As long as you can get your hands on a current rent roll, a good analysis can occur regardless of the historical financials' quality. Rents are indeed the heartbeat of investment property. Knowledge of current rents and how these rents are positioned in the submarket will always be paramount to anything else.

Ideal Multifamily Underwriting Scenario

When I plug historical financials into the Tactica Value-Add Model, I like to see:

Current T3 Revenue

Current T12 Revenue & Expenses

Annual Financials for two years leading up to the current T12.

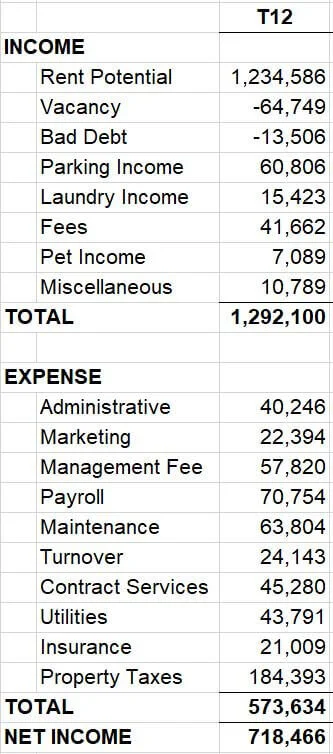

For example, I could accomplish the first two bullets if the property manager sent a T12 through October 2020 in the format below.

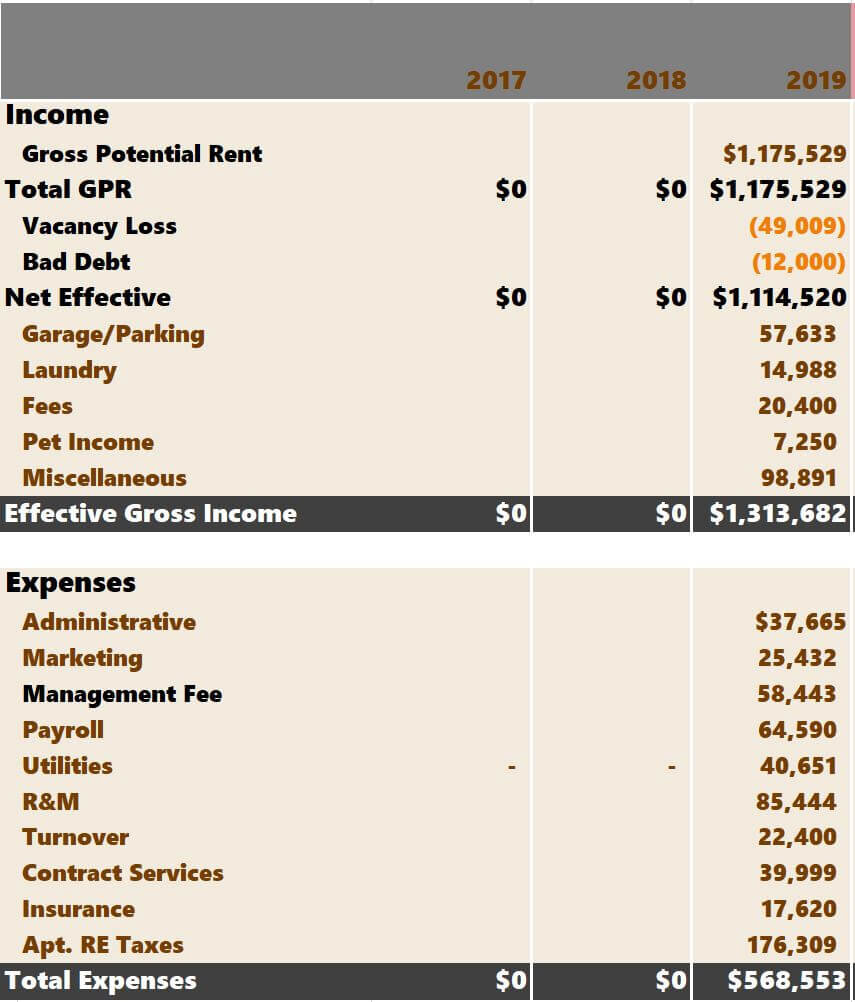

I would also like to see the full 2019 and 2018 financials. Upon receiving this data, I would enter everything into the financial model.

In the example above, I only keyed in data for T3 operating revenue and T12 operating revenue and expenses for the sake of time.

It’s a reasonably straightforward exercise when you get the latest trailing-twelve report. But what about when financials aren’t presented in the monthly T12 format? What’s the process then? I'm going to explain various common scenarios of less-than-optimal financial exports and explain:

How they present themselves

How I would enter them into the model

How I would underwrite them

First, let’s briefly discuss historical financial statements in real estate and how you should think about them.

