Underwriting Apartment Buildings During a Recession

Someone asked me an interesting question the other day. A website visitor was browsing the value-add financial model and asked me if it would work if the apartment complex is projecting negative rent growth. Specifically, could the model handle underwriting apartment units and common area renovations while simultaneously seeing a decrease in rents?

It was a sobering moment and is a theme many multifamily investors must stomach when considering investment opportunities.

Net Operating Income (NOI) growth is no longer a given in the current economic climate, and investors must underwrite revenue more cautiously due to uncertainty and tightened lending requirements.

The short answer is yes; the free underwriting template and the paid value-add version can handle a bear commercial real estate market subject to negative rent growth and unpaid rent. The Value-Add Model will give the user more precision, but both tools can handle it. For heavily distressed projects, we also offer a Redevelopment Model.

I thought it would be worthwhile to show users how this can be done in the free and paid underwriting proforma templates.

Underwriting Apartment Buildings: Featured Tools

Multifamily Template

You'll have complete control over all the operating revenue and operating expenses. The revenue lines most likely to be affected in a recession would be:

Gross Potential Rent (specifically annual rent growth)

Vacancy

Bad Debt

The exercise would start by understanding the rent roll. When doing a rent comp analysis, knowing how the comps perform and what industry supports most of the resident base is essential. In the unit mix image below, the average rent is $920.

If you thought that, realistically, the average market rent would likely fall to $875 to maintain occupancy during challenging economic times, you would do a simple calculation:

$875 / $920 -1 = -4.89%

This is the rent growth rate that you’d use in Year 1.

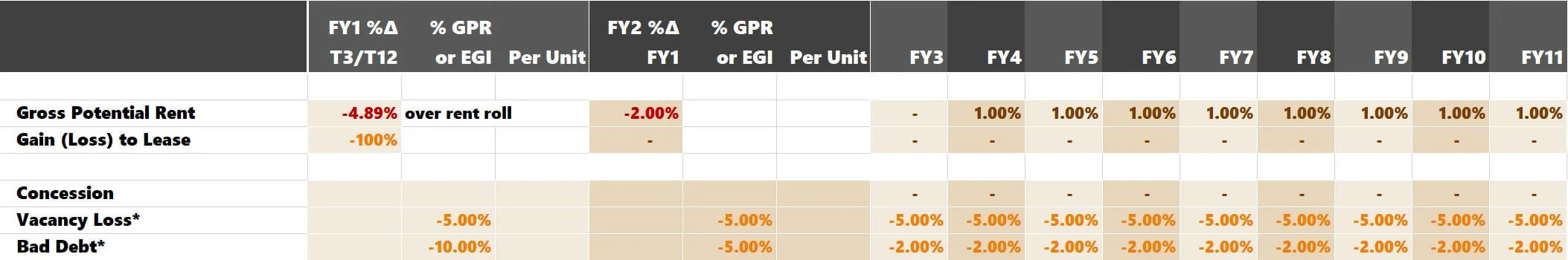

I am conservatively predicting rent growth as follows:

FY1: -4.89%

FY2: -2.00%

FY3: 0.00%

FY4 - FY11: 1.00%

Any concessions or discounted rent are included in the rent growth projections above. The loss-to-lease is ignored because I am focusing on actual in-place rents. A 5% vacancy is still a safe assumption, given that rent growth will be negative for two years.

Bad debt (residents not paying rent or coming up short on their monthly obligation) will peak in FY1 at -10%, fall to -5% in FY2, and remain at -2% after that. Bad debt is stated as a percentage of GPR.

