Analyzing & Underwriting Rent Concessions

Rent concessions are a crucial part of multifamily investing that requires three critical skills:

Familiarity with general rental terminology, different types of concessions, and how they differ

Knowledgeable of rental concessions history at the property

Understanding the rental market and how to underwrite concessions in your proforma analysis

Understanding the history of the concession at a property is not always straightforward and can require some investigative work. Failing to account for rent loss in your proforma underwriting could lead to disappointing investment results.

Analyzing & Underwriting Rent Concessions

Once you understand how property owners can offer rent concessions to tenants, you’ll need to analyze the rental concession data in the historical financials and rent roll to know how much current tenants benefit from free rent. Combined with submarket research, this information is paramount in proceeding with underwriting concessions in your proforma analysis.

Rental Concession Primer: Part II

This article is the second part of a two-part series. Part I covers the different types of concessions, primarily discussing the consequences of upfront vs. recurring rental incentives. Please click that link and review it beforehand. Part II covers accounting for and underwriting concessions in your proforma.

Concession Underwriting Contents

Let’s go through a few different scenarios of how you’ll experience concessions accounted for in real-life sale efforts. For example, we will examine a sample apartment complex in Memphis, Tennessee.

Pre-Underwriting Analysis

Forecasting future rent growth and concession burn-off (hopefully) should be done with a combination of the following:

Submarket Analysis

How do the high-level labor statistics and rental fundamentals look in the submarket? Low population growth, a declining labor force, low wages, and high rents could make it challenging to burn off rental concessions.

Rent Comp Analysis

Are the comps giving away concessions? Luckily, offering one month of free rent is a marketing maneuver that most commercial real estate owners will post on their website or the listing. If comparable properties also offer concessions, what amenities do you offer residents that would allow you not to match the competition?

Conservative Rent Growth

Even if there is a good argument about why rents should increase, it’s best to underwrite future rent increases with caution and solve for a more modest rent increase.

Upfront Rental Concessions (Common)

The most common concession scenario is a property management company giving renters an upfront concession. They’ll offer prospective tenants a free month’s rent as an example to expedite a signed lease agreement and move-in.

When this is the case, underwriting is relatively straightforward because rents and concessions aren’t intertwined in the owner’s financial reporting. You will forecast your proforma rents based on the actual rents (leased rents) from the rent roll and then forecast your concessions based on the historical financials (T12).

When gathering your rent data, I’d focus on the “Average Leased” column and ignore the market rents for underwriting purposes.

Upfront concessions mean that the current ownership group is willing to take a loss when the rental lease commences but will be paid in full after the special period ends. We can see the concession history over the past twelve months. This property gave away free rent at various times throughout the year.

Concessions totaled $28,296 during the year and were present in nine out of twelve months.

This T12 financial format doesn’t tell us if concessions are coming from new leases or renewals (sometimes, this is deciphered). As a rule of thumb, concessions for new leases usually outweigh specials for renewal leases. From a renter’s perspective, moving all your stuff to a new unit is much work, and staying put tends to be the path of least resistance. Thus, they’ll be willing to accept a lighter or no discount to stay put.

Using Tactica’s Value Add Model, I’d take the following steps:

Unit Mix: I’d input the unit mix and actual “ true leased” rents per the rent roll (I ignore market rents).

Financials: I’d then input the T12 historical financials in the model.

I also put the trailing three (T3) financial data into the proforma underwriting model. The $6,080 rental concessions in October, November, and December are then annualized in the T3/T12 column. T3 concessions are trending slightly less than the actual concessions handed out in the past year ($24k vs. $28k).

Note: Technically, I am underwriting a newer apartment complex in a tertiary market. However, Tactica’s Value-Add Model will still suffice for this asset class. You could also use Tactica’s free Multifamily Underwriting Template and follow a similar strategy.