Definition of Historical Financial Statements

I never adjust or amend historical operations. I believe that the proforma is the arena to make adjustments and changes. To me, historicals are final and unalterable. Suppose critical data are missing from historicals, such as a property tax payment or the lack of a property management fee. In that case, I will make a mental note and not emphasize the historicals for cap rate analysis.

Exception: I will strip out lender-specific expenses such as interest and principal payments as they are not operating expenses. I'll also deduct depreciation or ownership-specific expenses such as asset management and partnership distributions/contributions.

Calculating an actual historical net operating income (NOI) is the goal. You must only include true operating revenues and expenses to do this. CAPEX is another gray area. Unless an owner can prove that a significant expense was CAPEX and non-recurring, I won't touch or adjust any R&M expense line items.

Let's begin discussing different financial formats you may come across.

Incomplete Real Estate Financial Statement Formats

YTD Financial Statements with no Monthly Breakdown

Remember the first T12 image from above? Let's pretend it's presented like this instead:

While you can’t pick out trends such as monthly occupancy changes, rent growth, and cash flow fluctuations like you could before, it's still relatively easy to plug this data into the model.

I would then hide columns “G” and “H” before presenting to prevent confusion. This data is nicely summarized in column “I.”

Nothing changes from the inputs we entered earlier for the T12 revenue and expense column. Unfortunately, we will no longer be able to extract a T3 trend like we could when the financials were showing monthly results.

Nine Months of Financial Statements

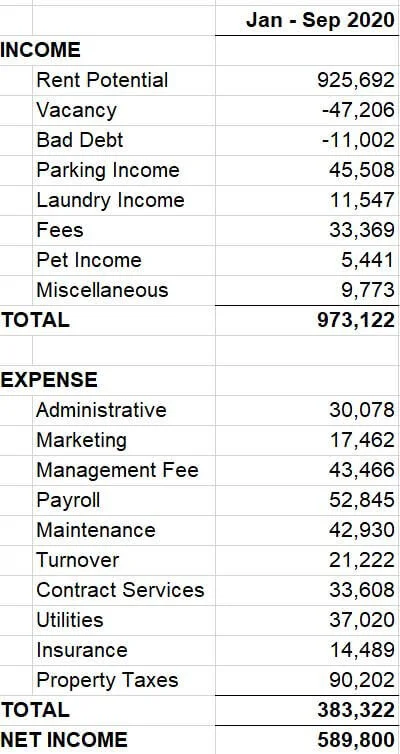

Let's instead say we have information that only spans nine months. So, the financial data covers January - September 2020.

You now must determine if you want to annualize the data. My rule of thumb involved two checks.

Check 1:

I will generally annualize the financials if I have eight or more months of data. Typically, eight months is a good enough sample size to feel comfortable extrapolating the data over a full calendar year.

Check 2:

Depending on the timing of the financials, it could be missing essential elements. For example, if I were to receive eight months of financials in Wisconsin spanning from April to November, I would hesitate to annualize it. The winter months would be excluded, which would likely see an uptick in utility expenses (gas/electricity to heat the building) and snow removal.

You also need to pay attention to property taxes. Many states will allow for multiple payments throughout the year. Incomplete financials may only include one of the two total property tax payments.

If the financials pass both checks, you can proceed to enter the historical financials in the following fashion:

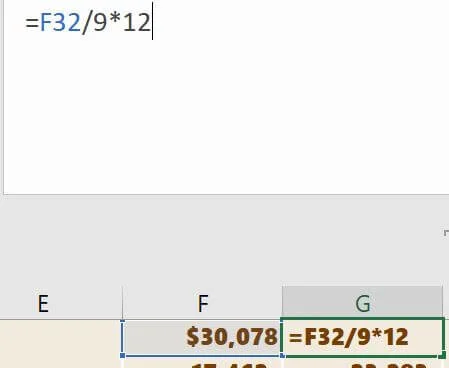

In column F, I changed the label to “T9” for clarity and entered the nine months of expenses.

In column G, I changed the label to “T9 Annualized” for clarity, and I annualized column F values with a simple formula:

I then labeled column H as "T9." This is important as the value-add model knows to annualize this "nine-month" revenue data. I then entered all the T9 revenue data.

Now you can hide some columns to make the data easier on the eyes to assess the historical financials.

When making proforma assumptions, I would feel comfortable using a revenue and expense escalator (usually between 2% and 3% annually) on most line items presented in the annualized T9 above.

Whether it’s a T8, T10, or T12 export that doesn’t show the operations breakdown, you can use the same logic as we did with the T9 above to develop a reliable historical operating year.

If you have less than eight months of data or the YTD financials are missing critical components of the multifamily investment, you could use the "Previous Year Financials" method."