You will also need to back into the capital number. The free template doesn't allow you to raise or finance investment capital. Any CAPEX is paid with cash flow from the project. If the idea were to put $5,000 into the units and another $50,000 into the common areas over one year, then you'd calculate the total capital spend:

$5,000 x 84 units = $420,000

Common Areas = $50,000

Total Capital = $470,000

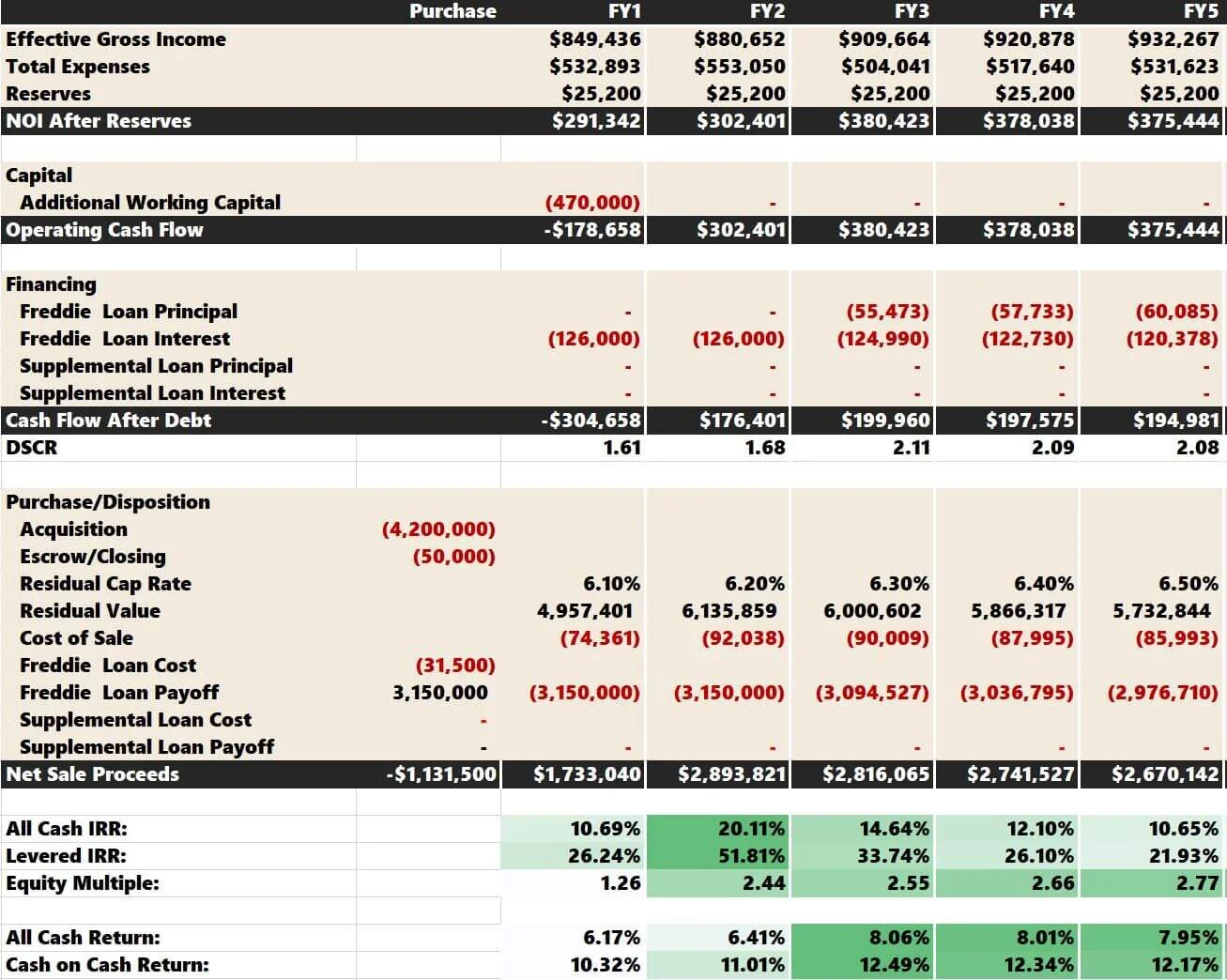

Now, you can play with the purchase price toggle to understand the return metrics at various price points. A $4,200,000 purchase price with a 5-year hold period would look like the following.