Underwriting Upfront Concessions

When the concessions are upfront, like in this example, we can underwrite rents and concessions separately. Let’s focus on the rent growth first. After doing my submarket analysis and rent comp analysis for Memphis, Tennesee, I am going to underwrite rent:

Year 1: 0% growth

Year 2-3: 1% growth

Year 3-11: 2% growth

Unfortunately, Memphis has shown some weakness in its labor statistics that could impact all rental properties. I’ll also be chipping away at some rental vacancy (currently at 7%) over the first few years, and I don’t want to be too ambitious with my rental assumptions.

I’d underwrite the concessions separately on the “Financial” tab. In the last three months, annualized $24,322 concessions hit the P&L statement. While the overall labor market appears weak, the good news is that direct comps are only offering potential tenants some free parking but no rental concessions. Occupancy in the submarket is also above 95%, a sign of strength. I will take the historical T3 concessions amount and burn it off at 33% yearly. Concessions will be burned off entirely by Year 3.

I will also widdle down vacancy loss from 7% to 5.5% by Year 3. As mentioned earlier, submarket occupancy is 95%+, which should be achievable with competent property management.

The cash flows in Years 1 - 3 are:

The annual net effective rent totals about 2% per year once factoring in:

Rent Growth

Vacancy Burn-Off

Concession Burn-Off

This is very conservative, as historically, Memphis's rent growth has been higher than the rent growth projections below.

Annual Net Effective Rent Collection Increases:

T3/T12 to FY1 Increase: 2.2%

FY1 to FY2 Increase: 1.9%

FY2 to FY3 Increase: 2.2%

Recurring Rental Concessions (Rare)

Underwriting requires a different approach if a property gives tenants recurring concessions. Unlike upfront concessions, tenants receive reduced rent for the entire lease term.

You will inherit these leases and be responsible for concessions, reducing your rental income and cash flow. The rent roll could be presented in several different ways. Ideally, the recorded rents are the effective rents (including the concession).

Manager Logs Rents as Effective

Example: Unit #1 Rent is $1,500, including two months of free rent allocated over a 12-month lease term.

Actual Annual Rent $1,500 x 12 = $18,000

Effective Annual Rent = $18,000 - $3,000 (2 free months) = $15,000

Effective Monthly Rent = $15,000 / 12 = $1,250

If Unit #1 rent is logged as $1,250 in the rent roll, and all other units are inputted with the same rationale, you’d be good to go. As we did in the example above, you’d plug this effective rent amount and all the other effective rents into the unit mix tab.

When underwriting concessions in the proforma, you can eliminate them in Year 1 as they are already factored in the rental assumption flowing in from the unit mix tab.

You’d need to follow the same pre-underwriting analysis we discussed to determine the property's appropriate annual rent growth.

Manager Logs Actual Rents (excluding concessions)

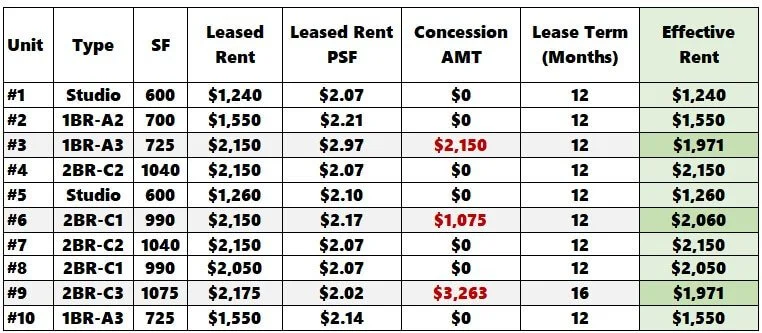

If the rent roll still logs actual rents, and you can see concessions in the P&L and know they’re recurring, the unit mix analysis will require extra work. You’d need to request from ownership a concession report that lists the following:

Every Unit

Concession Amount (by unit)

Lease Term (by unit)

You already have the “leased rents” from the rent roll. Now, you can alter your rents using the data from the concession report. You’d need to allocate the concession over the lease term to calculate each unit’s effective rent.