Previous Year's Financials Statements

If I have less than eight months of YTD financial data or don't think the data represents the property's annual cash flow, I will request the previous year's financials and the most current YTD. Generally, it’s not too hard for a property owner to export financial data further back in the past. Let's say the broker provides us with four months of YTD financials.

I would request a 2019 full-year financial in addition to this information. It would likely look similar to the T4.

I would enter the 2019 financials into the model first.

I would enter "T4" as the pink column header and then input the T4 numbers.

Now, the model presents a "T4/2019” financial snapshot. I'm confident that the operating expenses are accurate, and the T4 gives an excellent current, trended revenue picture. Again, I would feel comfortable building a value-add proforma from this data.

No Financial Statements

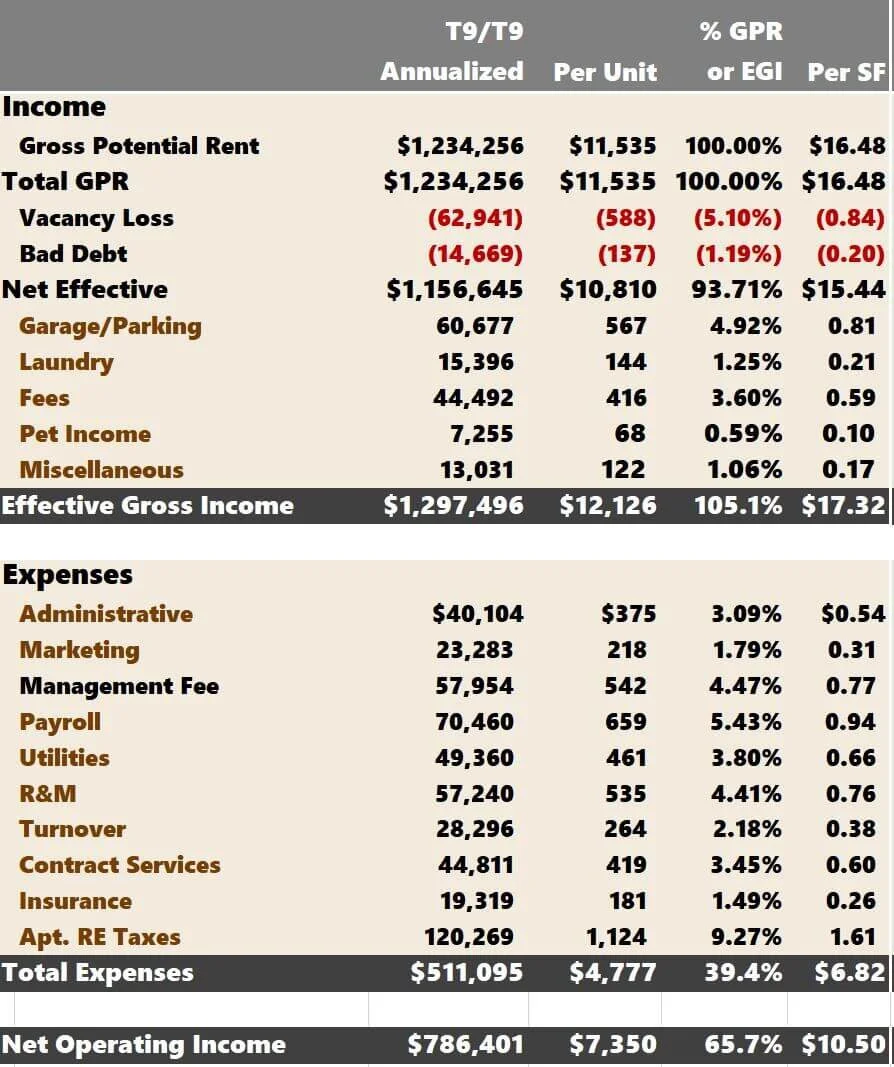

The final scenario is when there are no historical financials. Or perhaps you are a broker and don't care about the historical financials as you are trying to determine a valuation and likely purchase price for a property and want to make your assumptions for operations.