In this instance, real estate taxes are reassessed post-sale significantly below the current assessment levels, which creates diminishing taxes payable. It’s essential to think critically about how the assessing community will think about a sale below assessment levels and how to factor that into the “Real Estate Tax” tab of the template.

Make sure to adjust the residual cap rate. I increased from 5.5% to 6.0%. Depending on where you are looking, this could be more or less extreme. I have heard many investors saying a 100 basis points adjustment is likely.

Value-Add Model

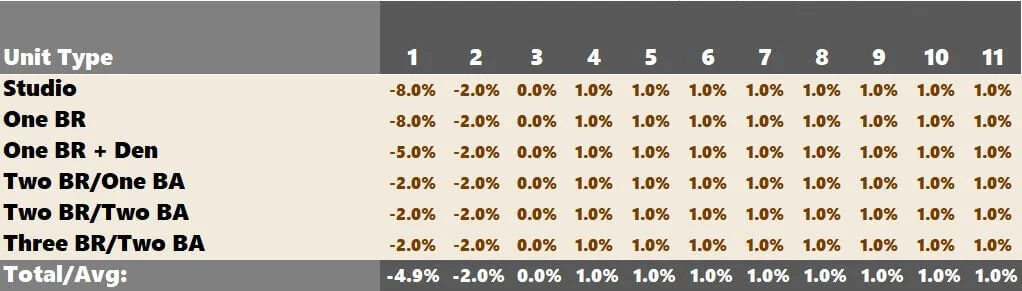

Using the Tactica Value-Add model will be similar to the steps above but offers more flexibility at the unit level to determine your rent projections.

For example, using the previous model, we were forced to assume rent growth that was more general (-4.89% rent growth). We can get more granular and develop appropriations for the different unit types within the overall unit mix.

Larger units usually perform relatively well during a recession as people take the roommate route to save funds. One BR and Studio units are thought to have more negative exposure as tenants occupying these units may be more sensitive to the rents if they lose their jobs or take a pay cut. You could plug in different annual decreases to account for the difference in demand for other unit types.

All units are projected to decrease in rents year over year but will be less severe for the larger floorplans. You would set premiums as $0 for each type, and the capital per unit would be $5,000 per unit.

You would account for the $50,000 in common area capital on the Summary tab in the “Use of Proceeds” section.