For units that received rental concessions (units #3, #6, and #9), we’d need to calculate the true effective rent,

Effective Rent = (Leased Rent x Lease Term - Concession Amount) / Lease Term

Unit #3 Effective Rent = ($2,150 x 12 - $2,150) / 12 = $1,971

Unit #5 Effective Rent = ($2,150 x 12 - $1,075) / 12 = $,2060

Unit #9 Effective Rent = ($2,175 x 16 - $3,262) / 16 = $1,971

You could convert the unit information into more general categories (Studio, One BR, Two BR, etc) and input these average effective rents into the unit mix table. You wouldn’t need to factor a concession line item in the proforma as the rents are already discounted and inclusive of the rental discounts.

Concession Burn Off

There’s one more way you could go about underwriting recurring concessions that will require more time but could result in a more accurate proforma concession burn-off schedule. Assuming you can get your hands on a concession report that lists:

Each Unit

Concession Amount

Lease Term

Then, you can estimate your “would-be” close date and determine how many concessions would burn off each month as inherited leases expire.

Example: You plan to close the 95-unit apartment complex on January 1st, 2023.

We will look at the same ten leases as earlier but tailor the underwriting to a more precise concession burn-off model in Year 1.

We gathered a few more pieces of information to calculate the total inherited concession in Year 1. Because we want to break out concessions separately, we’d go back to inputting “leased rents” into the unit mix tab.

On the “financials” tab, we can underwrite the inherited concession (on a per-unit basis). In this example, we are only underwriting inherited rental concessions, as we plan to no longer offer discounts on new leases or renewals once we take over ownership.

In Year 1, concessions are calculated for the ten units as follows:

-$358 - $538 - $2,039 = $2,935

-$2,935 / 95 units = -$31

(You’d need to follow this logic for all 95 units; I’m only looking at ten units for the sake of example.)

In Year 2, we eliminated concessions (-100% FY2 change).

Note: I don’t use this concession underwriting method very often because:

Recurring concessions are rare

It’s extra work

It isn’t conducive if future concessions are necessary

Realistically, you may need to give out more concessions to residents if the market softens or other comps are doing it. If you are only solving for their current lease concession burden and burning them off immediately at lease expiration, the proforma would be understated if you continued offering potential residents discounted rent.

For the infrequent occasion of recurring concessions at a property, I prefer to determine effective rents and use that as the starting point of the proforma analysis.

Hidden Concessions Red Flag

As a word of caution, concessions can be well hidden in the operating expenses in the P&L. I think when rental concessions are present at the property, for transparency, there should be a negative revenue line dedicated to them called “concessions,” “incentives” or “discount.” Nine times out of ten, this will be the case.

However, I have seen instances where concessions are buried in marketing expenses. This type of accounting is infrequent and usually reserved for new construction projects with ample lease-up concessions.

If you see a sizeable historical marketing expense with an ambiguous name, verify that it’s not concessions. Marketing a lease-up effort for new development is expensive. If you purchase a pre-stabilized or newly stabilized apartment complex, a common underwriting strategy would be to cut down this expense once the property is stabilized (subtracting broker fees, online marketing, leasing staff, etc.).

Suppose concessions are baked into general marketing expenses, and you cut the historical marketing expense at stabilization. In that case, you’ll be overstating the NOI if concessions are necessary to entice residents to live at the property. It would be best if you did more research to get to the bottom of what the true effective rents are.

Video: MF RR - Concessions & Other Income Analysis Tutorial

Concessions Analysis Summary

When creating a business plan and underwriting rental concessions, you’ll first need to complete a submarket analysis, do a rent comp study, and have a pulse on a reasonable rent growth assumption. From there, depending on how ownership allocates for its concessions:

Upfront Concessions

Recurring Concessions

It will likely determine the underwriting path you choose to embark on in your proforma analysis. Recurring concessions are rare, but if management does build concessions into the entire lease term, it may entail more documentation for you to request and more work overall.

Finally, some groups may bury concession revenue loss in expense line items like marketing or administrative. If this is the case, it’s best to understand the gravity of the discounted rent and move those “concession expenses” back to the revenue side of the proforma as a rent loss.