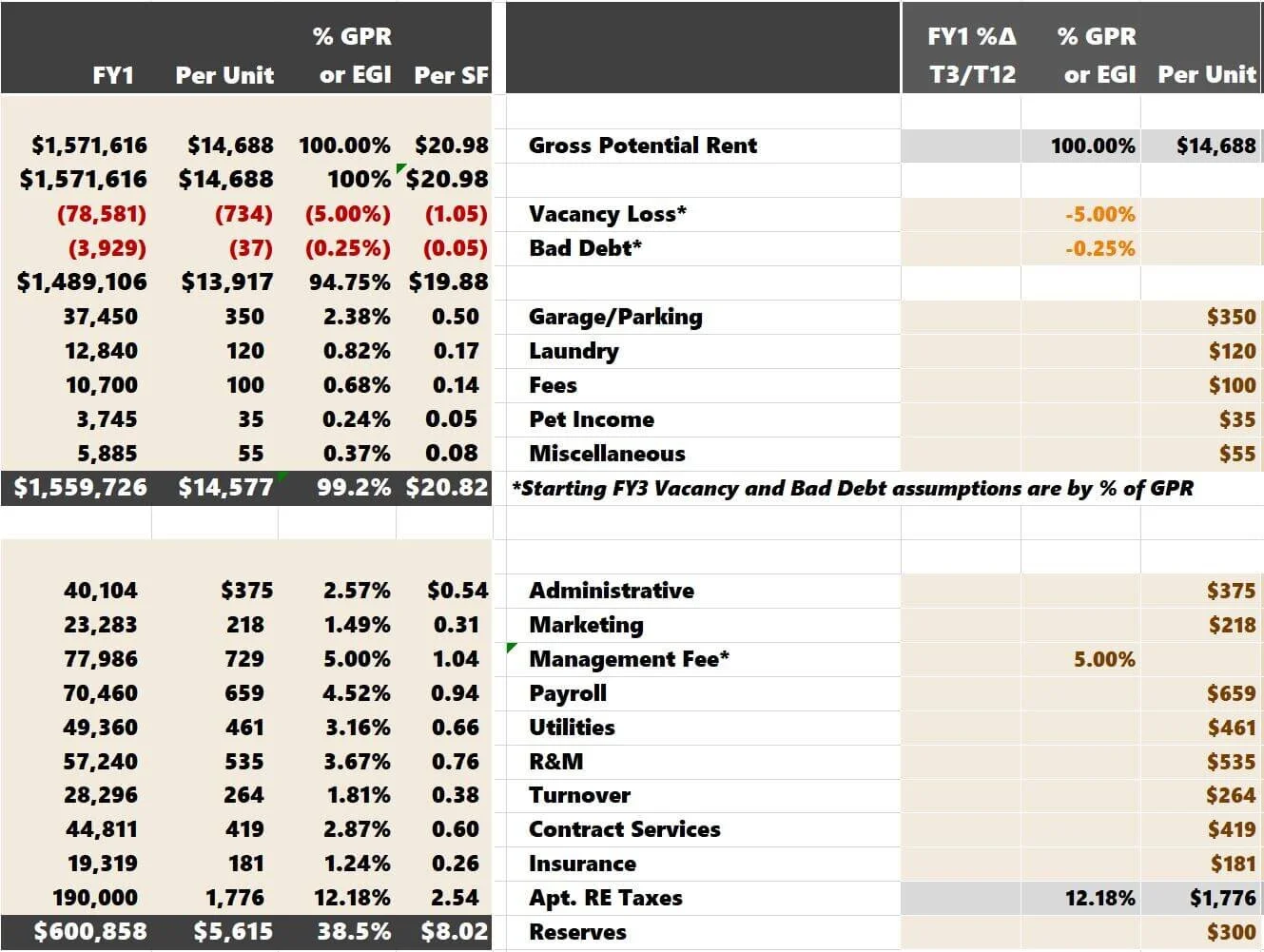

I have done this many times, especially when I want to do a quick and dirty analysis and don't feel like plugging in historical numbers. I first deleted everything from the historical columns.

In the financial model, I can make Year 1 proforma assumptions as either:

A percentage increase over the historical financials

A percentage of GPR or EGI

A per unit basis.

Remember, we assume we have a rent roll for this multifamily deal already loaded into the template. The GPR is calculated from the rent roll, and I am doing a 2% annual rental increase, which is controlled on another tab. I will make assumptions for all the other line items (except for property taxes, which flow in from a different tab).

I made all assumptions on a per-unit basis except for “Vacancy Loss,” “Bad Debt,” and “Management Fee.” Vacancy loss and bad debt assumptions are made as a GPR percentage, while the management fee is made as a percentage of EGI.

These assumptions properly control the Year 1 proforma line items to the left. You would have to do your due diligence to estimate appropriate underwriting assumptions. This process is what many of my seasoned clients will do. They never depend on the historicals solely.

Video: Scrubbing & Organizing Multifamily P&L Statements

Summarizing Underwriting Multifamily with Incomplete Financial Statements

When analyzing multifamily real estate investments, a curated T12 will not always be in the cards. Understanding how to handle inferior financial statements, specifically how to input them into a workbook and build a proforma from them, is essential. More data is always better and will give you more options when uploading historicals for pricing analysis.

Hopefully, this blog post gives you some ideas and makes you feel more confident analyzing deals from less sophisticated owners who can’t produce T12 financials for their apartment buildings.