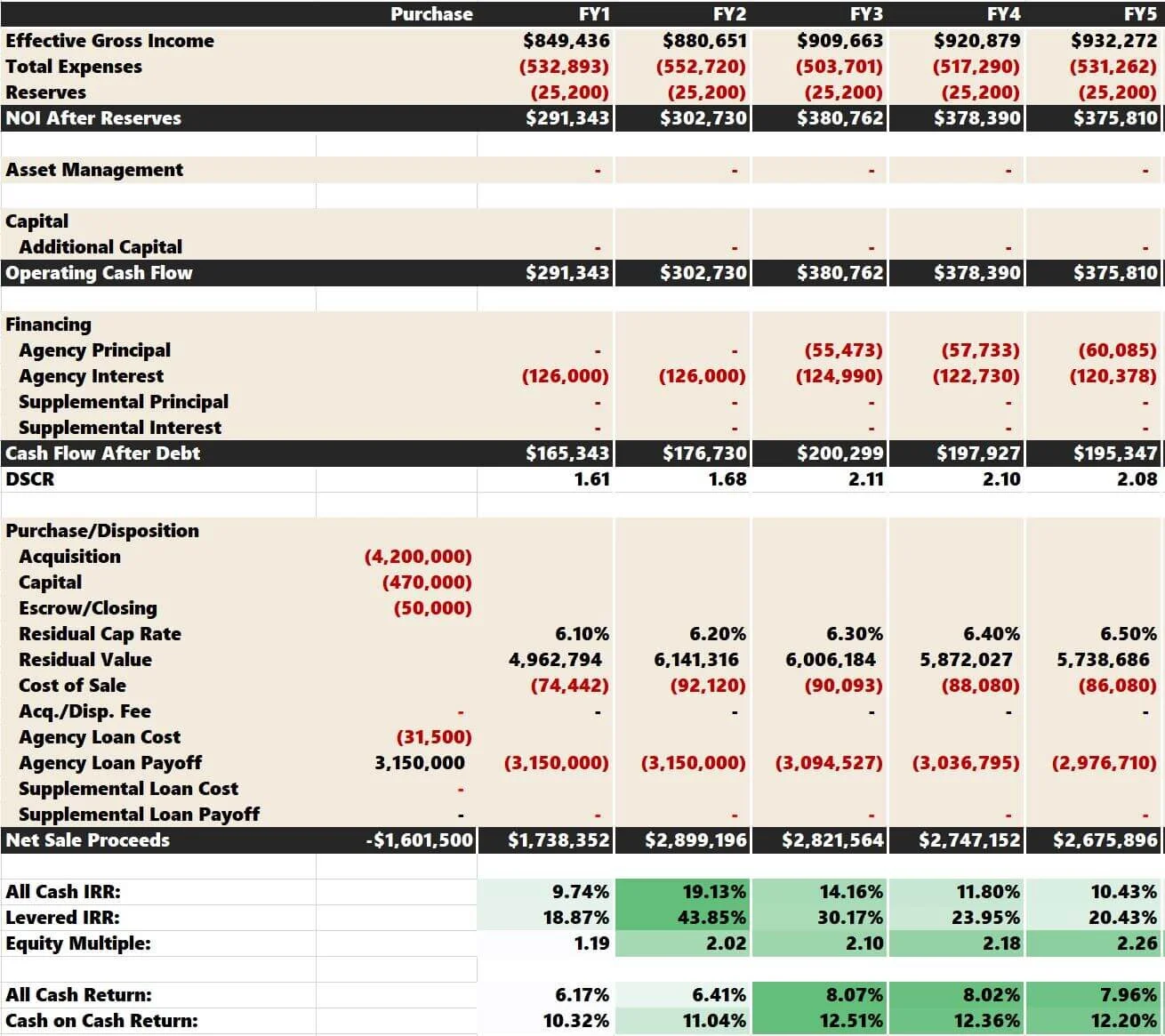

You can see that the model automatically factors in the $5,000 per unit in the "Renovation Capital" cell of -$420,000. A $4,200,000 purchase price with a 5-year hold period would look like the following.

The IRR is lower than in the free version because the free version assumes capital expenditures are paid by cash flow, which can boost IRRs significantly. This also affects the equity multiple adversely, as more equity was required in scenario #2.

This phenomenon is covered in detail in an article about budgeting for capital expenditures. The value-add model will assume renovation capital is raised on the front end with money from the real estate investors. All other assumptions are steady (loan amounts, interest rates, loan-to-value, property tax assumptions, etc.)

Assumptions for concessions, vacancy, and bad debt follow the same protocol as in the free underwriting template.

Redevelopment Model

Suppose you are purchasing a heavily distressed project during an economic downturn. In that case, it’d be best to review our Redevelopment Model tutorial content, as this model has a unique process for detailing the construction schedule and underwriting rent projections.

Underwriting Apartment Buildings in a Recession Conclusion

The days of aggressively underwriting higher rents to win an offering are over. Hawkish Fed policy could put significant downward pressure on rents indefinitely. Successful multifamily deals will be reserved for the investors who do their due diligence, understand the current marketplace, and are realistic about the direction of future market rents, even if this means going negative.

It is crucial to have a tool that will allow you to stress various rent growth scenarios and be sure that the project still works if declining operations are possible. Tactica has multiple free and paid options that fit this bill.